Shivam Investments

shivam-investment

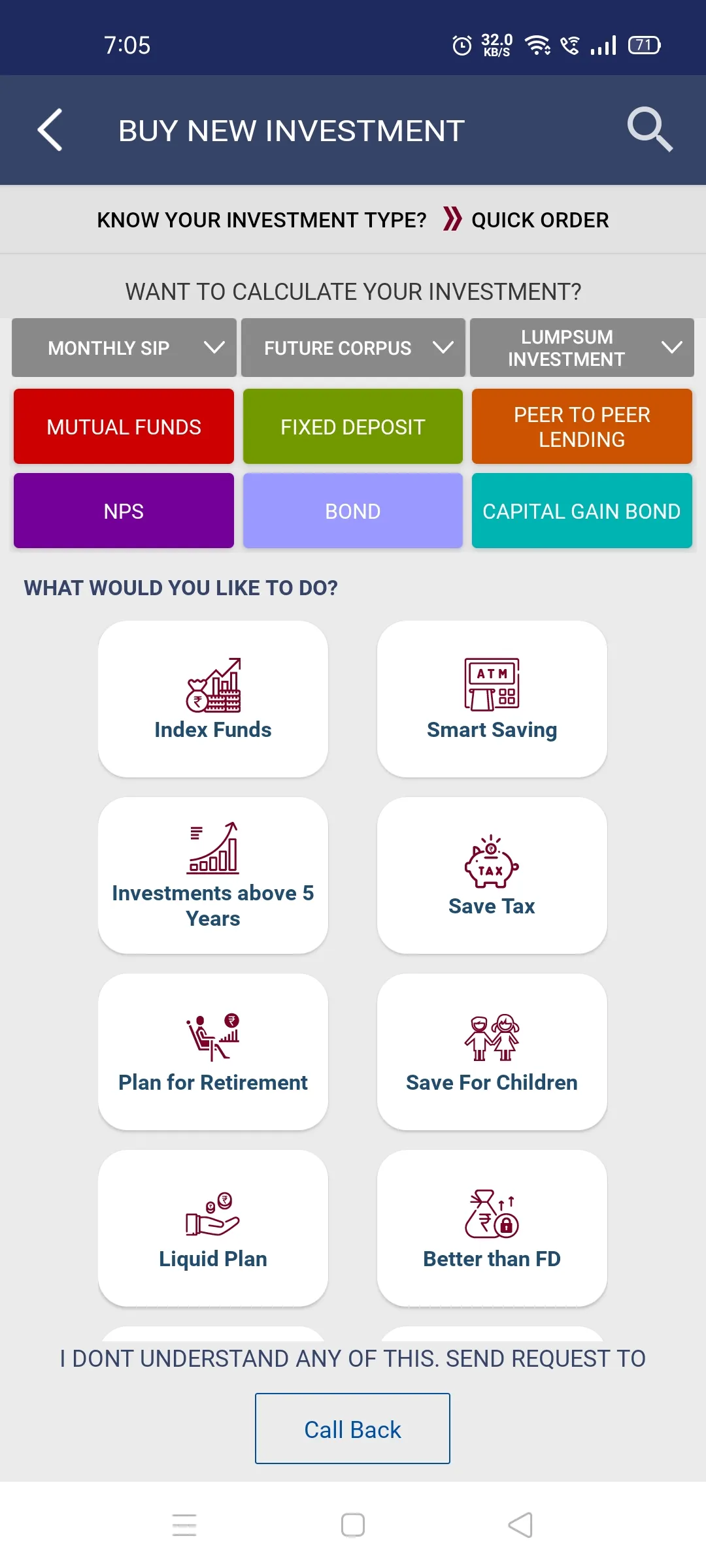

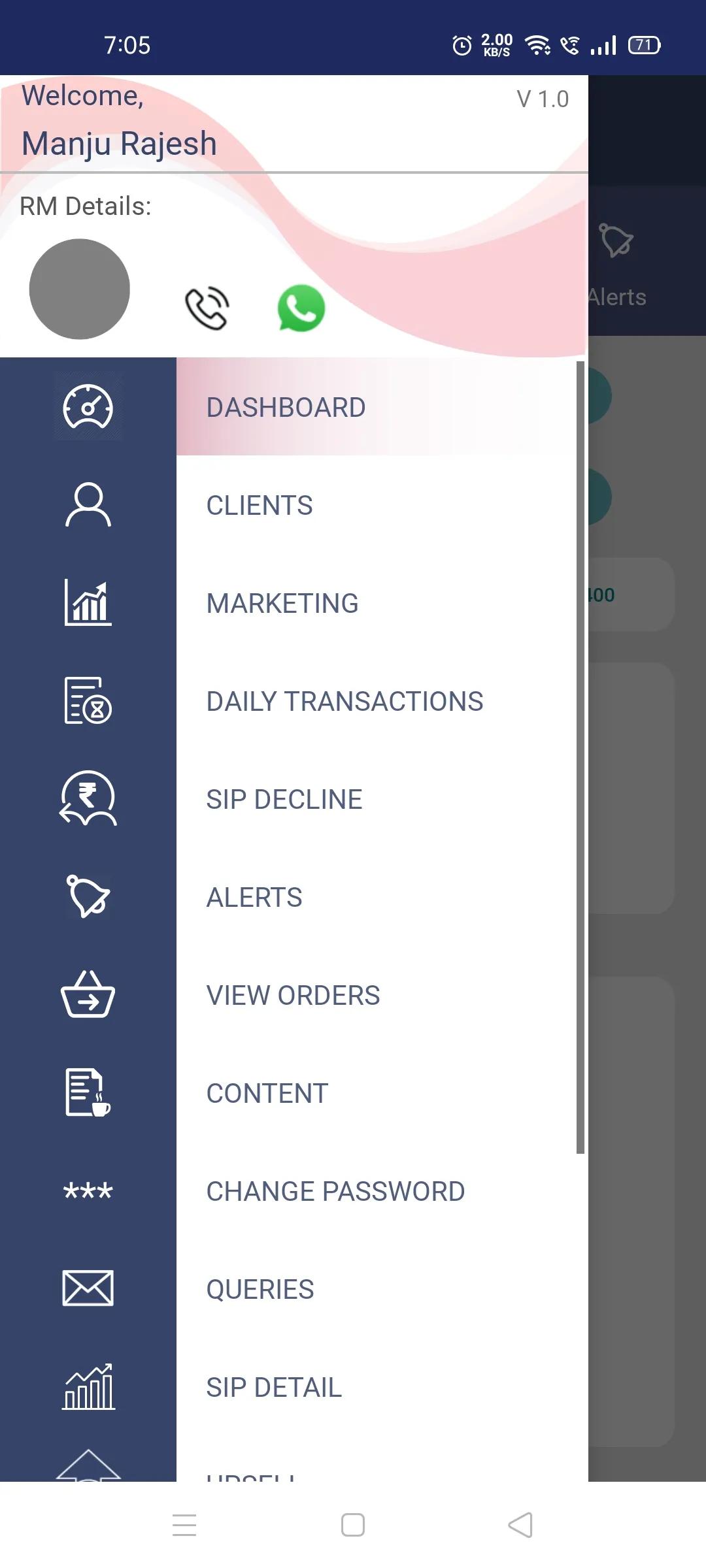

About App

App for mutual funds investments, that lets you easily do systematic investments (SIP) or one-time investments to build long-term wealth, save taxes, retirement planning, and other goals like education and marriage of children. All mutual funds schemes are available. The app also allows easy redemption / sell of your mutual funds investments, in case you need money for any emergency. Why Use Shivam Investments - Easy account opening We help you quickly open your mutual fund account and start i

Developer info