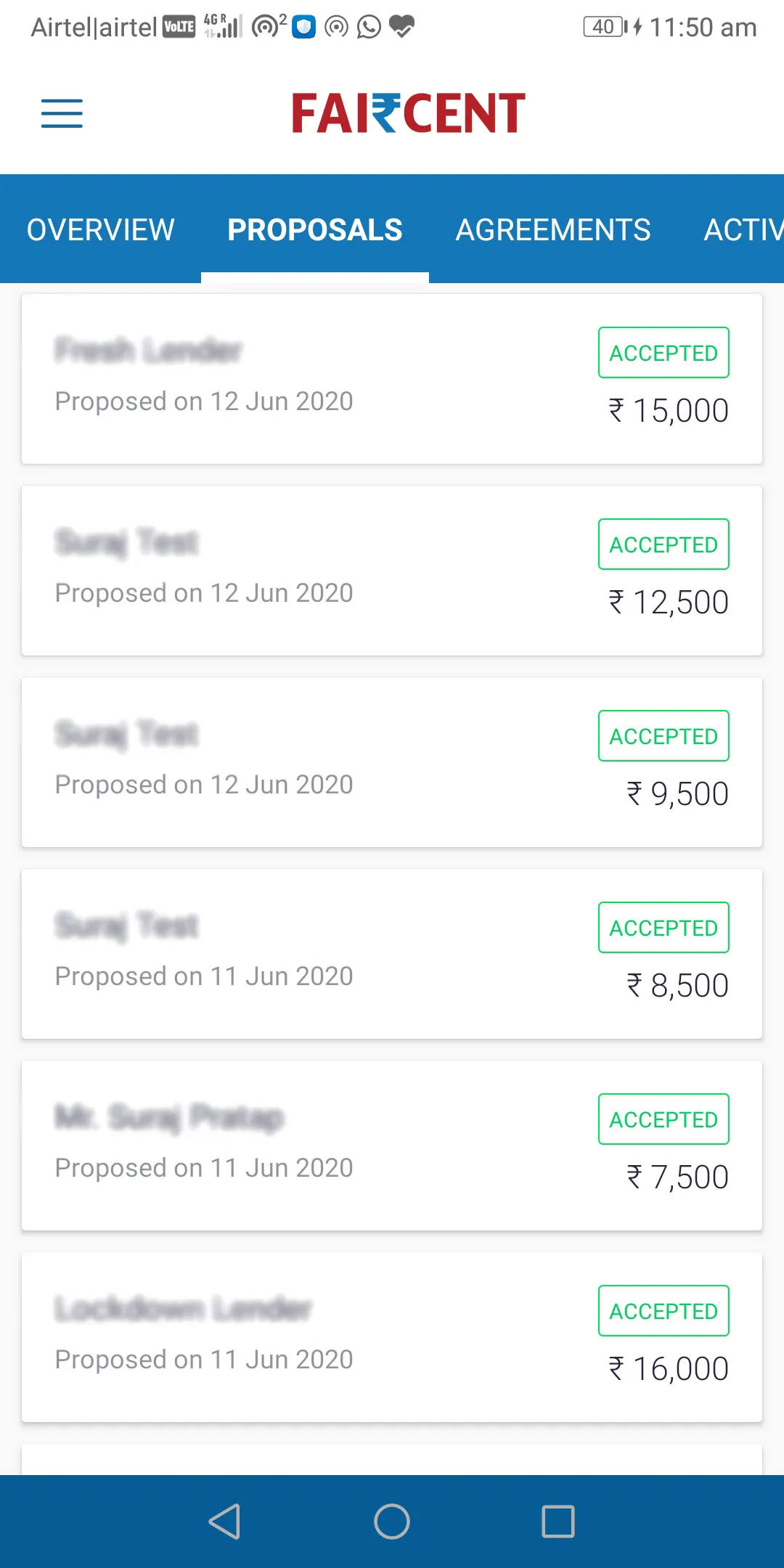

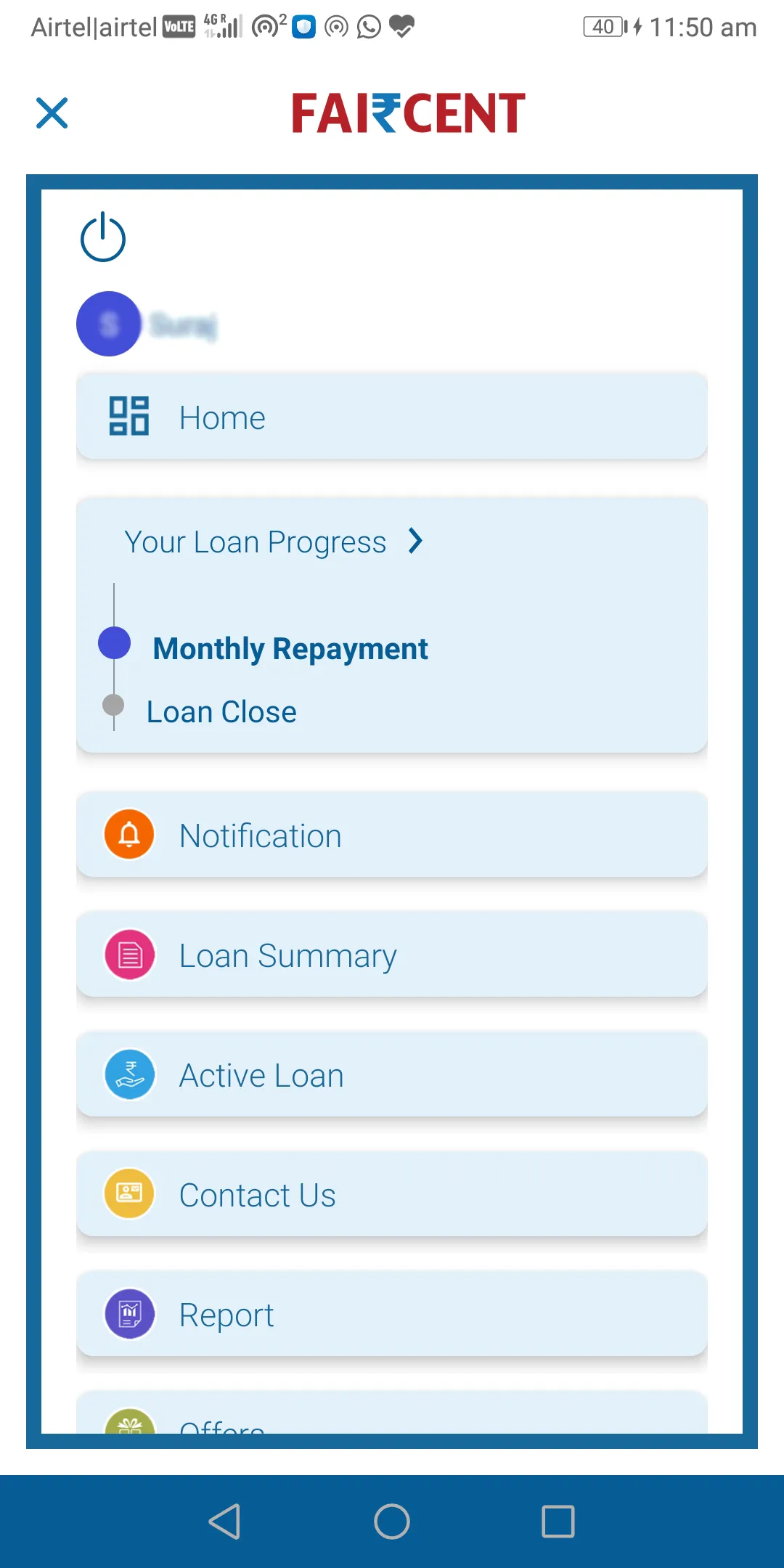

Faircent - Loans & Investments

faircent

About App

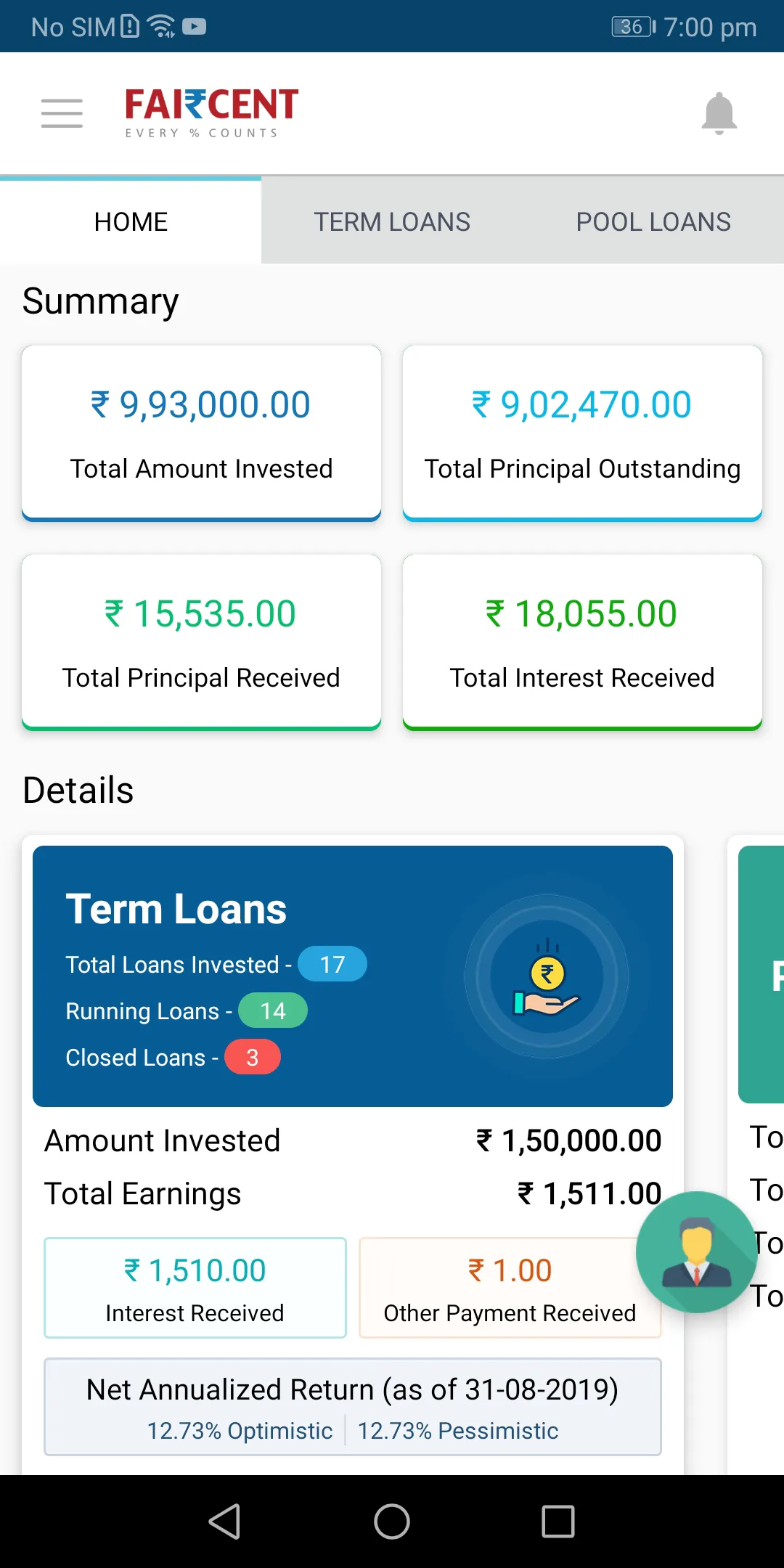

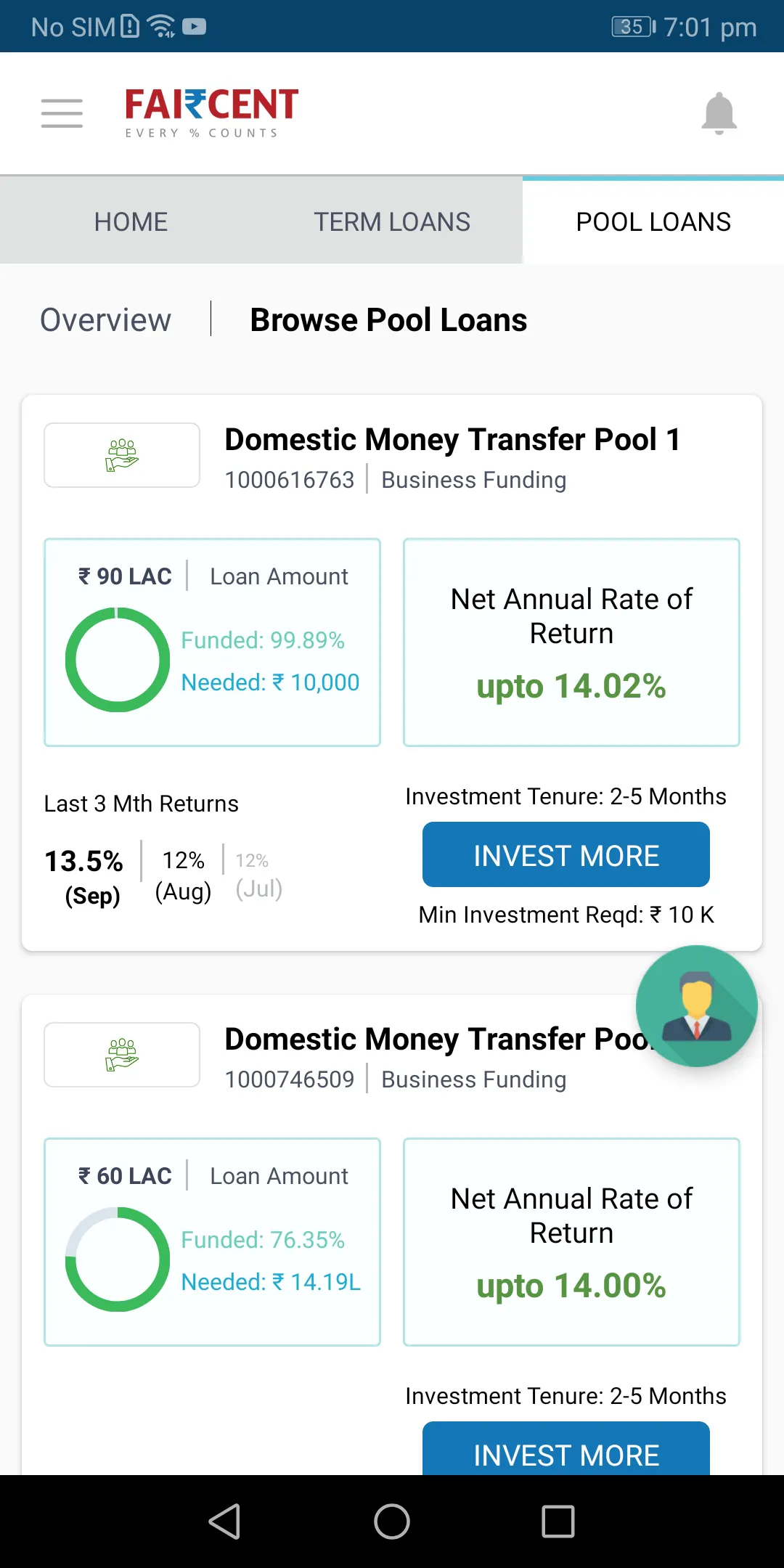

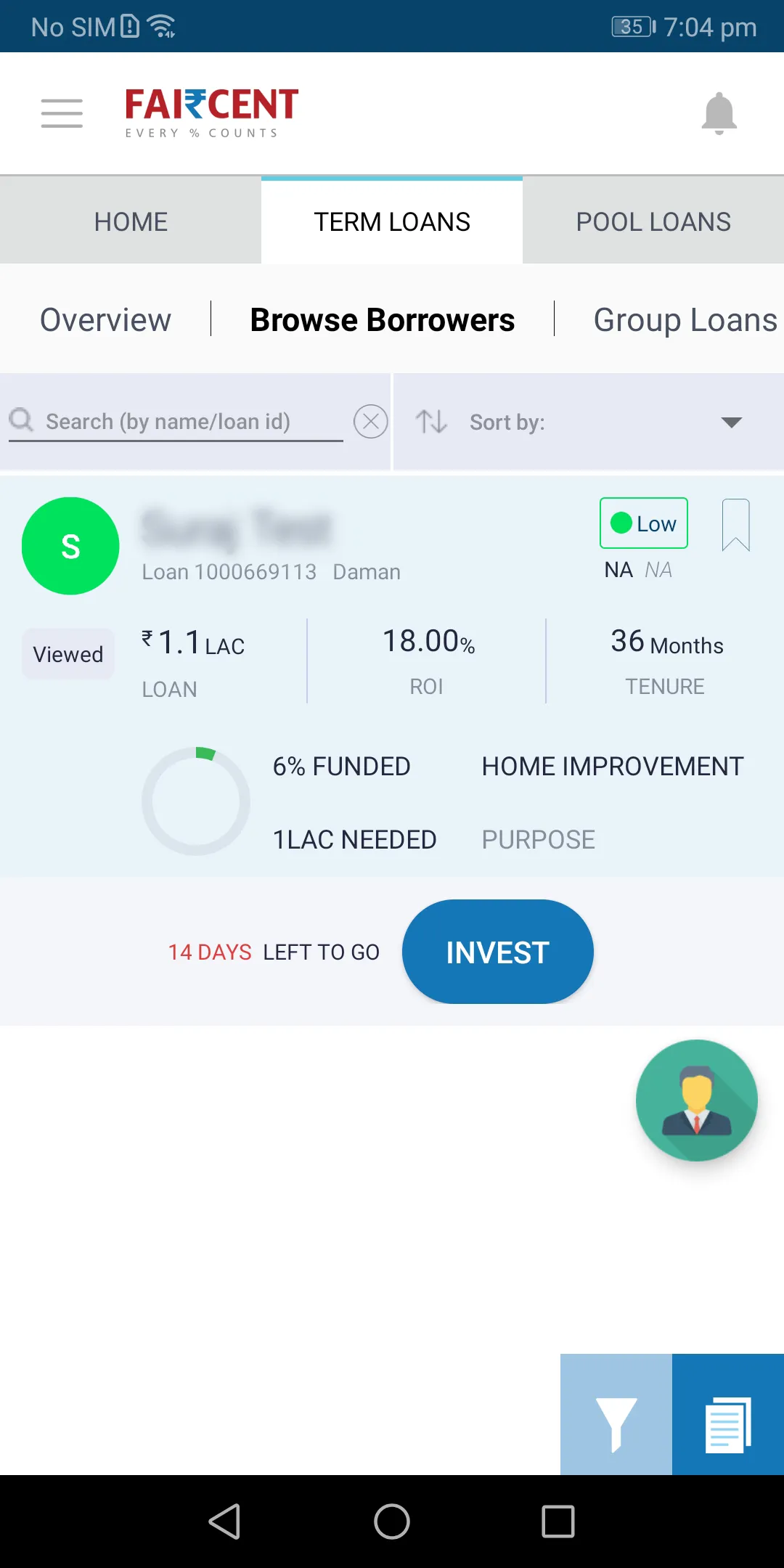

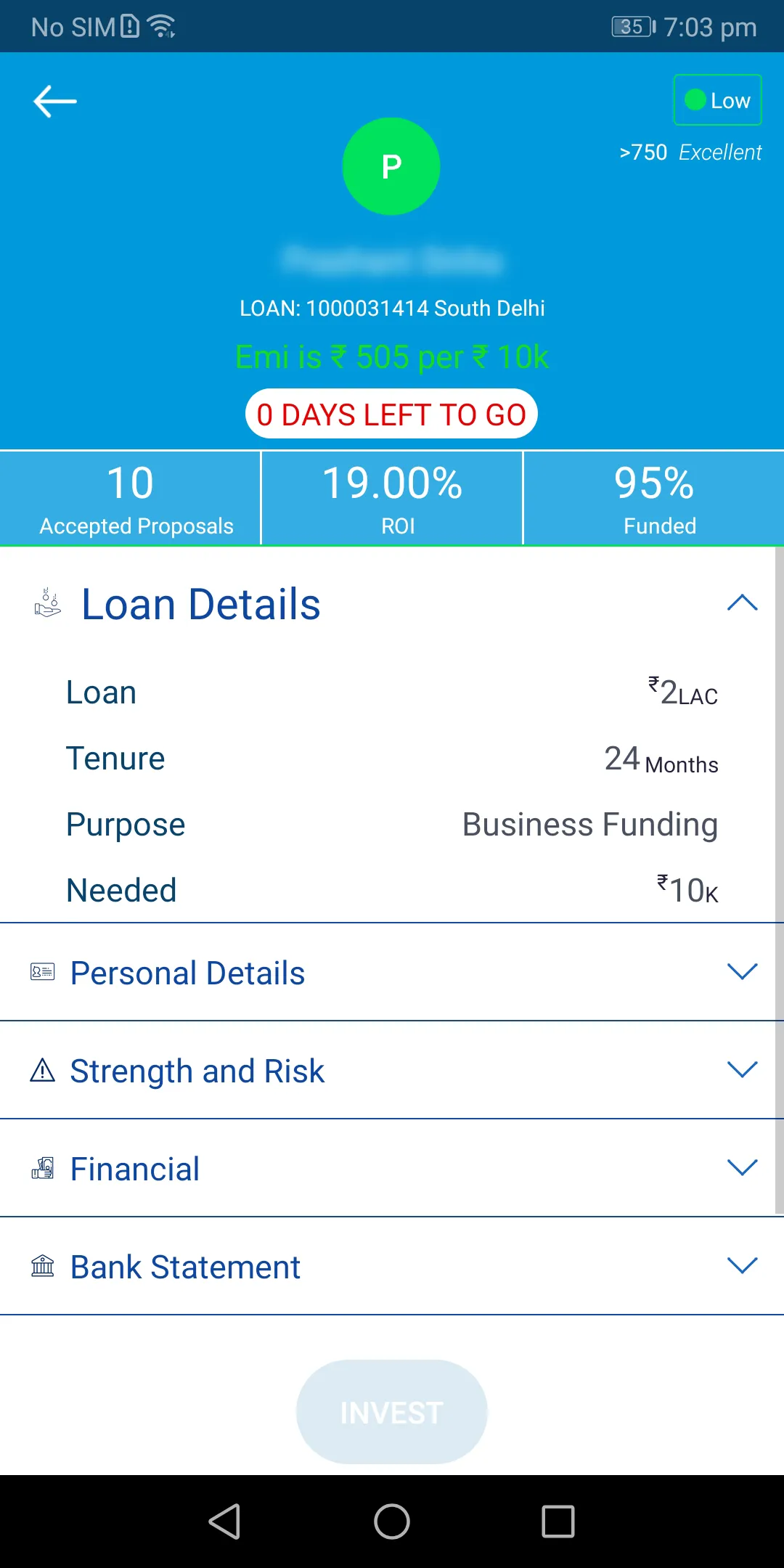

Peer to Peer Lending – Making Investment More Rewarding and Credit More Reasonable for All Welcome to FAI₹CENT - India’s leading Peer to Peer (P2P) lending platform and first NBFC-P2P to receive a Certificate of Registration (CoR) from the RBI. Fairassets Technologies India Pvt Ltd (Faircent.com) has a Certificate of Registration with the number N-14.03417 provided by the Reserve Bank of India allowing us to operate as an NBFC-P2P (Non Banking Financial Company – Peer to Peer Lending) in Indi

Developer info