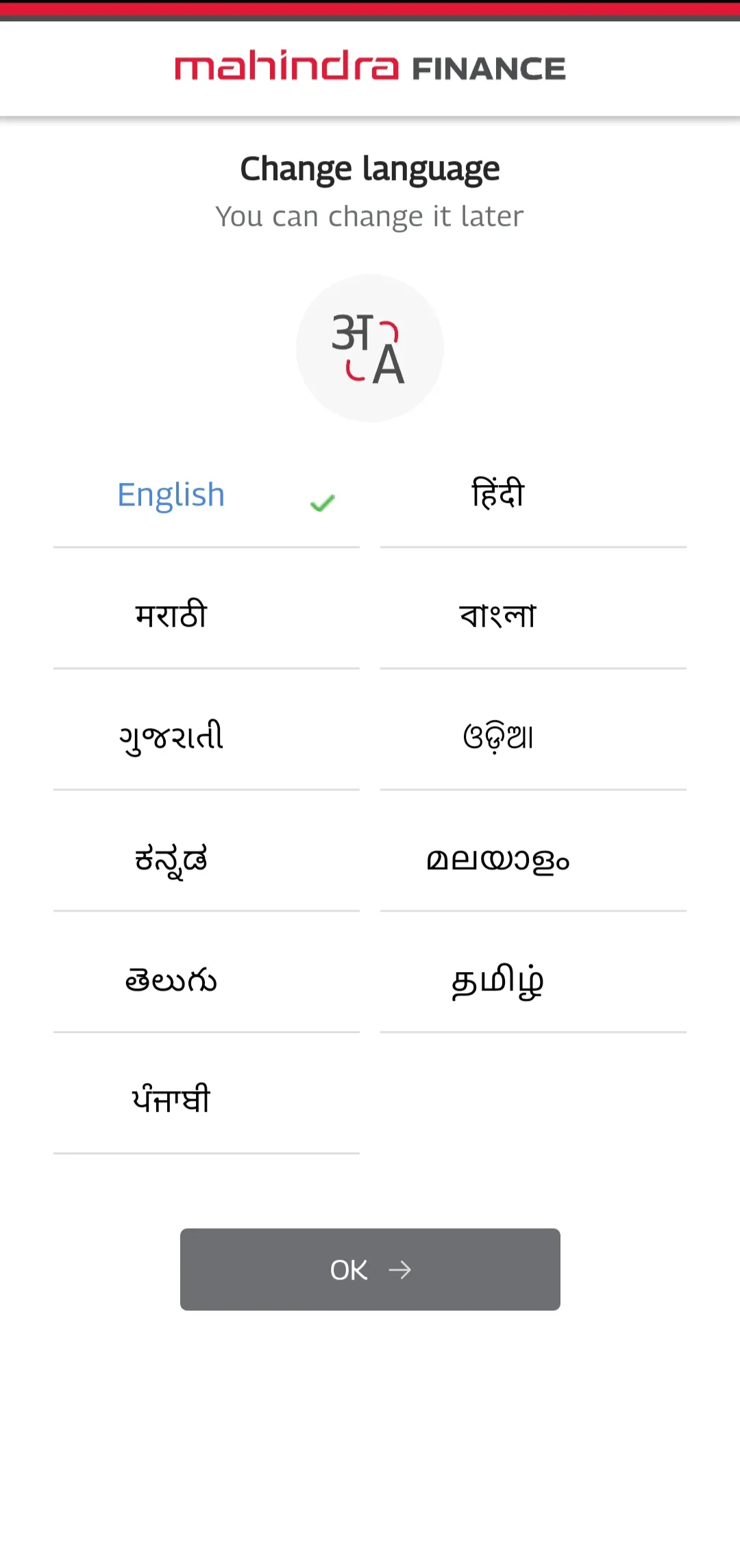

“Mahindra Finance App” is the official customer app of Mahindra Finance.

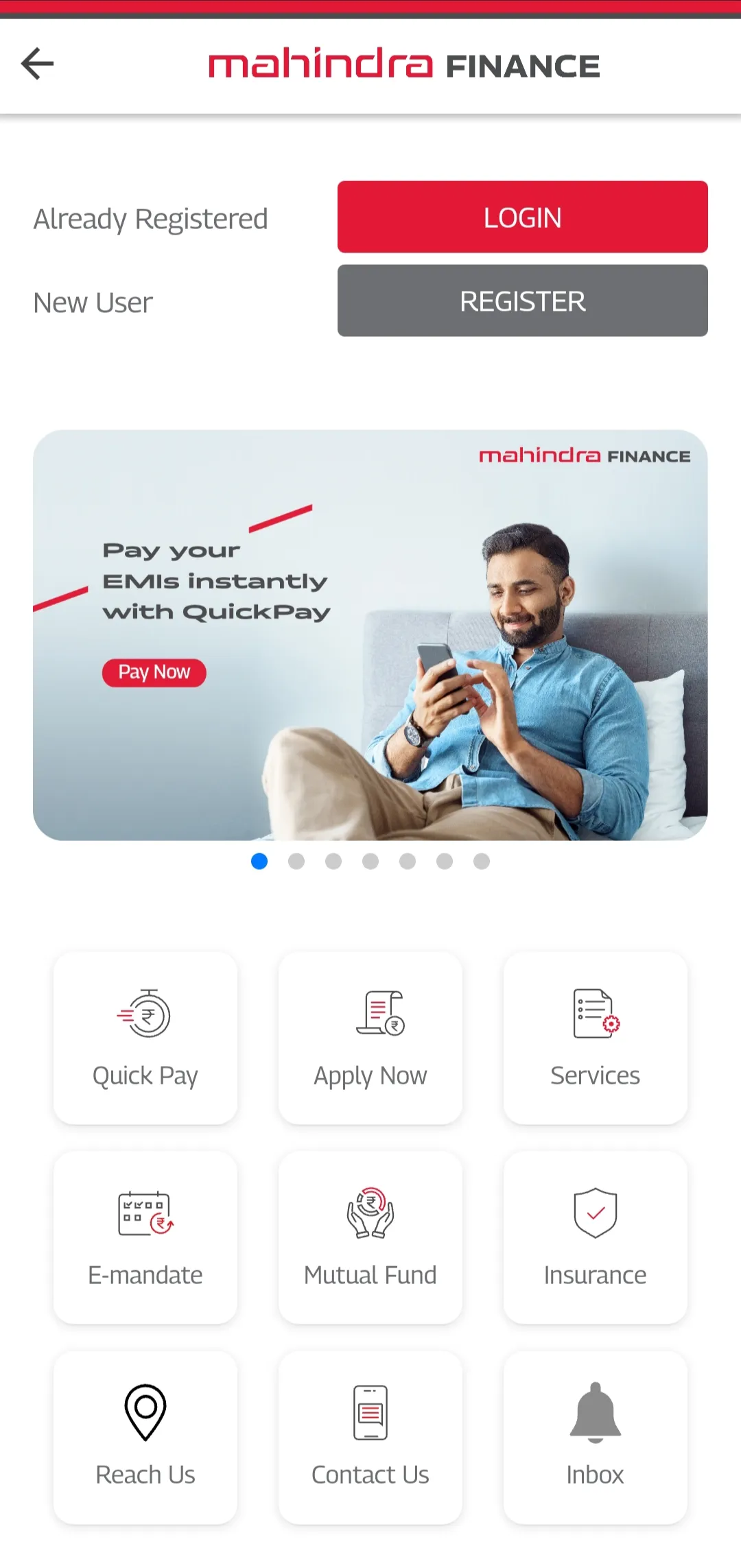

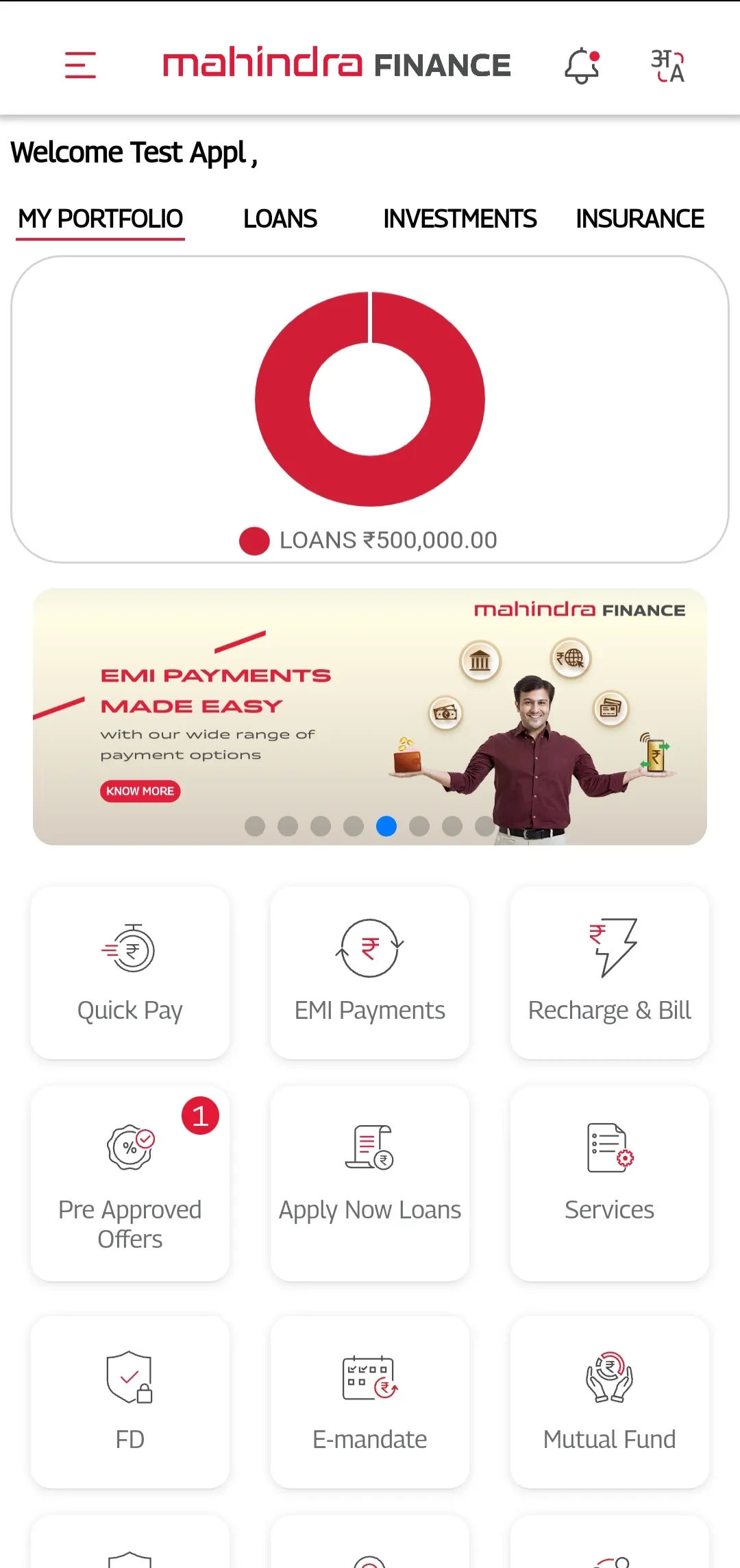

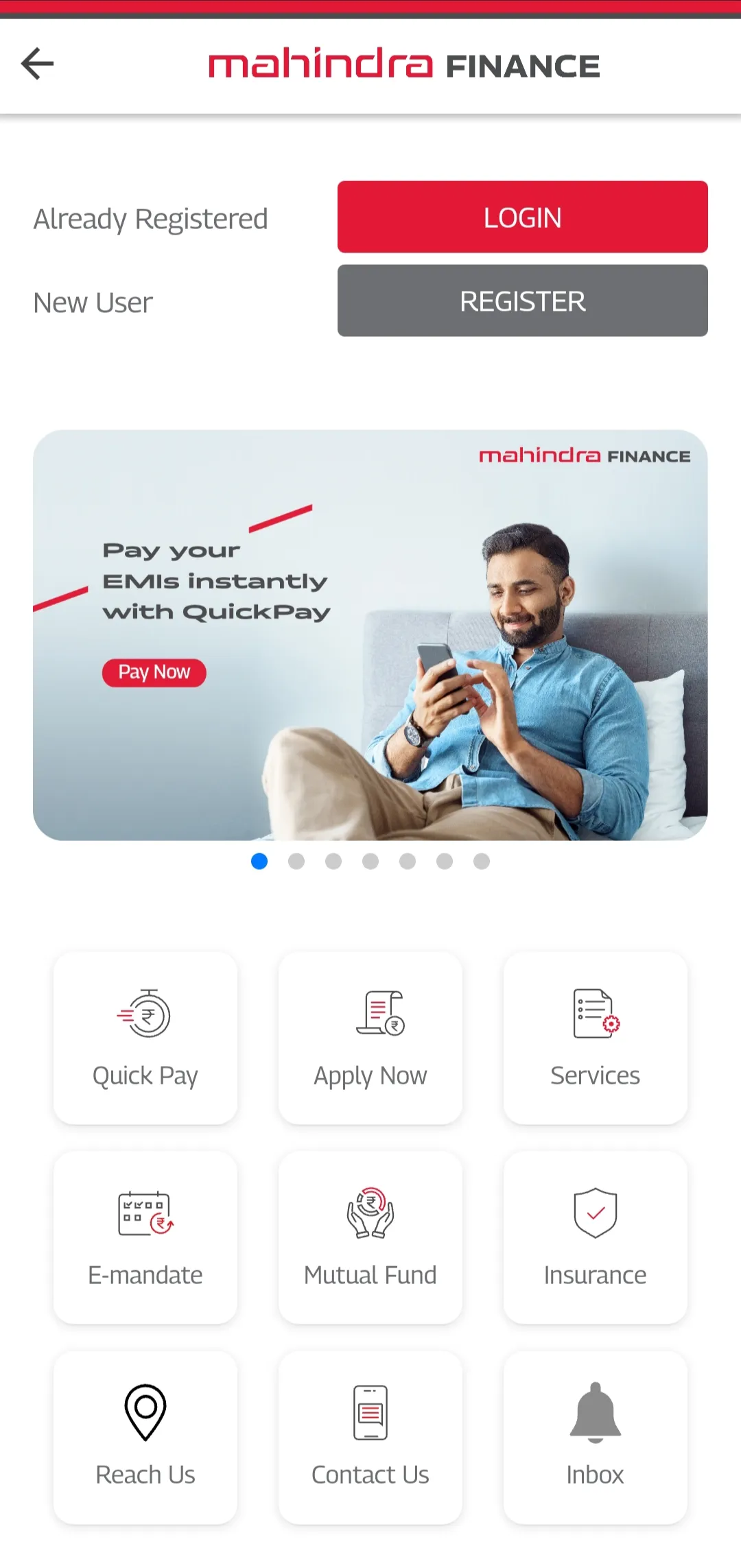

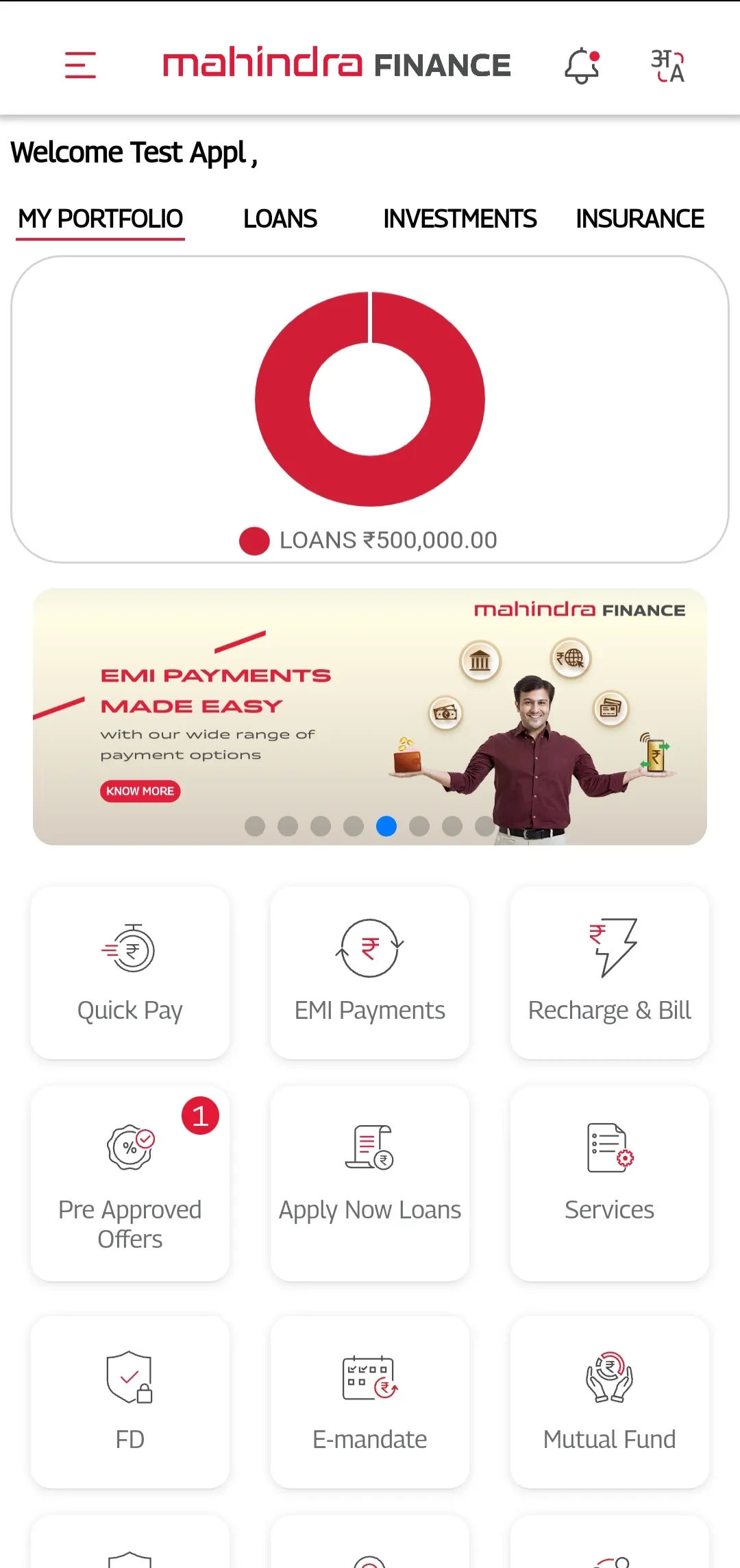

Through Mahindra Finance App, consumers can view vehicle loan, FD details or apply for pre-approved loans and other customized offers.

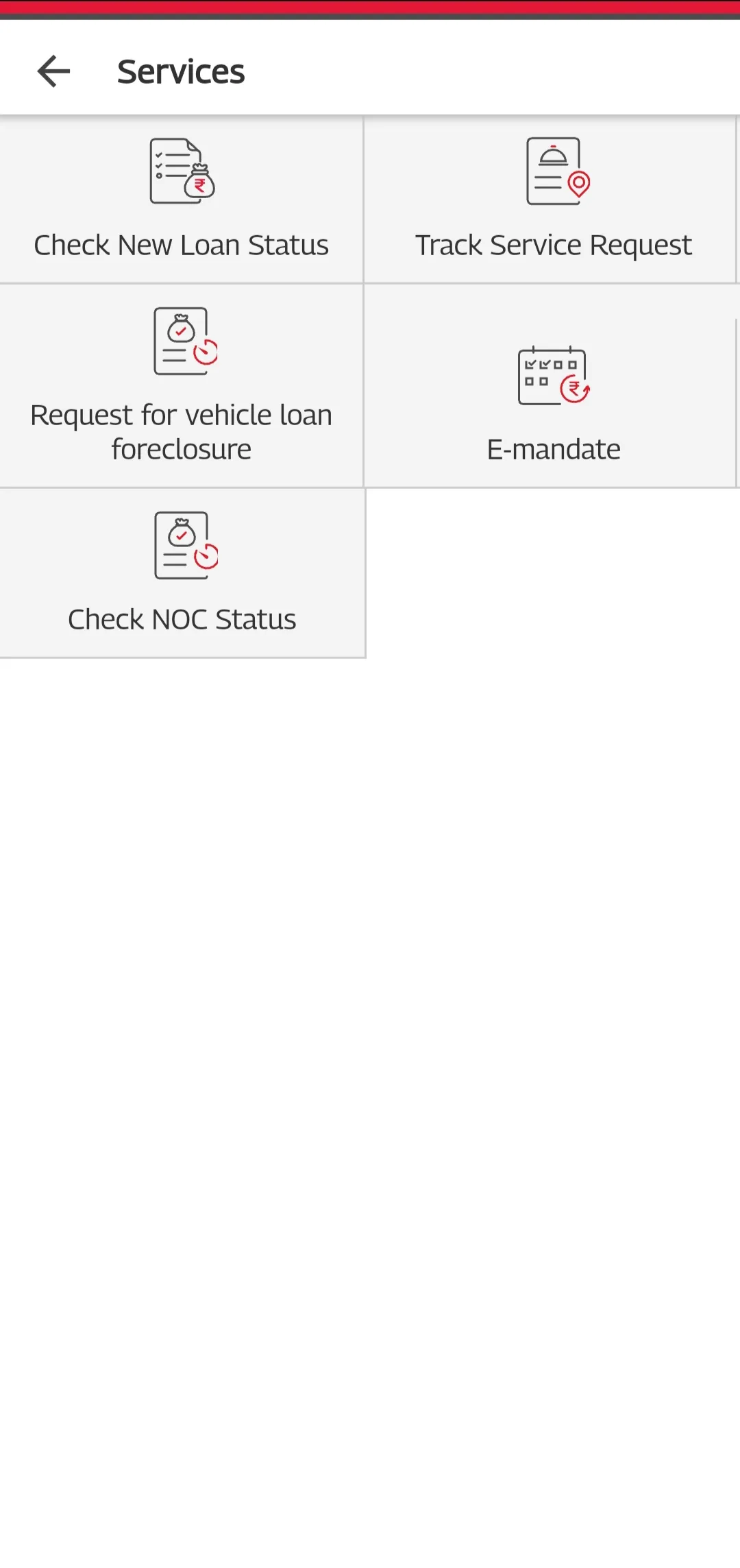

Here is what you can do with the new and improved app.

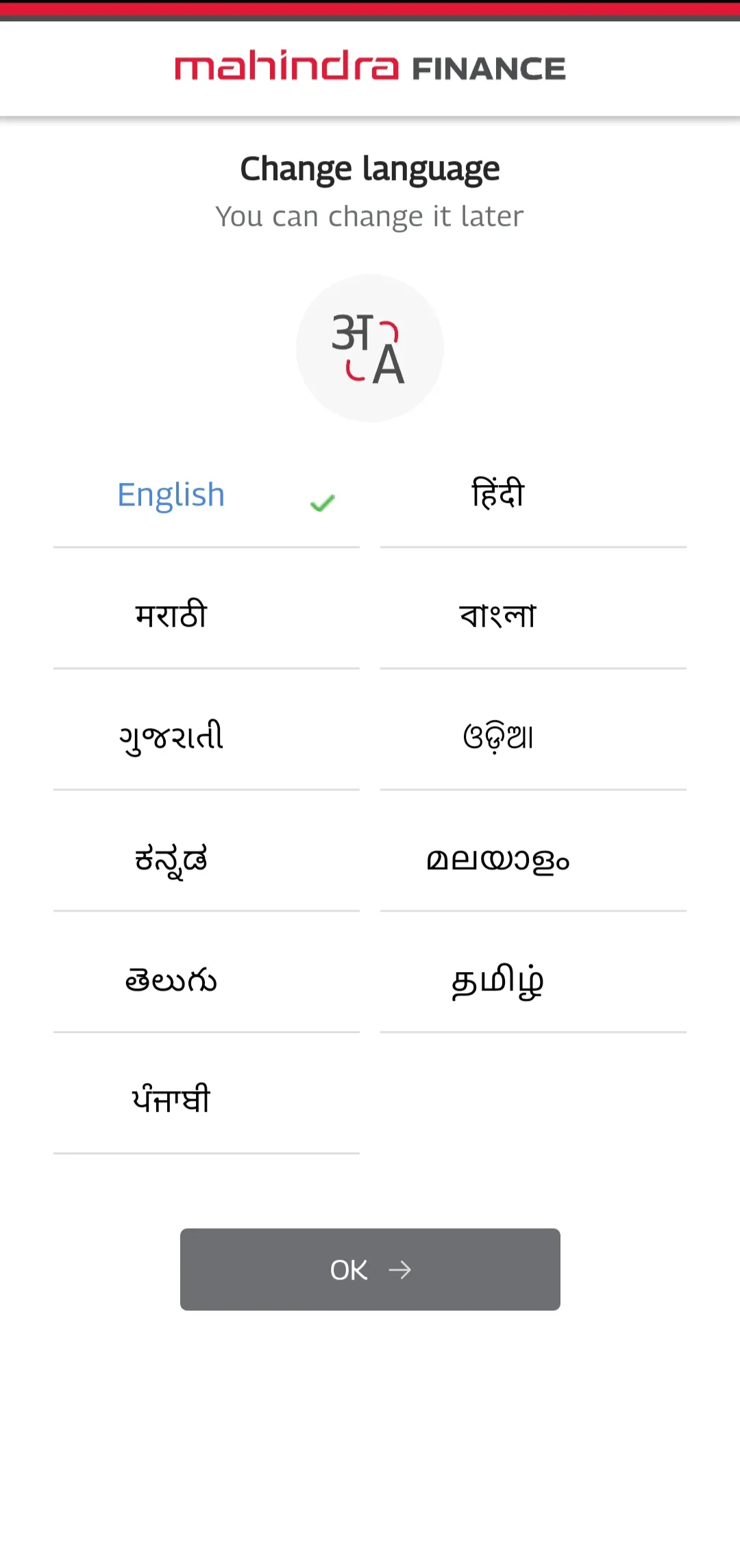

1. Quick Easy one time registration with login via PIN or Fingerprint

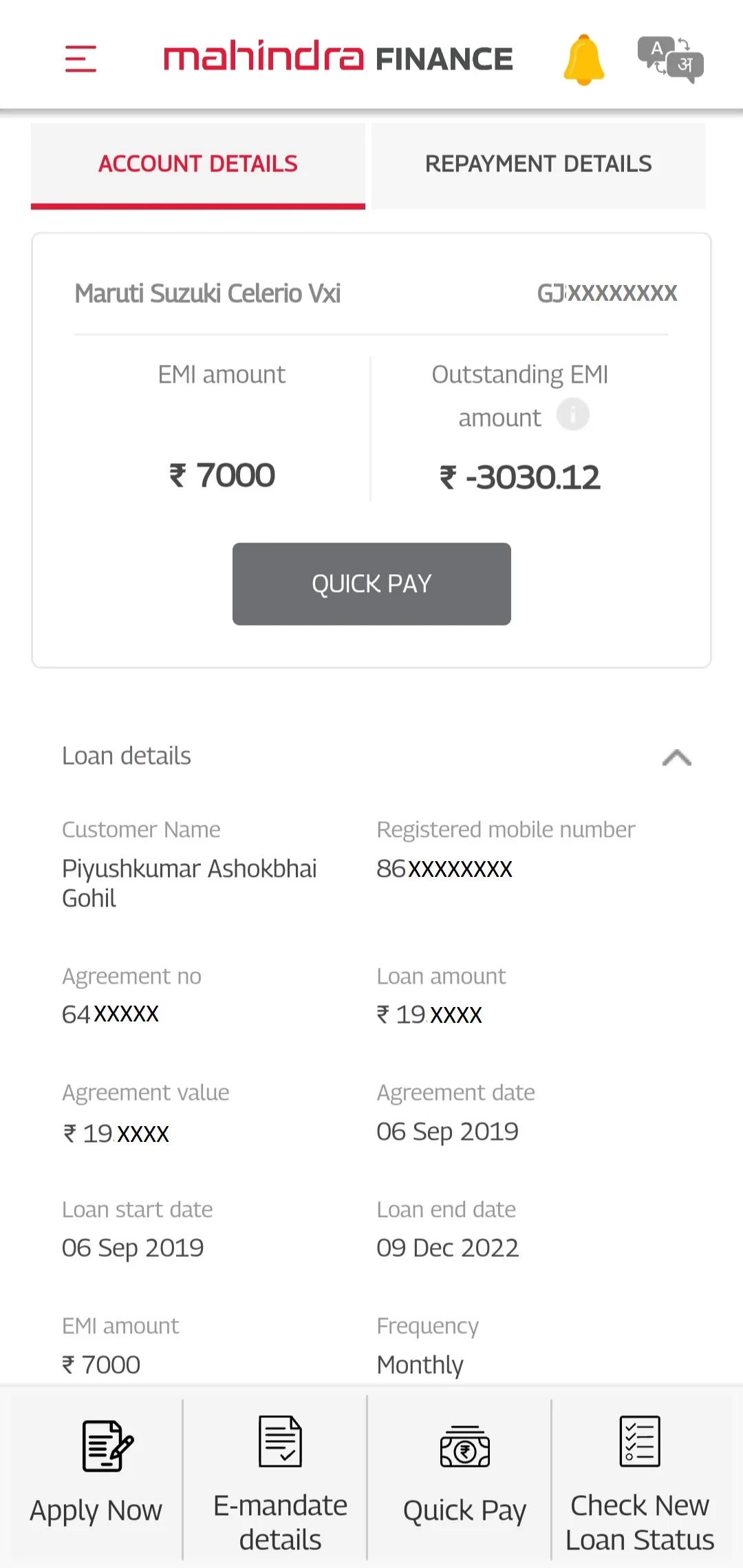

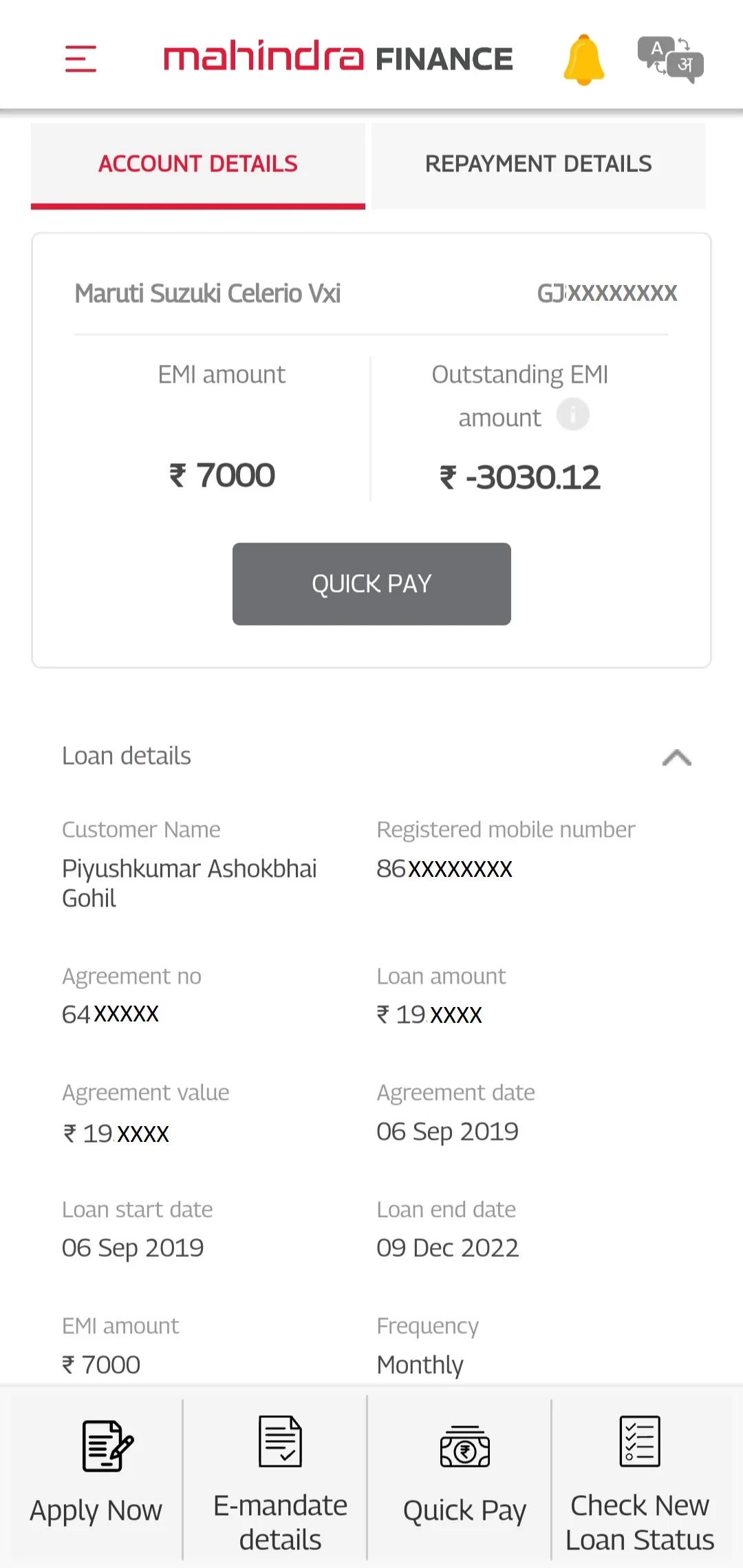

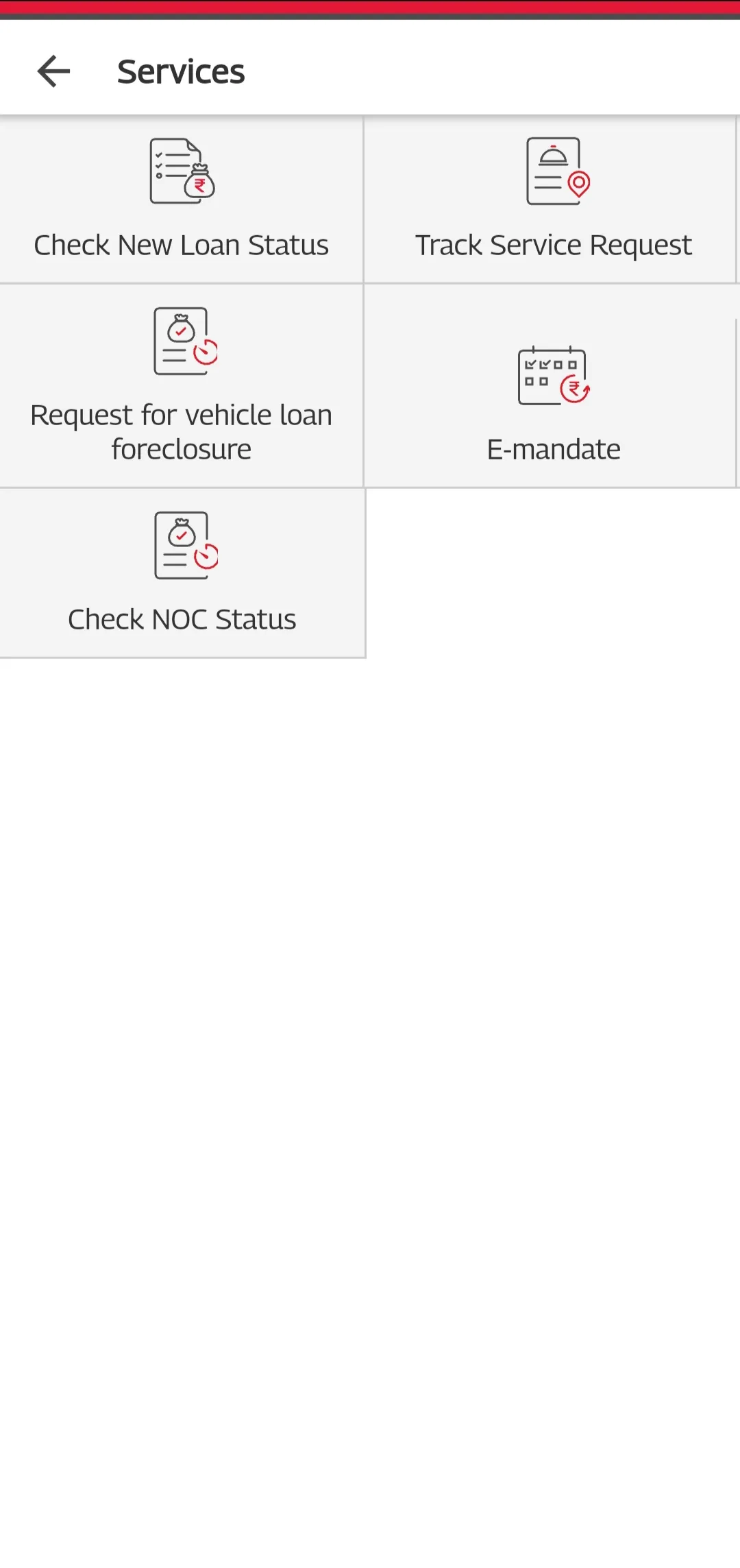

2 .Active account information: View and manage your active loans and Fixed deposit investments, make payments and more.

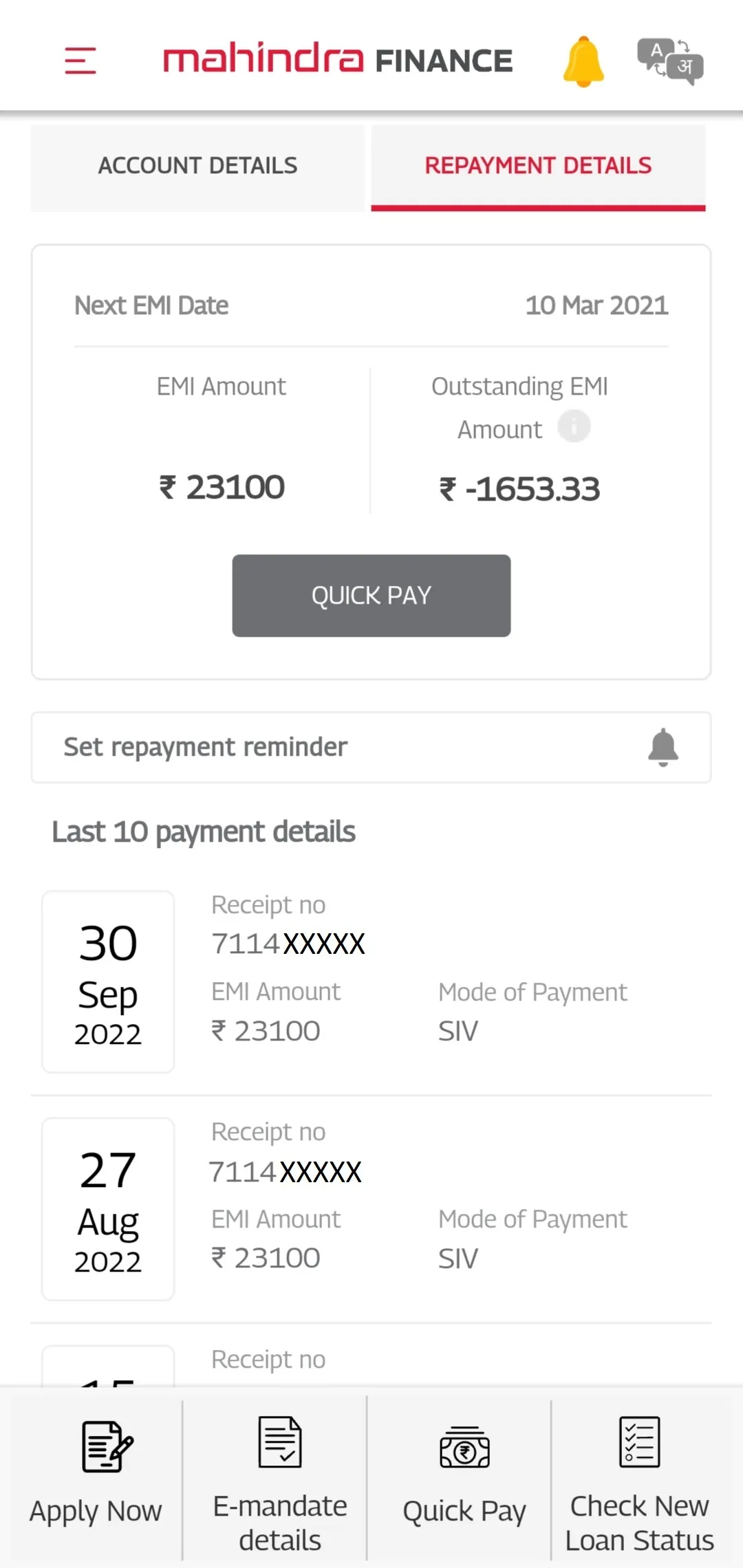

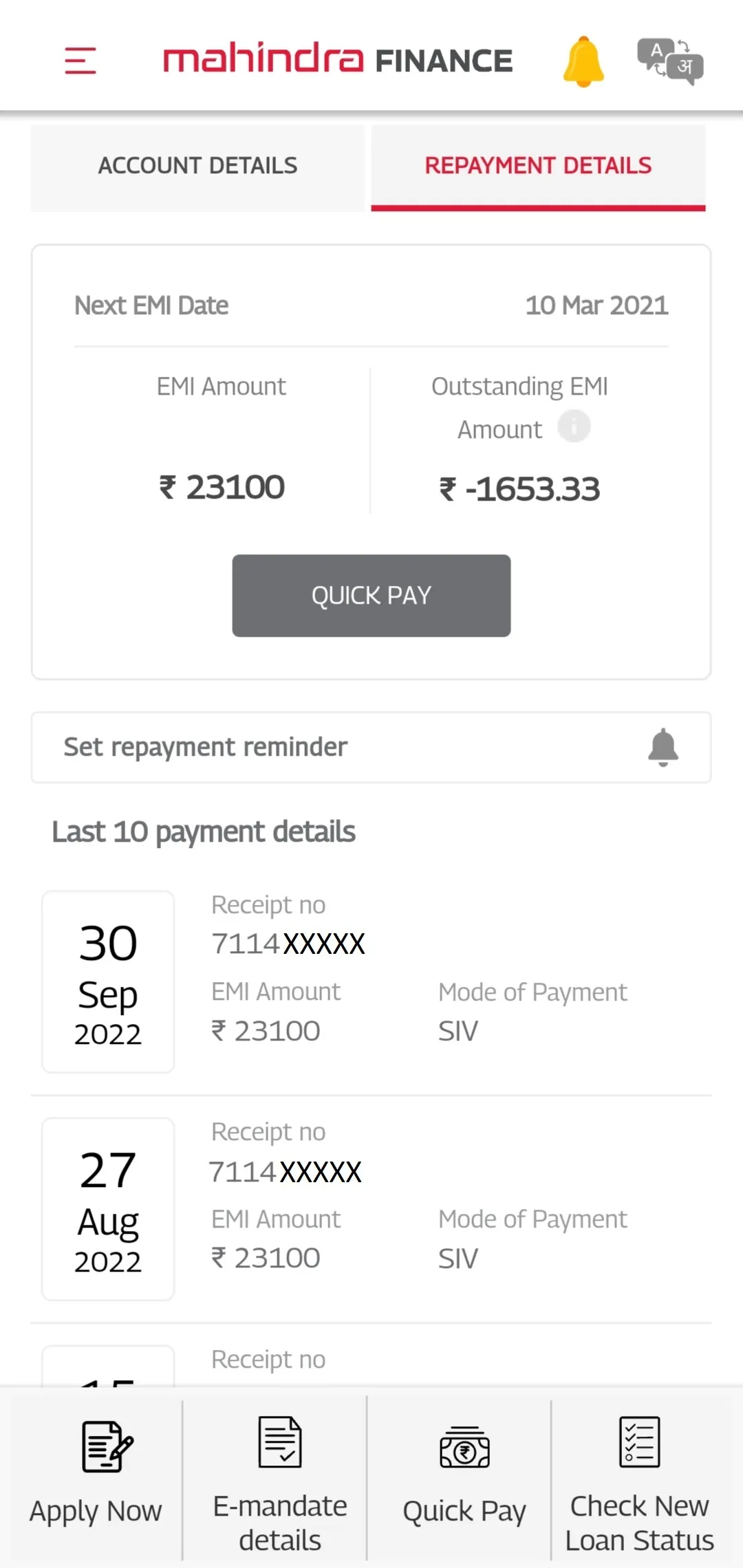

3. Repayment Schedule: Access repayment information, EMIs due, amount paid, and amount remaining and download repayment schedule.

4. Pre-approved offers: View pre-approved offers & details, get product information or request a call back.

5. Payments: Pay your EMIs using your preferred mode - Debit Cards Net Banking, Wallets, UPI.

6. Executive Connect: Connect with your relationship executive for any assistance through our Request a Callback facility.

7. Branch Locator: Branch locator provides an easy navigation to the branches near you.

8. Cash Payment Points: For consumers, who want to pay their EMIs in cash, locate your nearest cash collection centers.

9. Offline Capability : The app provides key user information like account summary, repayment details, executive information etc. even when you’re offline.

10: Easy apply for Mahindra Vehicle Loans & Mahindra Mutual Funds & Insurance.

11: Receive important messages from Mahindra Finance with notification feature.

Minimum tenure : 6 months , maximum tenure : 18 months

Rate of interest : 1% per month

Min loan amount 25k , max amount : 1.75 lakh

AIR : Annual interest Rate : Min: 19% , Max : 25%

Option to have insurance cover (MLS) at an additional small fee which protects the Borrower from any further liability.

Scenario with insurance cover

Finance cost : 1 lakh

Tenure : 12 months

Finance charge (1 % per month) : INR 12,000

Processing charge : INR 2000 ( ACH mode : 2% of loan amount , Cash mode 3% of LA)

* ACH mode has been chosen in this case.

Future receivable : INR 1,12,000 ( 1,00,000 FA +12,000 INT)

Amount to be disbursed after deduction = Finance amount – ( processing fee + MLS ) = 1,00,000 – (2000+337 ) = INR 97663

Monthly EMI is listed in calculator too = Future receivable / tenure. 1,12,000/12 = 9333*11 , 9337*1

Scenario without insurance cover

Finance cost : 1 lakh

Tenure : 12 months

Moratorium : 30 days

Finance charge (1 % per month) : INR 12,000

Processing charge : INR 2000 ( ACH mode : 2% of loan amount , Cash mode 3% of LA)

* ACH mode has been chosen in this case.

Future receivable : INR 1,12,000 ( 1,00,000 FA +12,000 INT)

Amount to be disbursed after deduction = Finance amount - Processing fee = 1,00,000 - 2000 = INR 98,000

Monthly EMI = Future receivable / tenure. = 1,12,000/12 = 9333*11 , 9337*1

Supported for Android OS 7.0 and above