Important Update: Fincare Biz is now AU Connect

AU Connect - Empowering Digital Banking for All

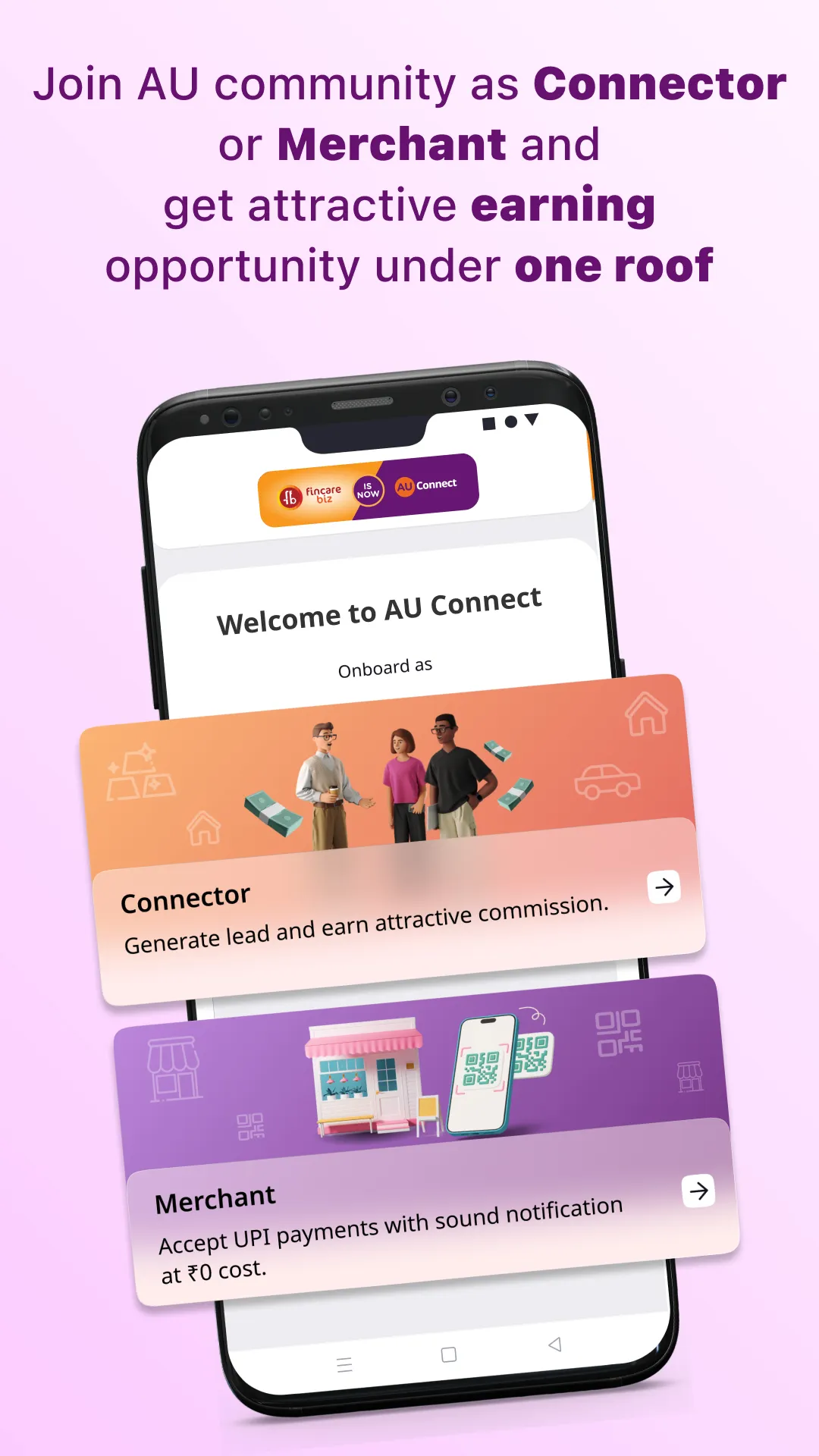

AU Connect (formerly known as Fincare Biz) is a cutting-edge digital banking platform designed to serve individuals and micro, small, and medium enterprises (MSMEs). It offers two core functions:

• Connector: This feature enables businesses to submit leads for various banking products and earn attractive commissions.

• Merchant: The Merchant section helps in collecting UPI payments effortlessly via QR codes and helps track transaction history. The app also acts as a sound box, which announces UPI payments received on the QR code in multiple languages. The sound box feature helps to save the cost of a physical sound box for the merchant.

Registration and Activation:

• Connector registration is open to all users.

• Merchant accounts require activation by our sales agents or partners.

• Once activated, users gain access to the Merchant section, allowing MSMEs to conveniently use QR codes linked to their Bank Account.

• Merchant login includes static/dynamic QR code generation for payments, sound box notifications, and the ability to run in the background on multiple mobile devices.

Key Features:

• Enables partners to generate qualified leads for the bank.

• Seamless paperless onboarding with eKYC and eSign.

• Instant lead generation for various products.

• Facilitates network-building for both connectors and the bank.

• Merchants can accept payments via QR codes with sound box notifications on the app.

Best-in-Class User Experience:

• Digital onboarding in just 5 minutes.

• Integration with Aadhaar-based eKYC and credit bureaus.

• Automated payouts for connectors and merchants.

• Versatile business use cases across various financial products.

Process Flow:

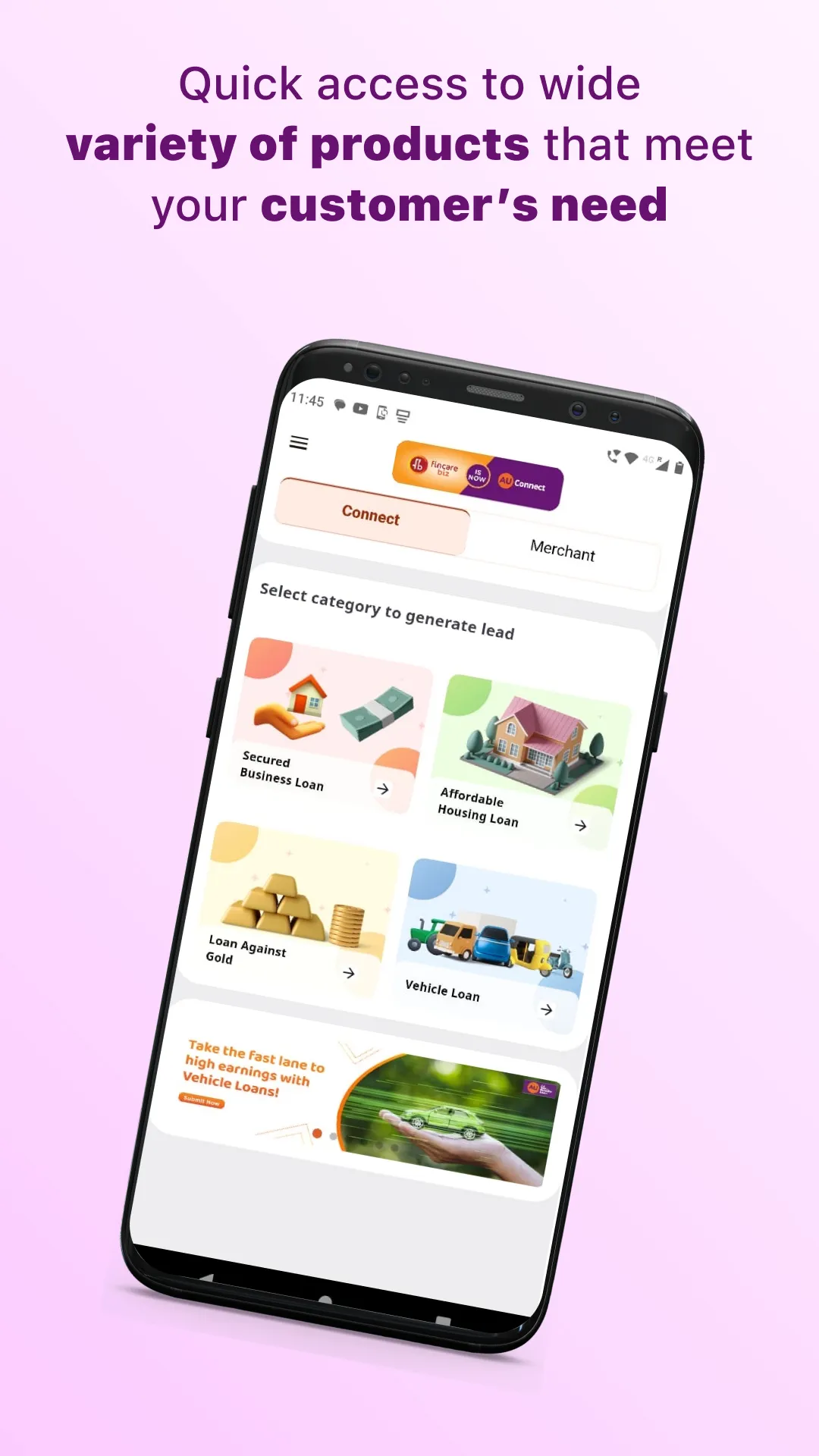

For Connector:

• Download the AU Connect App and enroll online.

• Login using the registered mobile number on the Connect section.

• Enter prospective leads, which are instantly approved or rejected based on credit algorithms.

• The leads can be entered across a range of products like Secured Business Loan, Affordable Housing Loans, Loan Against Gold, Vehicle Loan, etc.

• Approved leads proceed to loan processing or account creation, which is entirely managed by the bank.

• Once the leads are successfully closed, automated payouts are made to connector bank account.

For Merchant:

• Activate the merchant section through a Fincare (is now AU) representative to get a QR code linked to bank account.

• Login using the registered mobile number.

• Generate QR codes and accept payments.

• Customise the experience with sound box notifications and transaction history.

Why Partner with AU SFB?

• End-to-end digital processes ensure instant credit checks, faster approvals, and customer satisfaction.

• Transparency throughout the lead generation, sanction, and disbursement process.

• Superior user experience for merchants and connectors.

• No signup or listing fees.

• No cost for sound box or mobile app.

• Seamless merchant login with multiple language sound box notifications, QR code generation, and transaction history all in one app.