UrbanMoney

urbanmoney

About App

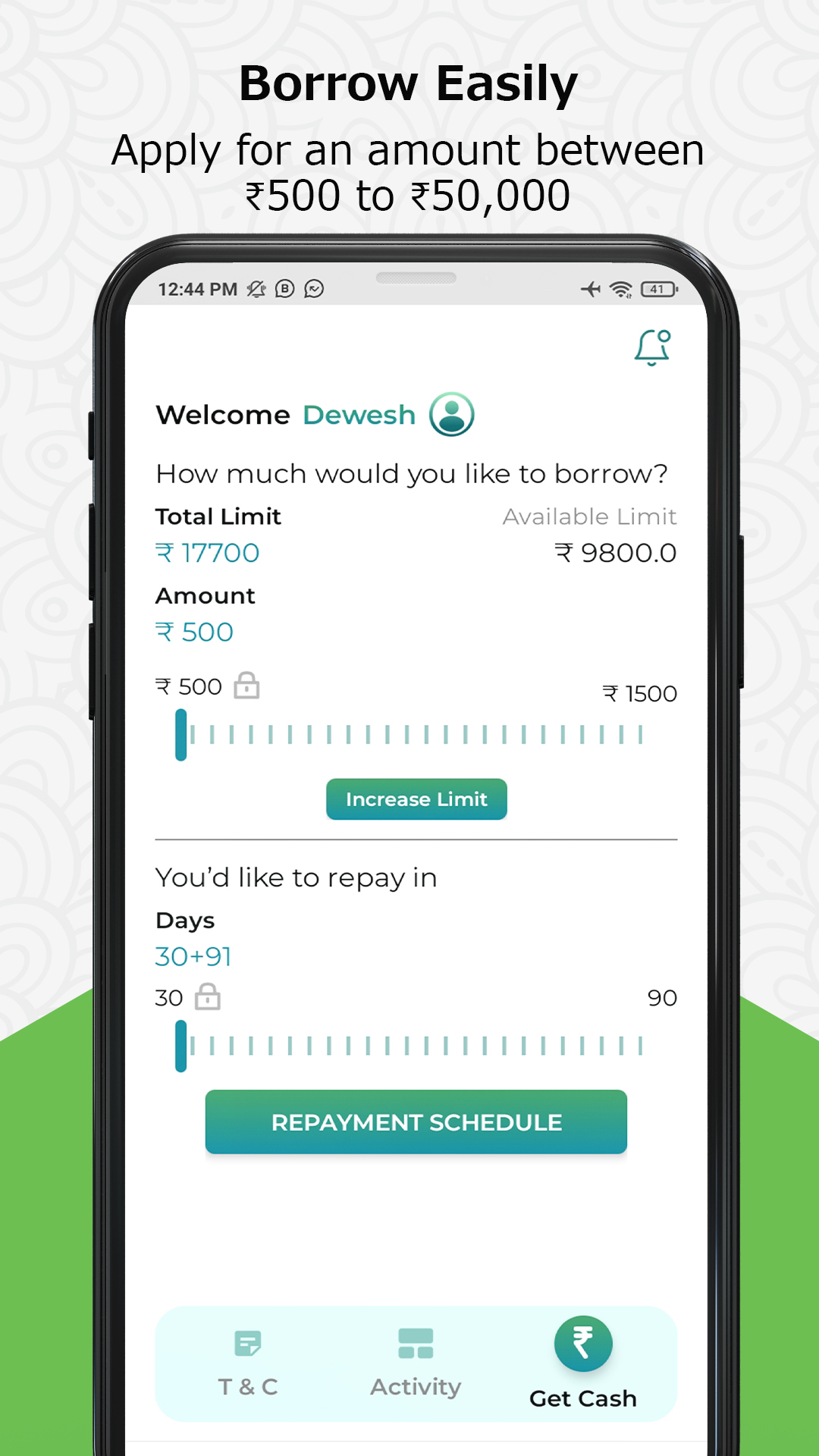

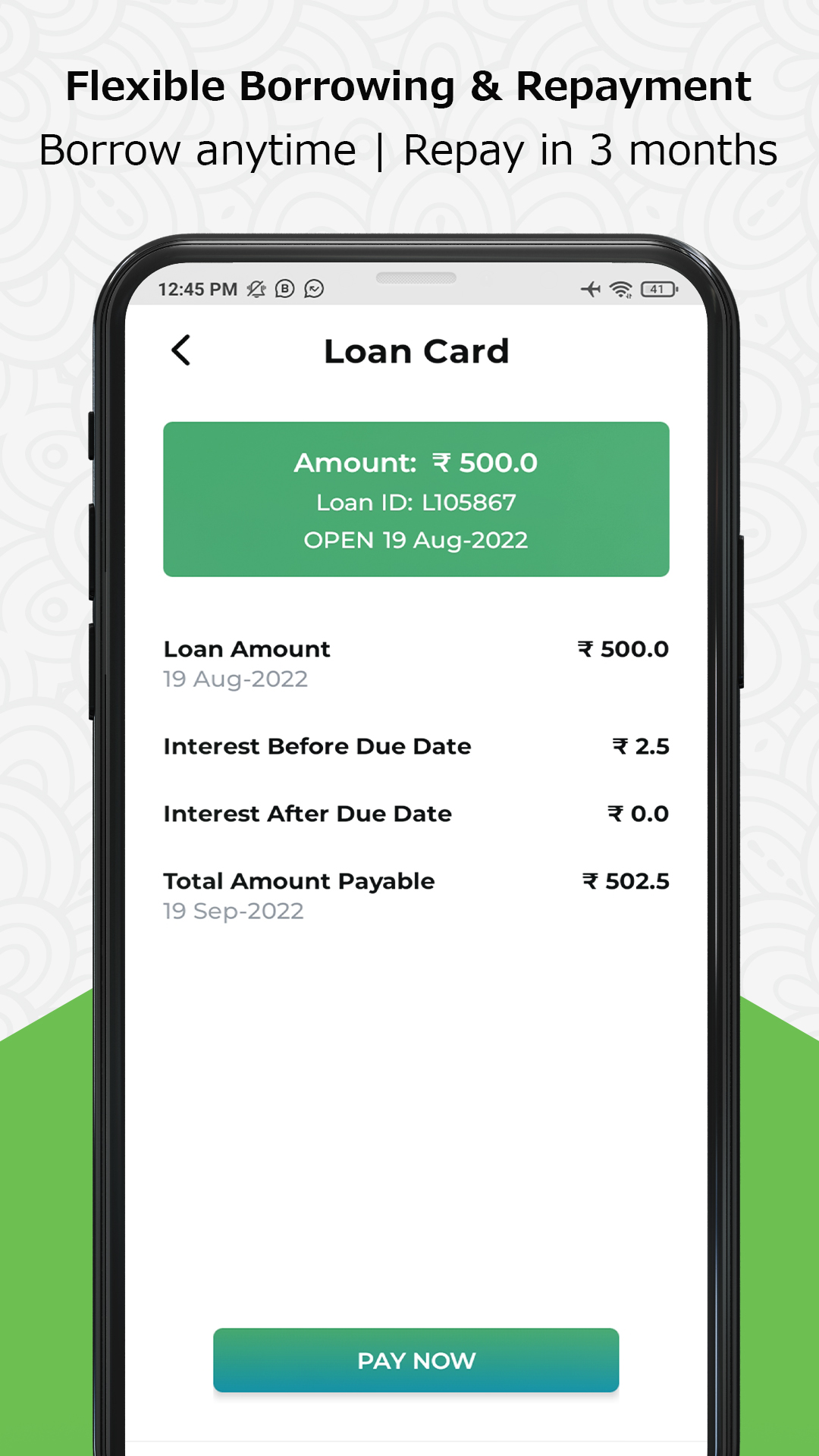

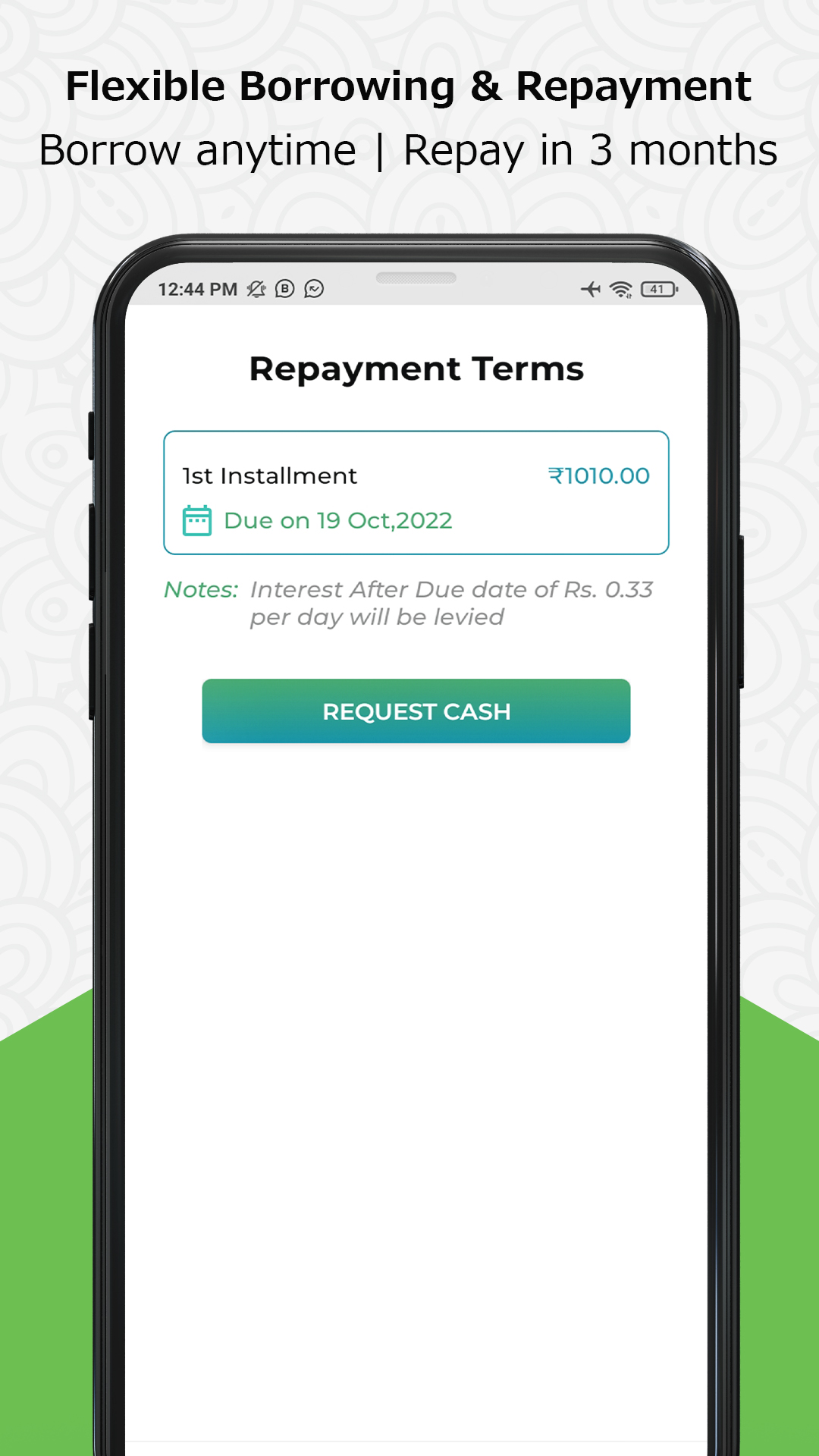

Best Online Loan App. Instant loan app for students, Instant loan for salaried, Loan upto Rs 50,000. RBI(Reserve Bank of India) Registered NBFC(Non-Banking Finance Company). The core functionality of the app is to provide loans to it's users. UrbanMoney is the best student loan app and salaried loan app. Get instant loan for college students and instant loan for salaried employees. Avail personal loan instantly ranging from Rs 500 to Rs 50,000. Just open this online loan app and consider this a

Developer info