Verified

4

Rating

16 MB

Download Size

About App

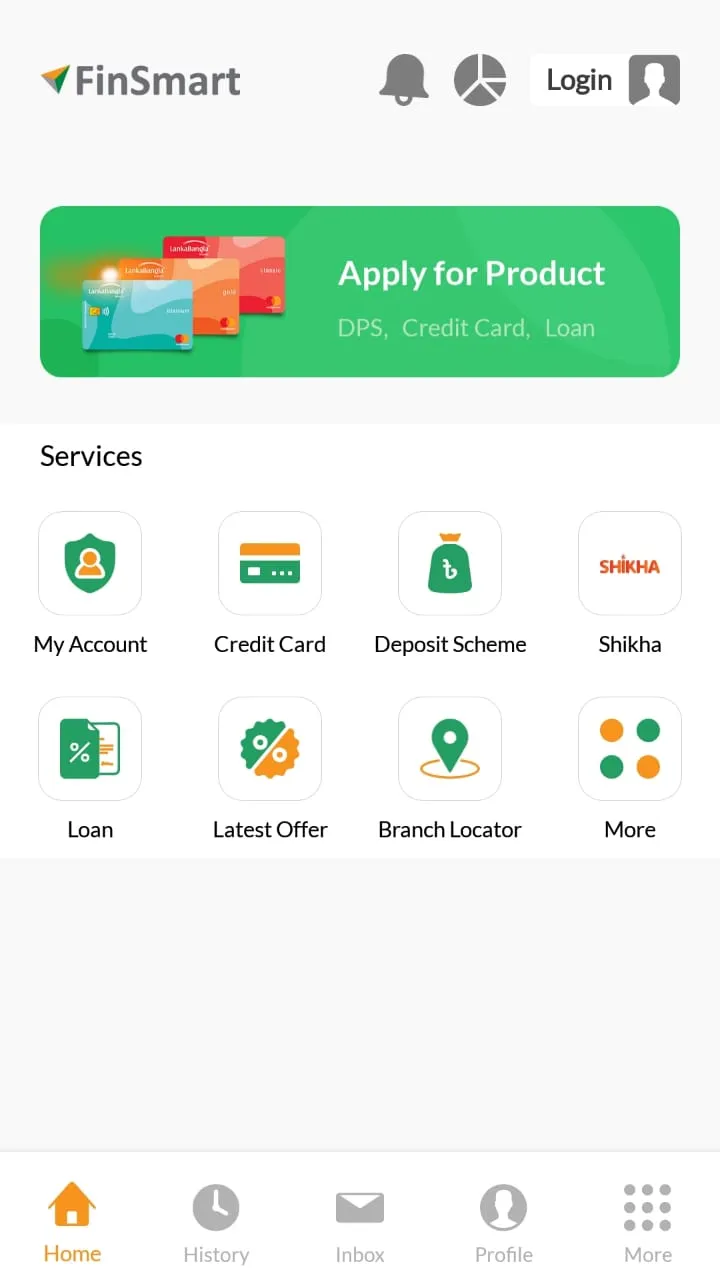

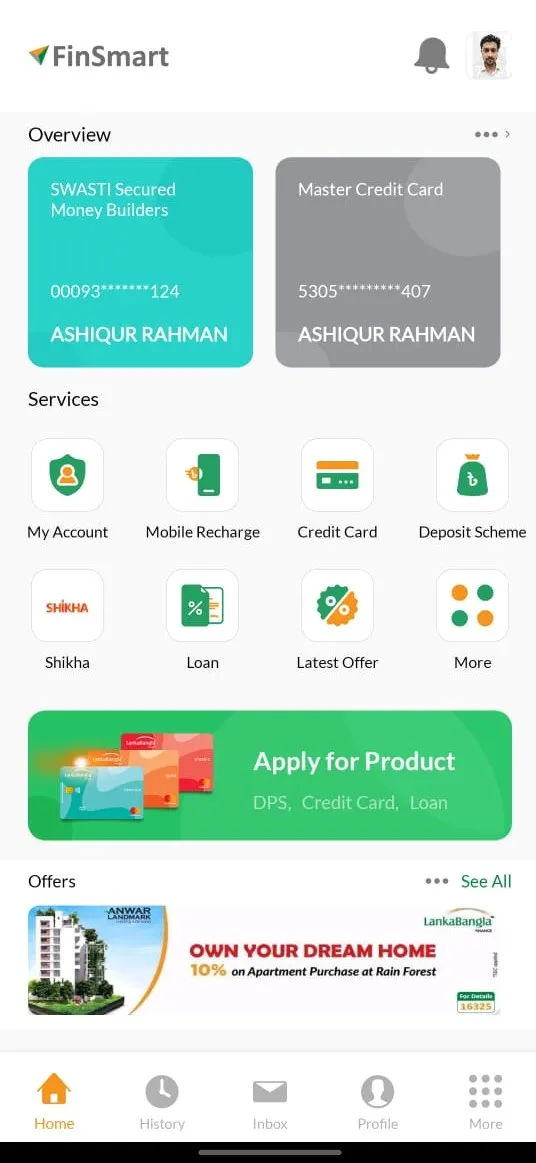

With FinSmart, customers can get the desired service at their fingertips anytime. FinSmart supports both English and Bangla Language, Use Wallet ID and PIN to login. Registration can be done by using the tagged mobile number of your LankaBangla Accounts in the app's 'Sign Up' option. Download from Google Play or the Apple app store only.

This Mobile App includes the following services:

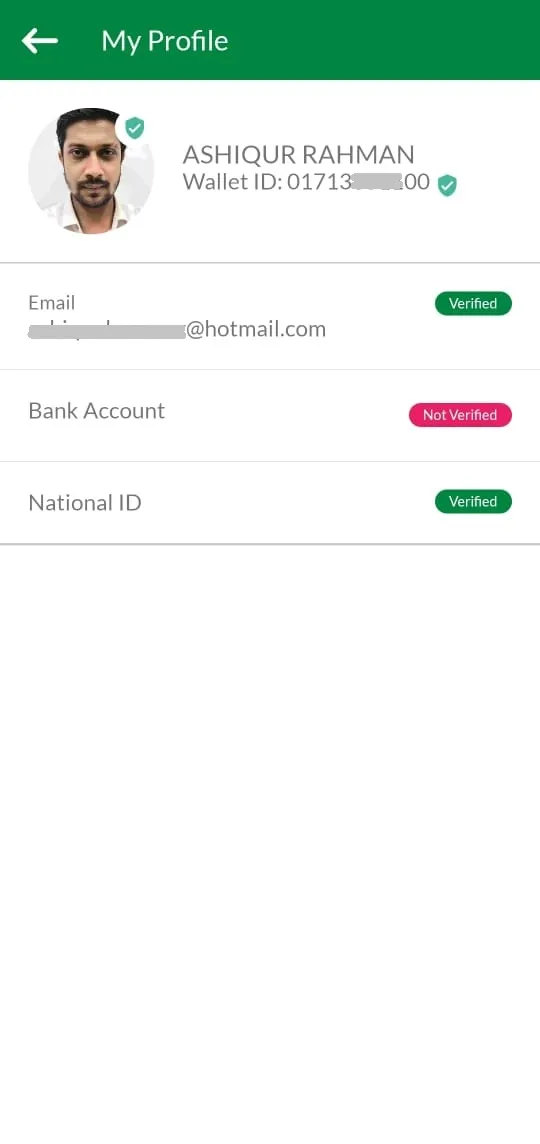

• Self sign up with NID

• Fingerprint log in

• Self PIN reset

• Latest statements of products

• All account details in My Account

• Online Application of Multiple Products

• Statement and Certificate request of Products

• Latest Offers, Reward Catalogue, Discount Privileges and EzyPay@0% interest

• Online payment solution for Multiple Products

• Branch locator

• Product features

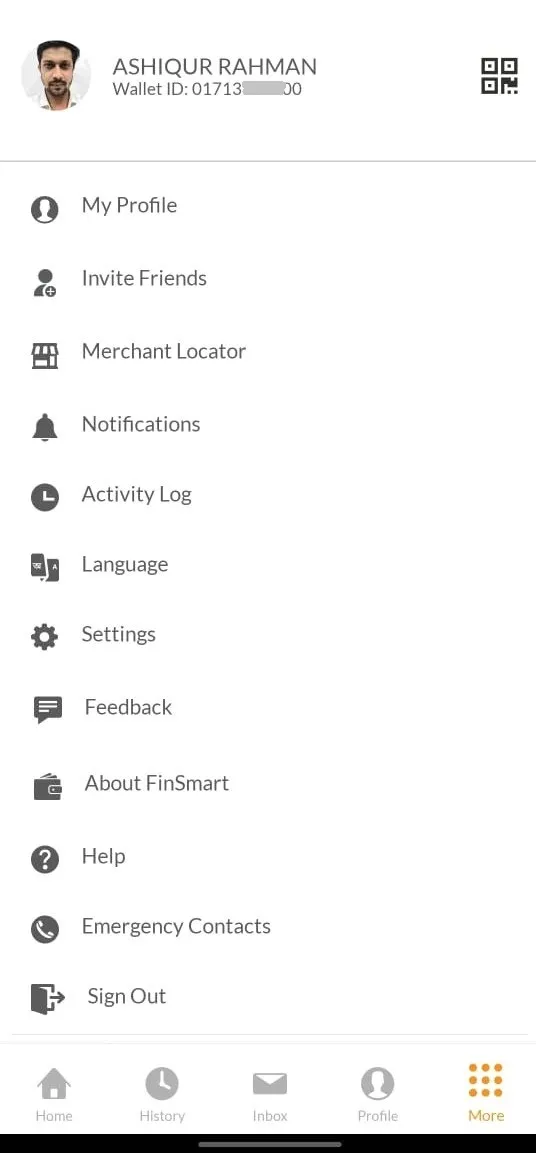

• Language preference (Bangla/English)

• In-app notification

• Inbox

• Call to contact center, 16325

• Feedback Option

• Schedule of Charges

• Mobile Recharge

• Corona info

• Activity log

• Transactions history

• Merchant locator

• Emergency contacts

Pre-login features:

• Products Information

• Latest offers

• Branch Location

Download and Registration Process:

1. FinSmart Mobile App is available on Play Store and App Store –Search by the name, Install and Open the App.

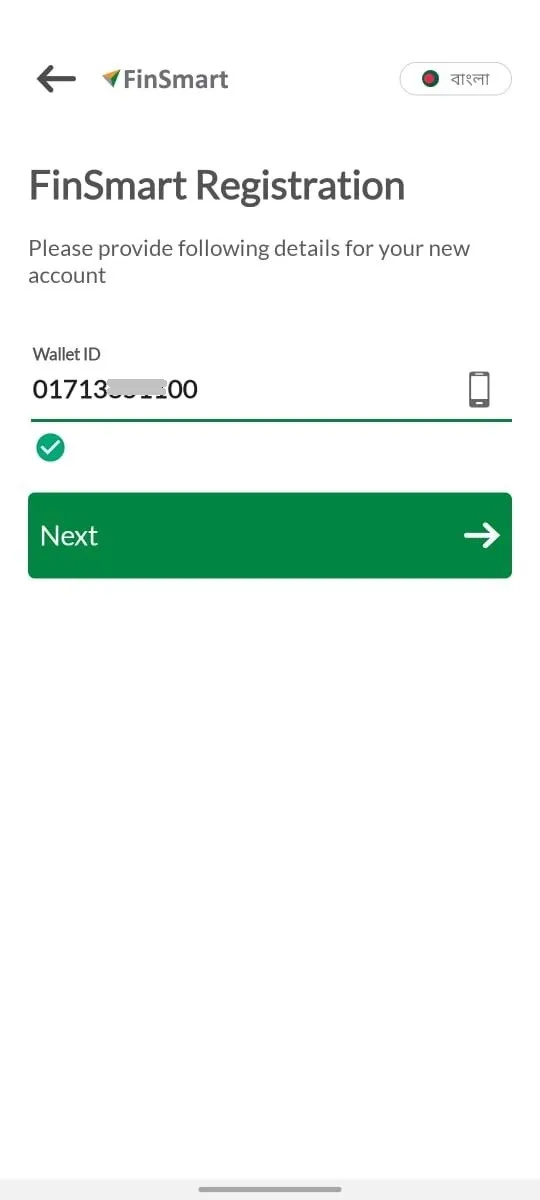

2. Input the Mobile number that is tagged with your LankaBangla Accounts, a Green tick mark will appear under the number. You will be asked to verify OTP and go next.

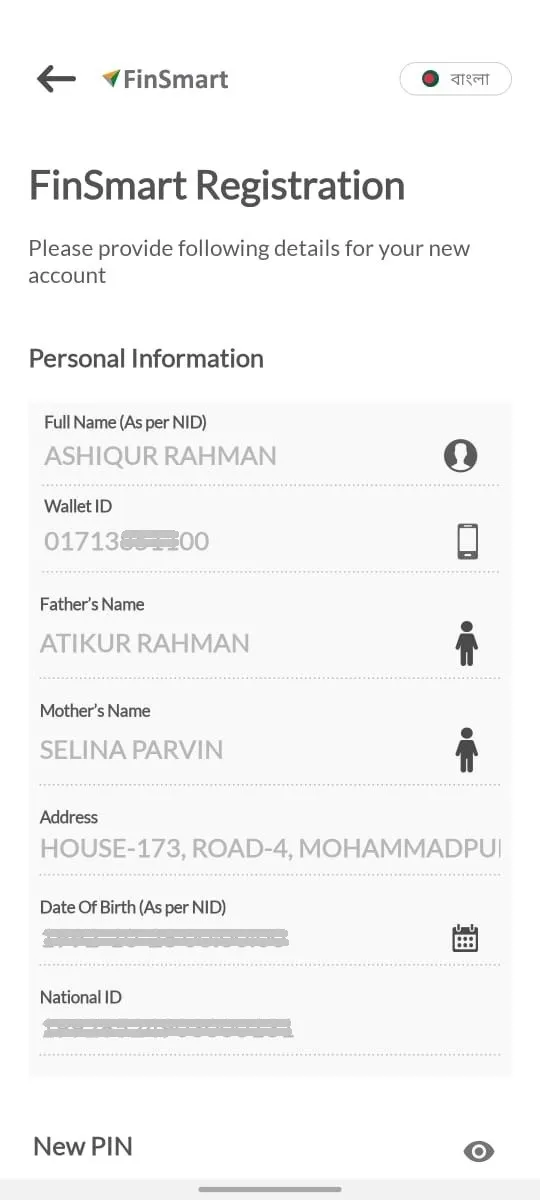

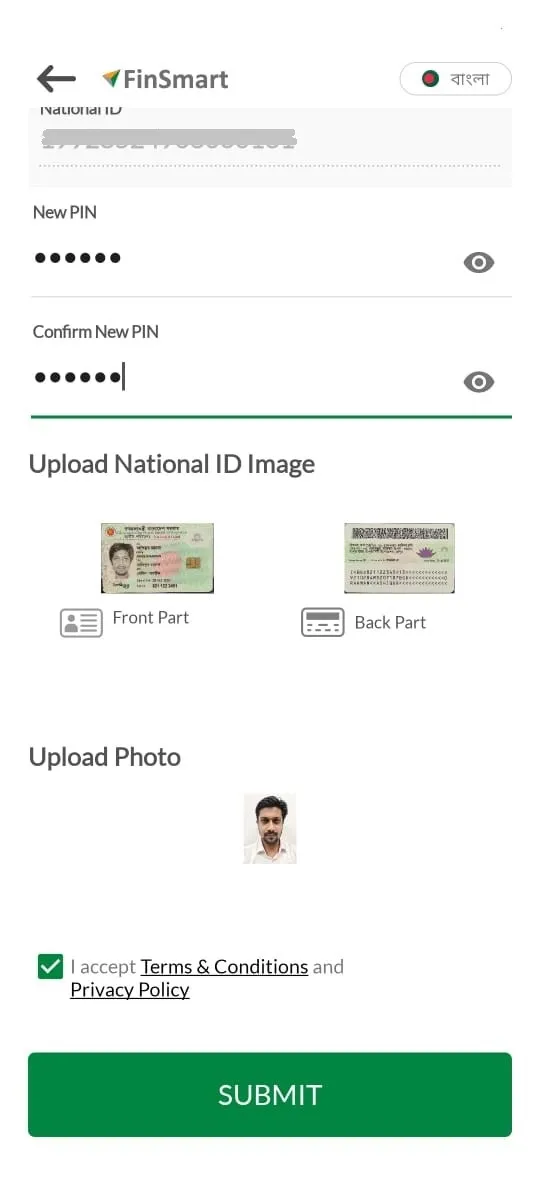

3. Review your personal information, set a 6-digit PIN for the next login, upload the front and back part of your NID and take a selfie with the front camera of your mobile phone.

4. Accept terms & conditions and submit. You will be notified about the registration through SMS.

Security & Compliance:

LankaBangla Finance Ltd is an ISO 27001: 2013 and PCI DSS certified organization. Thereby, FinSmart ensures its customers the maximum level of data security, privacy & compliance.

Fees & Charges:

FinSmart is free of charge and will always be. However, Internet data charges may be applicable as per the policy of your internet service provider.

Personal Loan Eligibility:

● Age between 25 years to 65 years

● Minimum monthly Income of BDT 30,000

● Minimum one year of Bank A/C relationship with any scheduled bank of Bangladesh

● Having 1 year professional experience for salaried employee & 3 years for contractual employee

Personal Loan Features:

● Highest loan ceiling in the market, BDT 25 Lac

● Minimum Repayment Tenure: 12 months

● Maximum Repayment Tenure: 60 months

● Top Up Loan facility

● Partial Disbursement Option

● Partial prepayment option

● Life Insurance Coverage

● Equal monthly installment basis up to 60 months

Sample Loan Calculation:

Loan amount: BDT 200,000.00

Loan Duration: 36 Months

Rate of Interest: 11%

Total personal loan interest: BDT 35,728.00

Processing fees (PF) 0.50% (Plus 15% VAT): BDT 1,150.00

Documentation Fee (DF) 0.50%: BDT 1,150.00

Total Deductibles: N/A (PF & DF pay individually)

In-Hand Amount: BDT 200,000.00

Total repayable Amount(Loan Amount + Interest): BDT 235,728.00

Monthly EMI Repayable: BDT 6,548.00

Interest, tenures and other specifications for Personal Loan:

● Equal monthly installment basis up to 60 month

● Maximum Annual Percentage Rate (APR) 11.00%

● Documentation Fee/ Processing Fee: At actual plus 15% VAT

● Early Settlement/Partial Payment Fees: At actual plus 15% VAT

● Penal interest charge: 2% above the nominal rate

To learn about the Fees & Charges, Rate of Interest and Tenure of our products, please visit:

https://www.lankabangla.com/fees-charge/

https://www.lankabangla.com/rate-of-interest

For feedback & suggestions, please call us at 16325

Developer Infomation

Safety starts with understanding how developers collect and share your data. The developer provided this information and may update it over time.

Email :