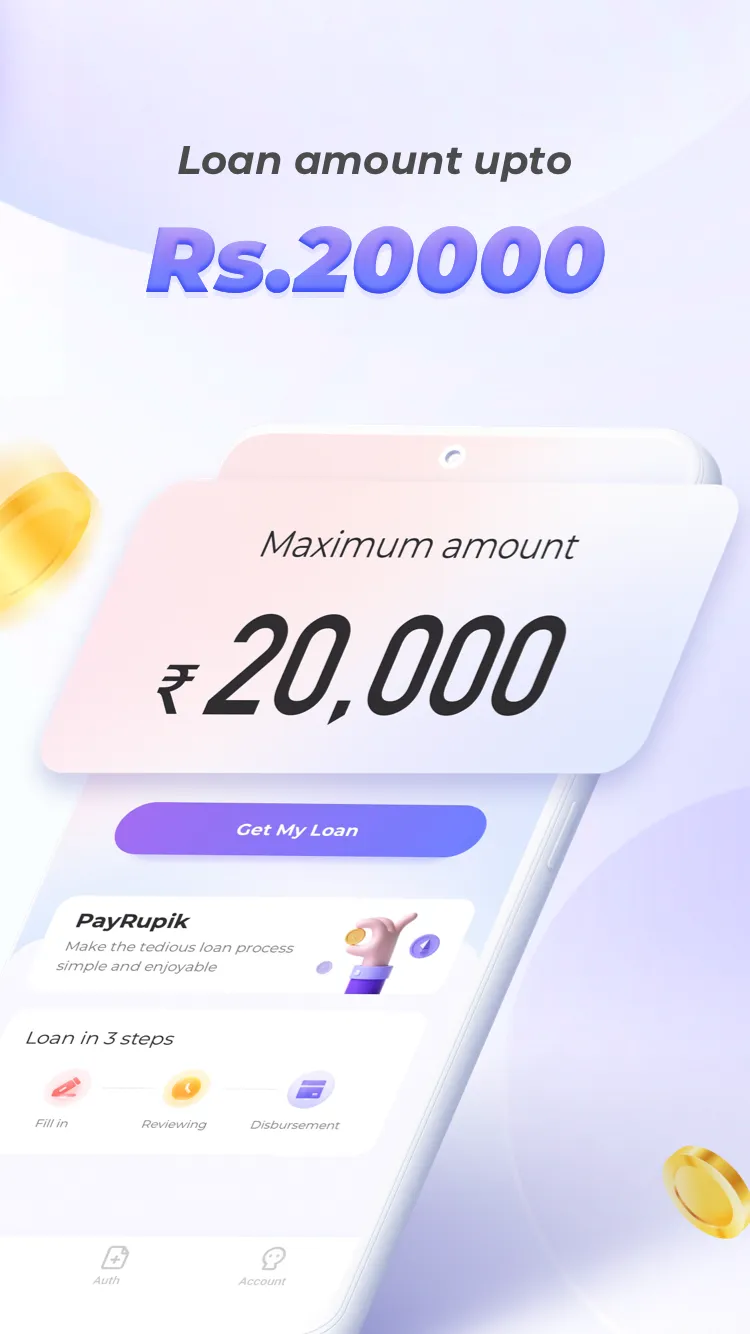

PayRupik Instant Personal Loan

payrupik

About App

PayRupik is an online instant personal loan platform trusted by over 5 million users, provides you instant credit in minutes. It is a loan product of Sayyam Investments Pvt Ltd which is a registered NBFC under RBI. You can avail loan amount ranging up to ₹20,000, process is fast, easy and safe. If you are looking for a friend who can easily borrow money without making excuses, PayRupik is your best friend. Production: Loan Amount: from ₹1000 to ₹20000 Minimum Loan Tenure: 91 days Maximum Loa

Developer info