vCard is a Mobile Credit Platform. vCard partners with RBL Bank for co-branded Credit Cards https://www.rblbank.com/product/credit-cards/rbl-bank-vcard and with Pinnacle Capital Solutions Private Limited ( RBI Registered NBFC) for credit line products known as PINCAP https://www.pincap.in/our-partner .

Activate Cash in Your Mobile Now

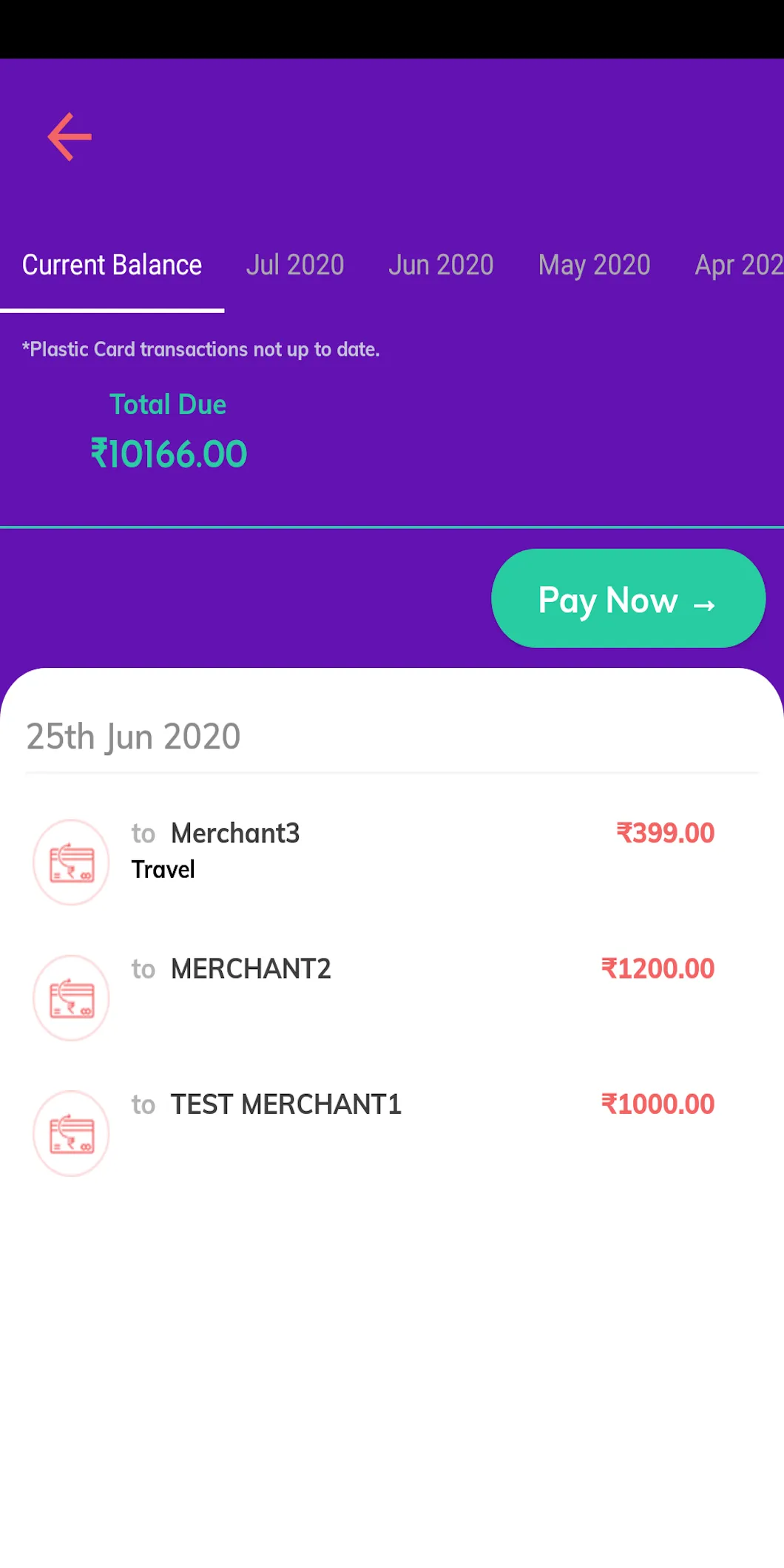

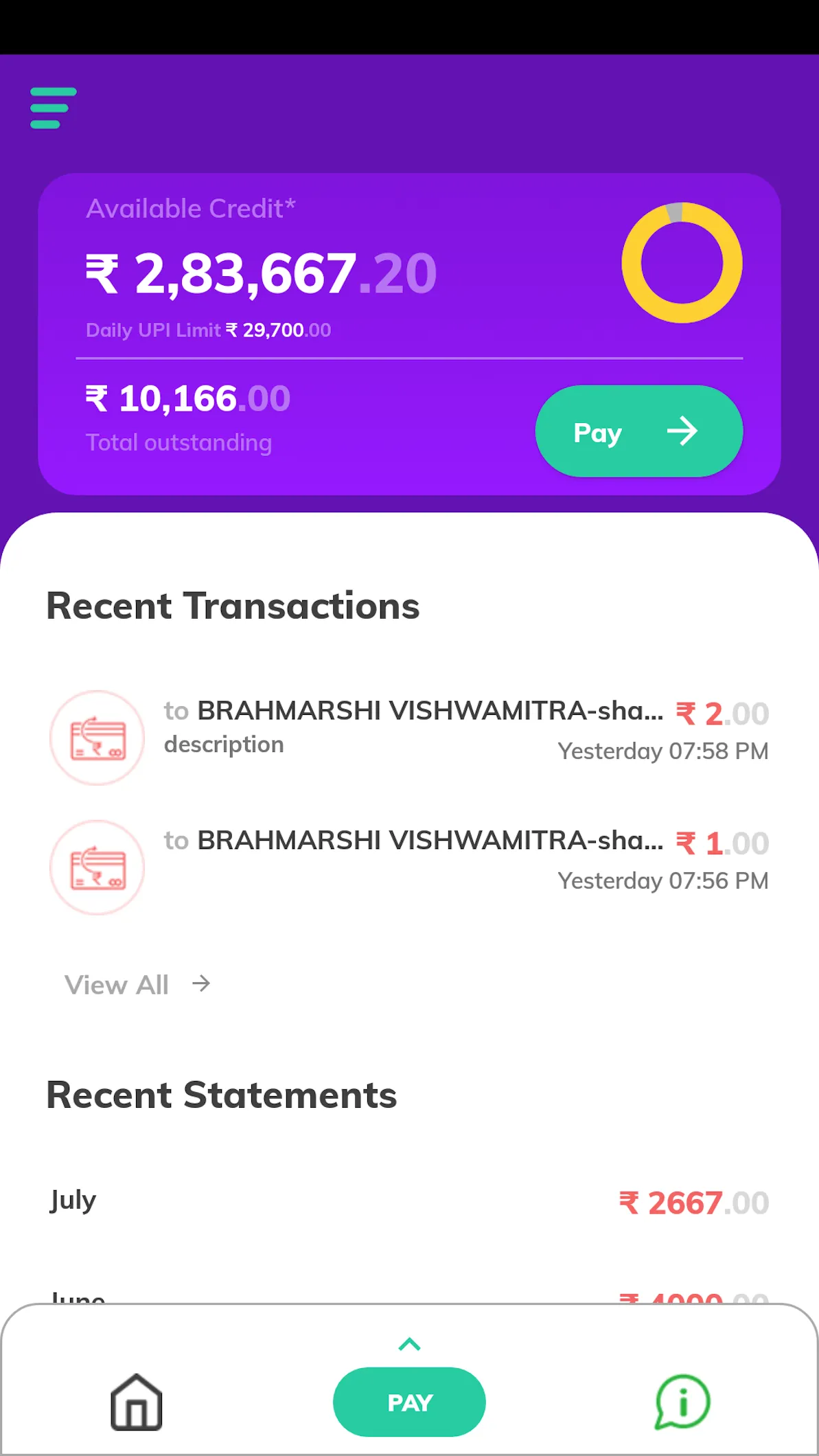

vCard is your One-Stop Finance App for On-Demand credit. Use it as Credit Card, use it as cash, and use it as a Personal Loan. Instant Approval,

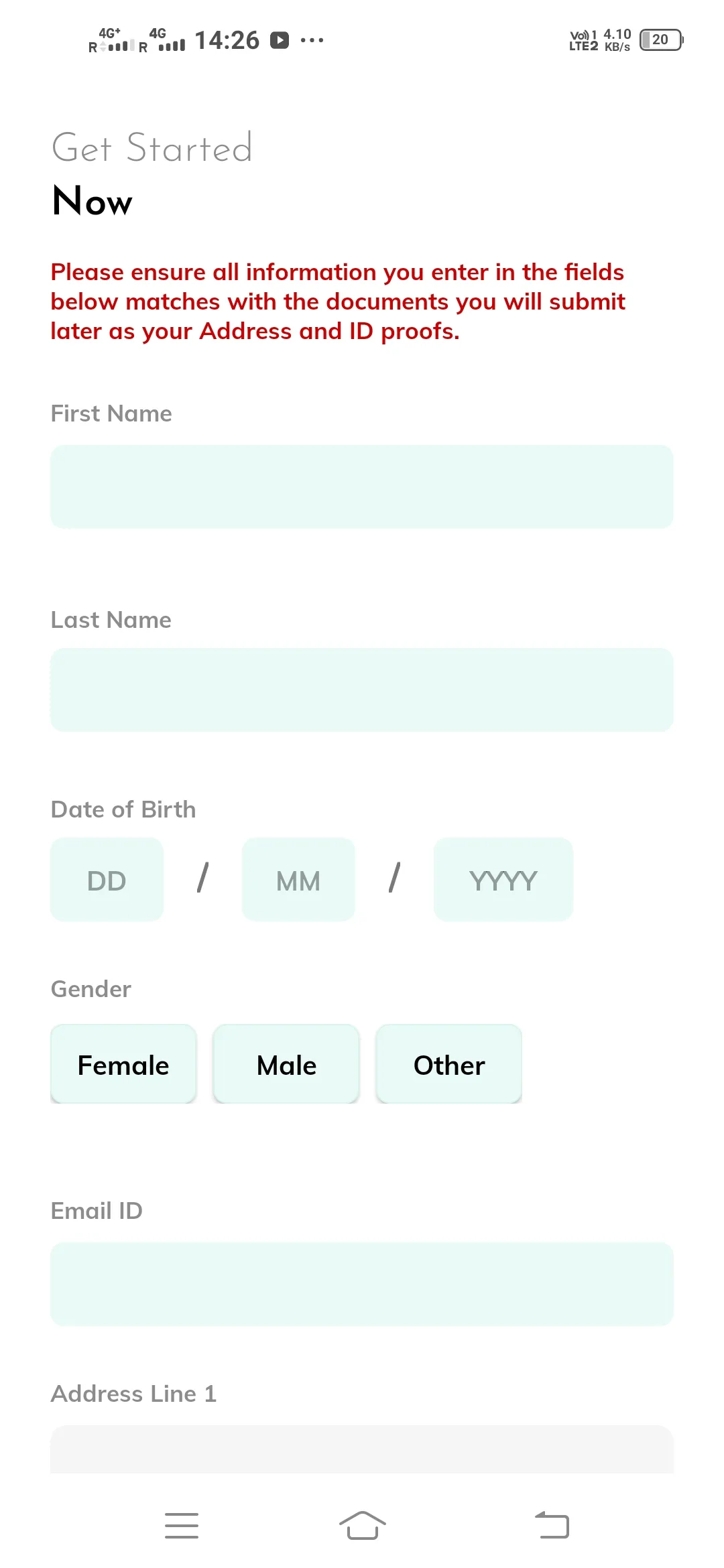

Digital Documentation, Zero Joining Fees. Contrast to 15 day+ processes for Plastic Credit Card.

Get a Visa vCard Mobile Credit Card ( Co- branded with RBL Bank)

● Physical Plastic Card Spends with cashback.

● 0% Interest on all card spends up to 50 days. 3.5% per month rollover interest after that.

● Transfer up to specified limits to your Bank Account on EMI @ 13- 20%.

● RBL Bank Credit Card for both Online and Offline Payments.

● Accumulate cash back from all your spends

● Zero Annual Fee for Year 1, waived off subsequently on spend of > Rs. 1L.

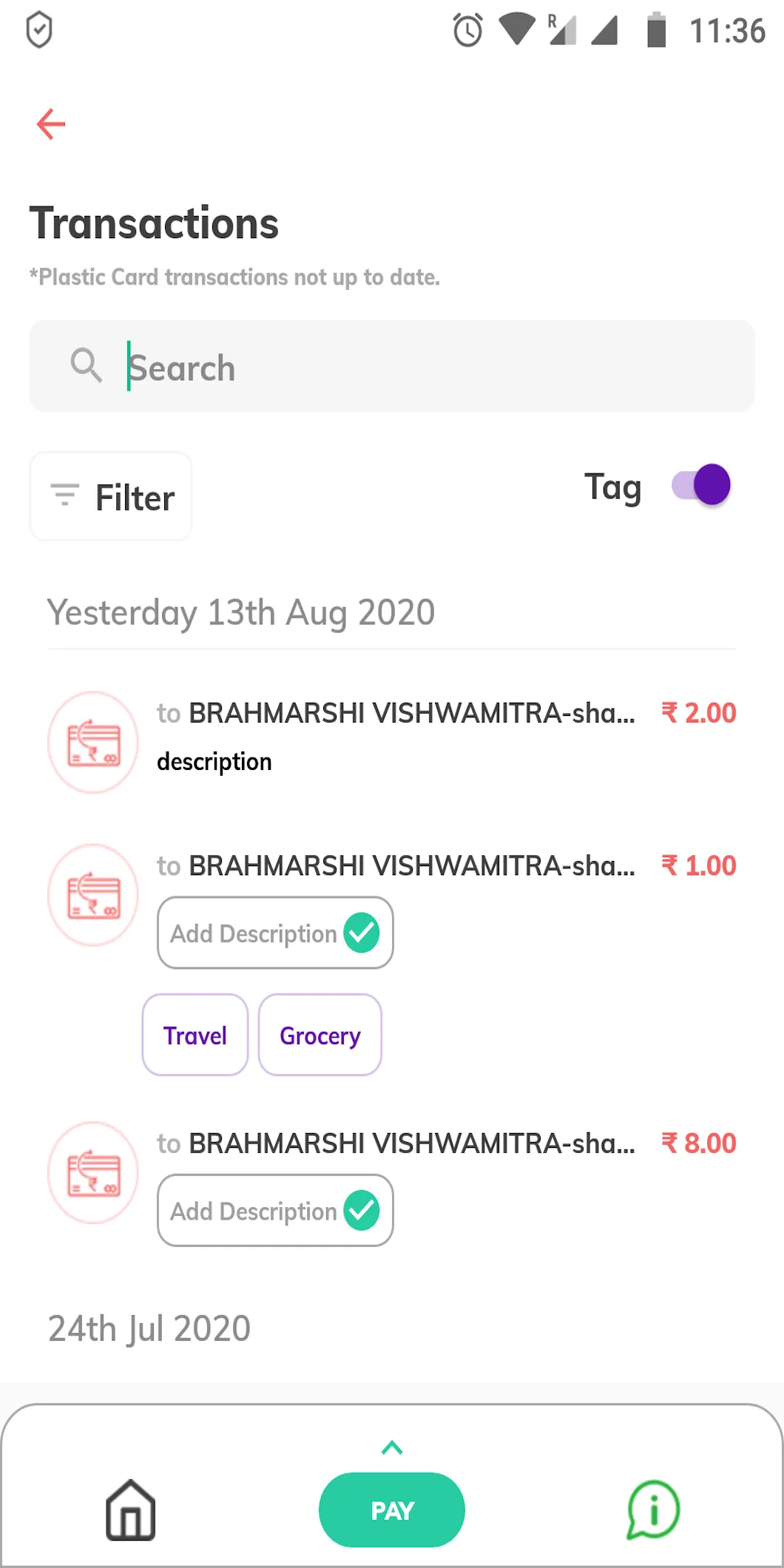

● Personalized offers on Food, Shopping, Entertainment, Online Spend etc.

For most important T&Cs of RBL credit card refer: https://drws17a9qx558.cloudfront.net/document/Credit%20Cards/RBL-MITC-final.pdf

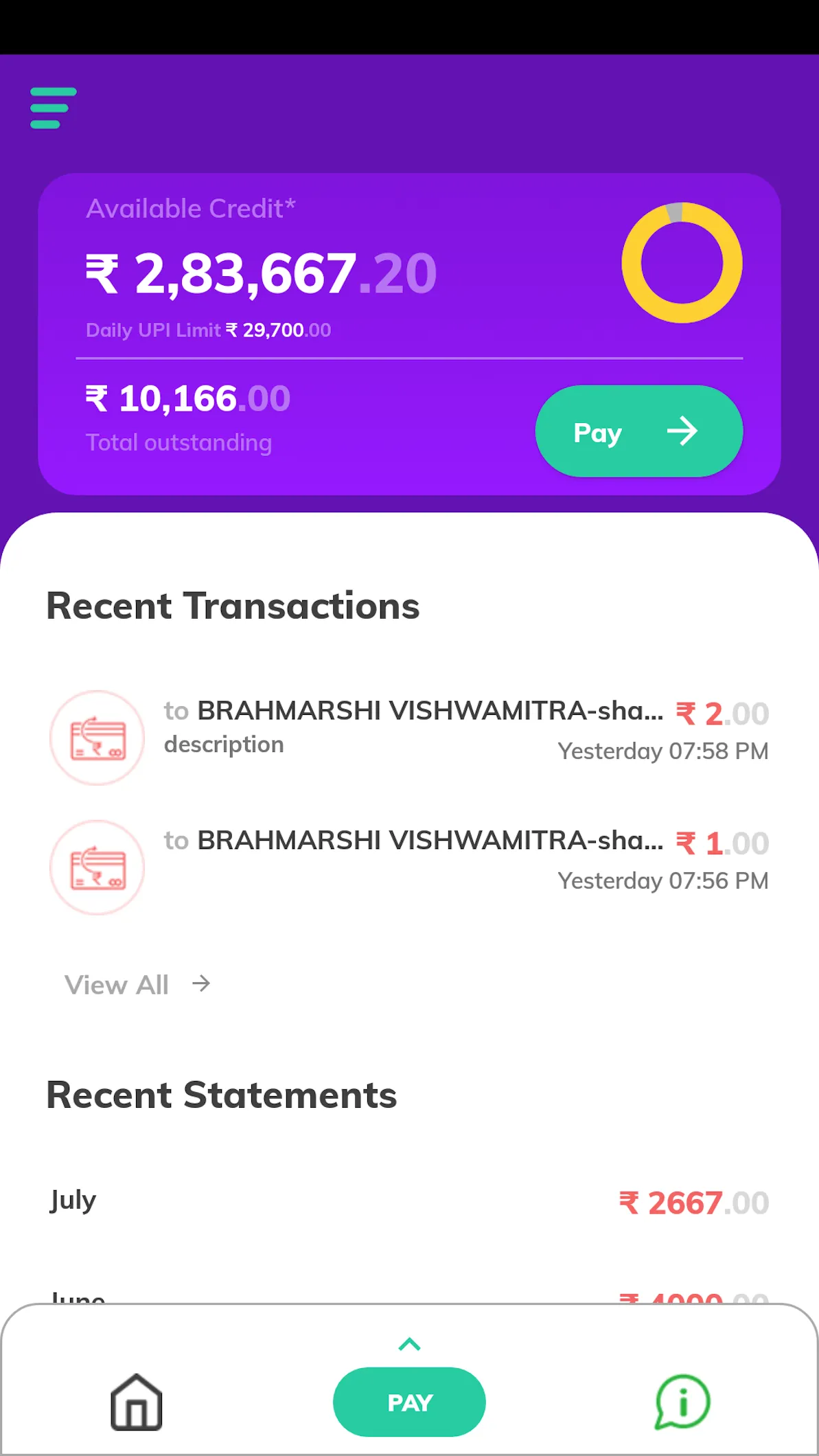

Get vCard Credit Line issued by Pinnacle Capital Solutions Private Limited ( RBI Registered NBFC) known as PINCAP.

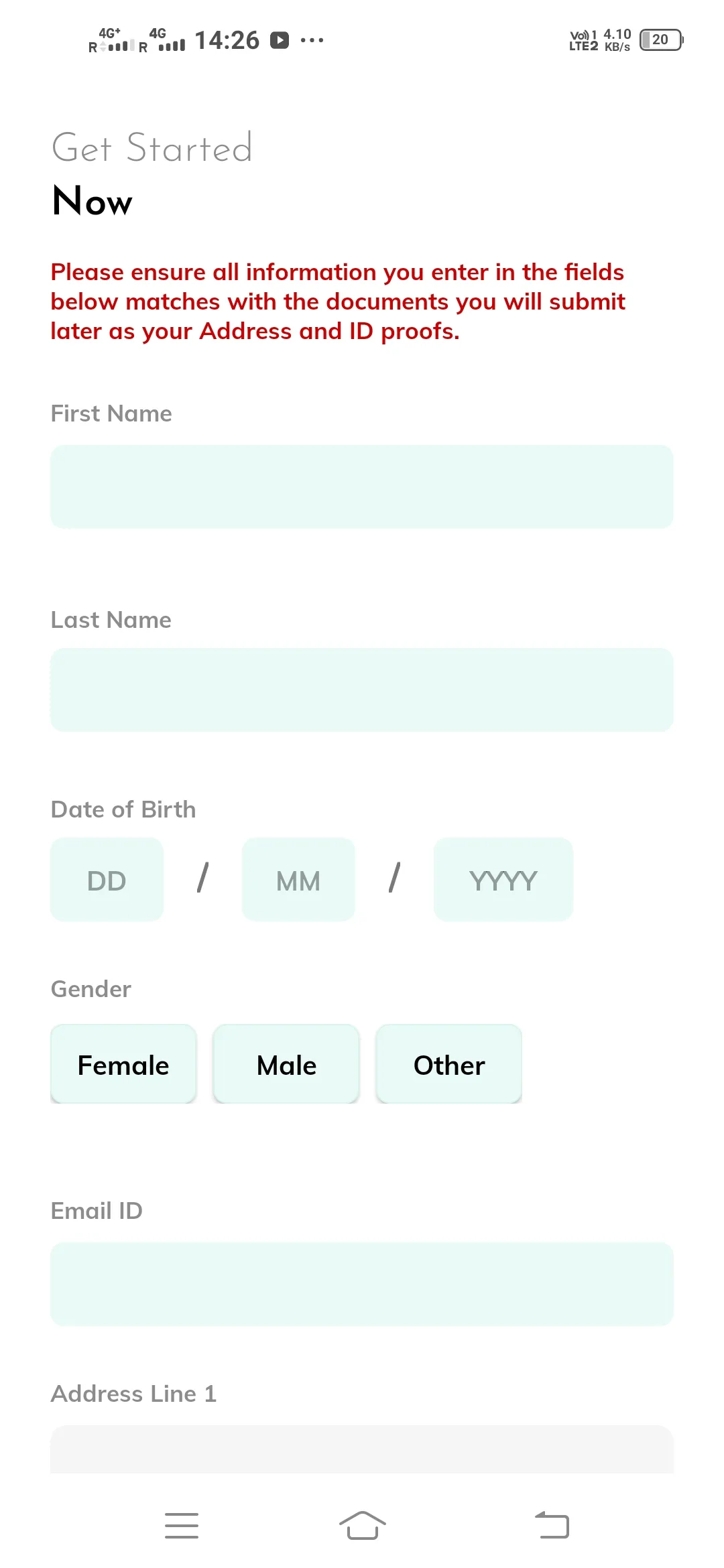

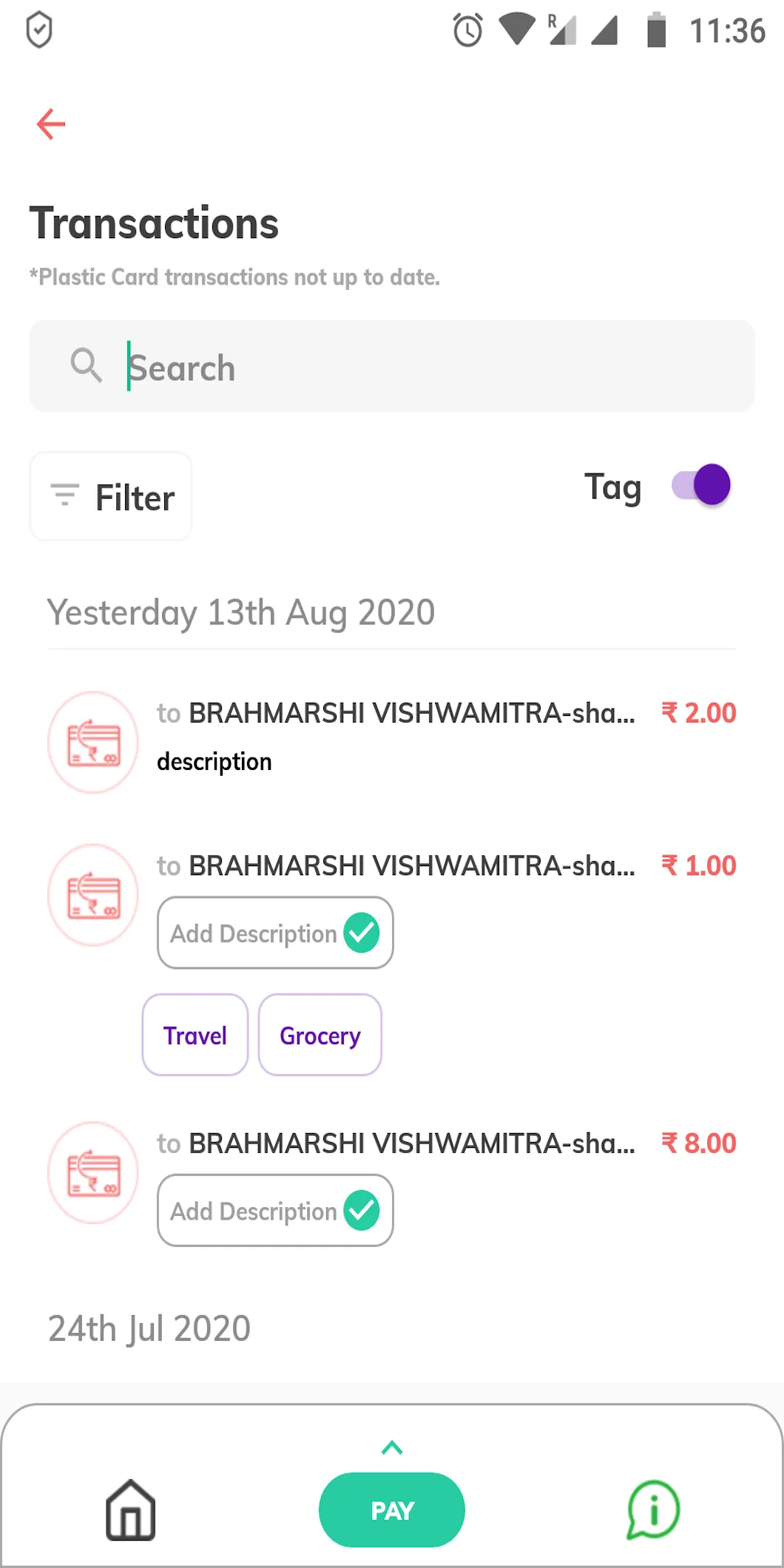

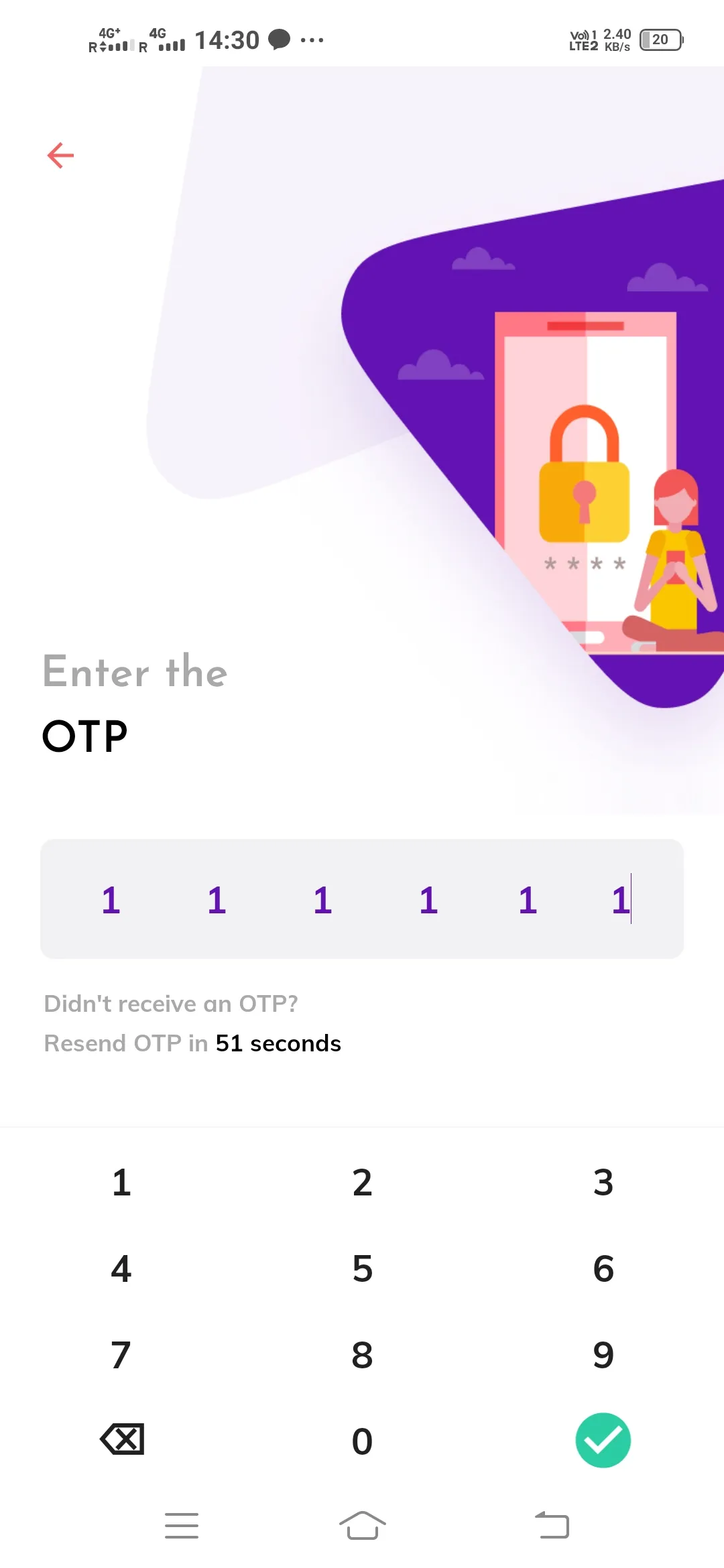

● Paperless KYC application.

● Zero processing charges and Zero Annual Fee.

● 3 - 3.5% per month roll over interest.(36% to 42% APR)

● 0 – 30 day Interest-free period depending on Credit Score and Monthly Spend.

● Up to Rs. 60,000/- credit limit.

● Pay at your convenience there are no prepayment charges.

● Option to convert the loan into monthly installments (EMI) of 3, 6, 9 months depending on the principal amount @24% and 2% conversion charges.

● Finance Charges reduce based on credit score and spend history.

● Personalized offers on Food, Shopping, Entertainment, Online Spend etc.

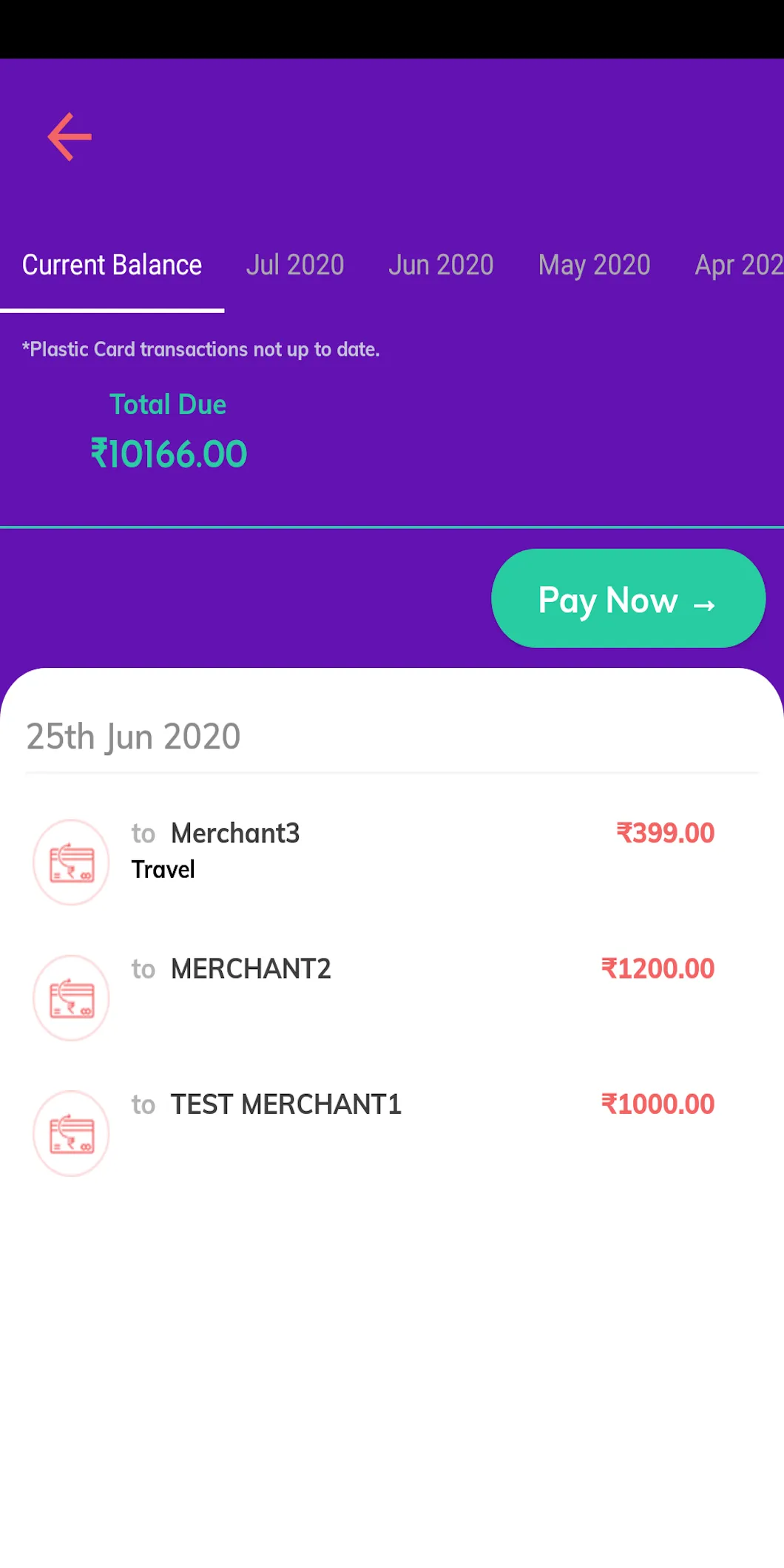

Minimum and maximum period for repayment

Tenures for EMI

Minimum: 3 months Maximum: 9 months

Sample calculation in case the loan is converted to an EMI:

For Loan of ₹5,000 of 3 month tenure with interest rate @24% per annum

One time Processing fee @2% of Principal = ₹100

Monthly payment/EMI = ₹1733.77

Amount paid back in 3 EMIs= ₹5201.31

Total interest on the 3 EMI= ₹201.31

Total interest + processing fee = ₹301.31

GST (applicable @18% on fees) : Rs 18.00

Total amount to be paid by customer i.e. principal + interest + fee + GST= ₹5319.31

AI in Credit

vCard also has a First-of-its-Kind Chat-based Credit Card Support on WhatsApp or reach out to us at

[email protected]

Now you don’t have to spend long hours waiting to connect to customer support or listen to the monotonous flute music. Just reach out to Bot + Human support through the vCard app.