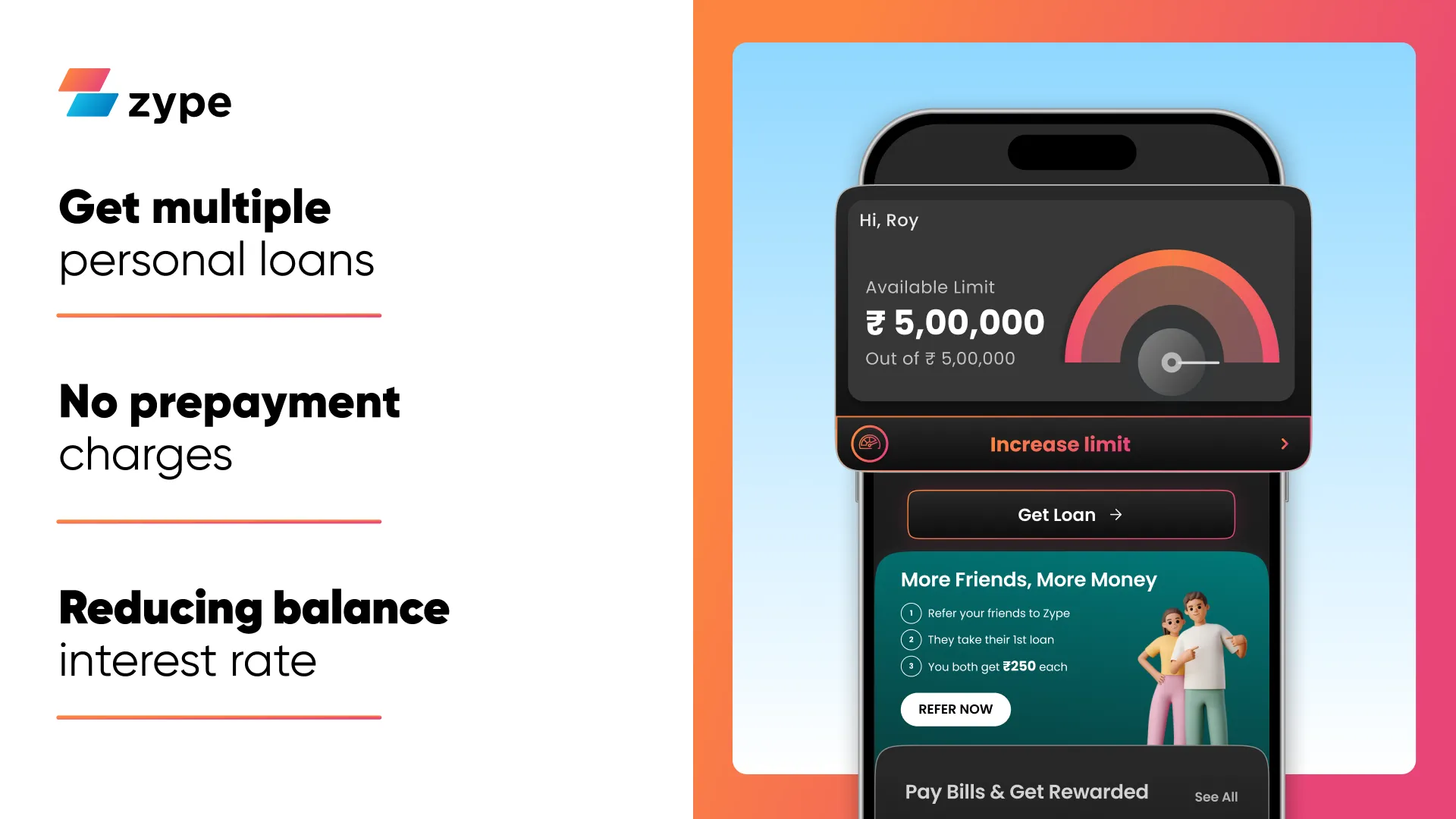

Need cash instantly? The Zype instant personal loan app puts fast personal loans at your fingertips! Get instant credit line & loan approval, then receive funds quickly into your account. With flexible repayment options & EMI, you choose what works best.

We make acquiring instant money loans easy & rewarding, too! Refer Zype loan app to your friends to earn perks while enjoying guarantees like zero hidden fees, cashback on bill payments, & full RBI compliance for your safety.

Over 2.5 million users trust us to deliver hassle-free & quick loans.

With the Zype loan app, you can:

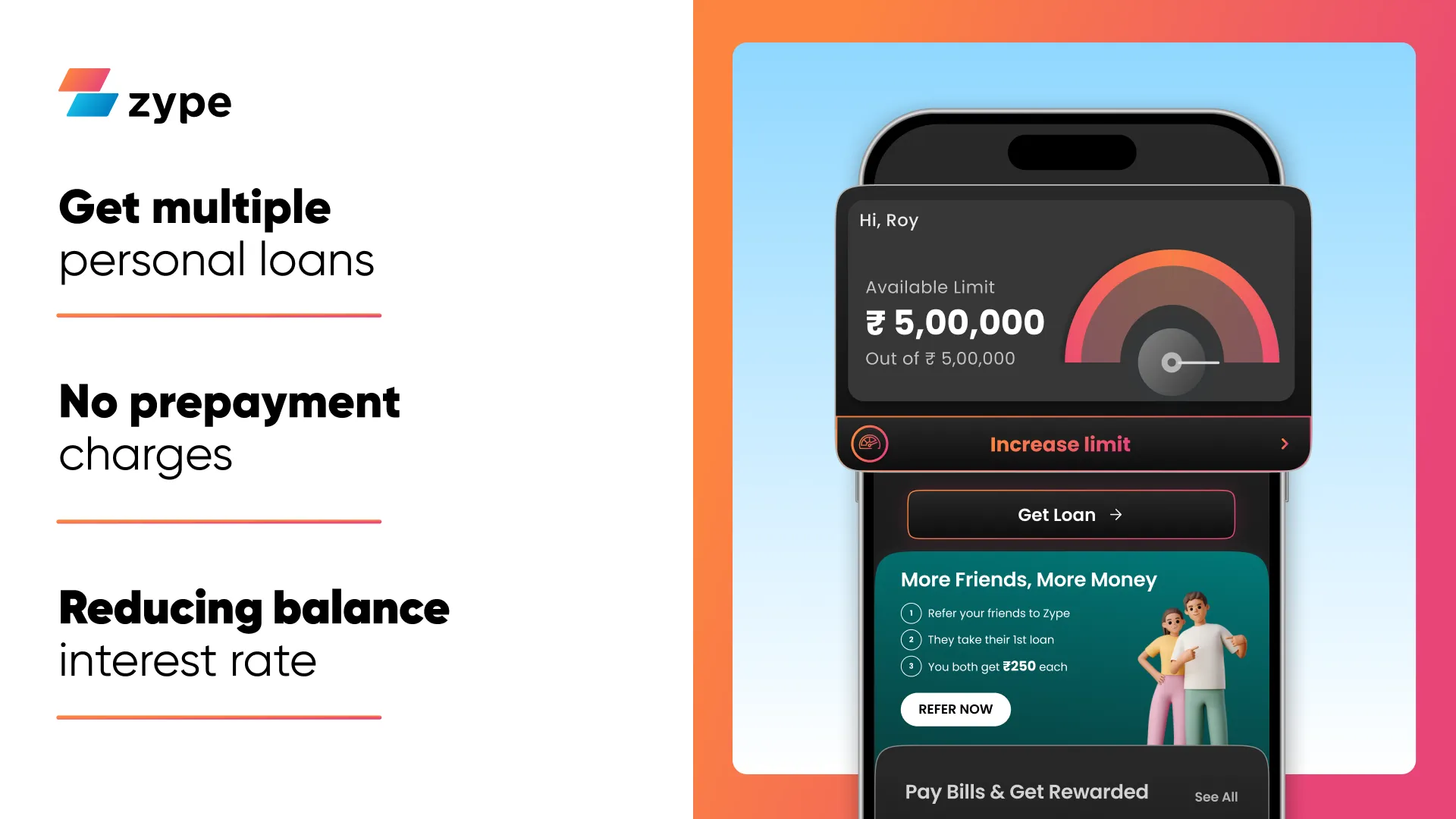

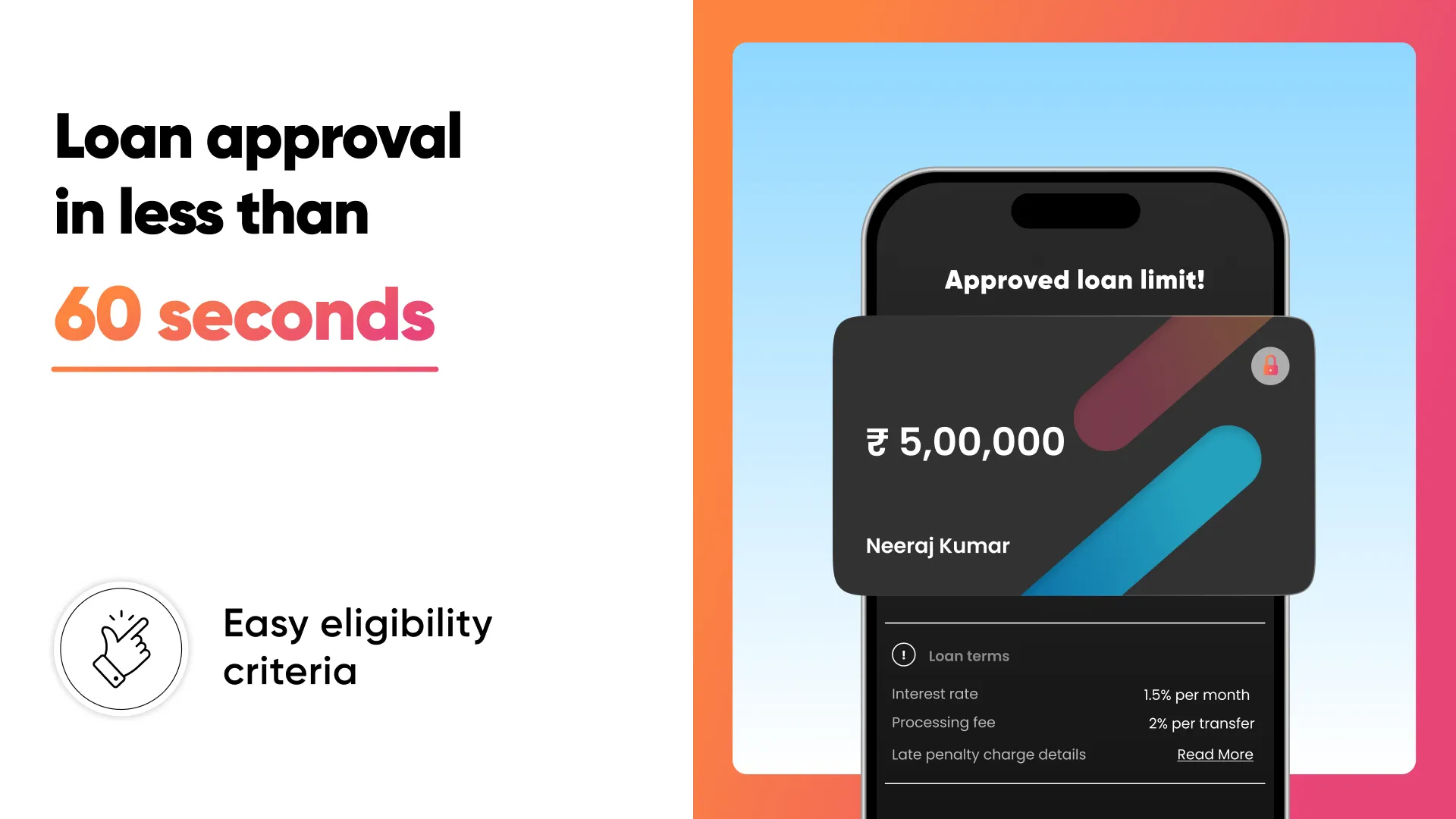

✅Get an instant credit line up to ₹5,00,000

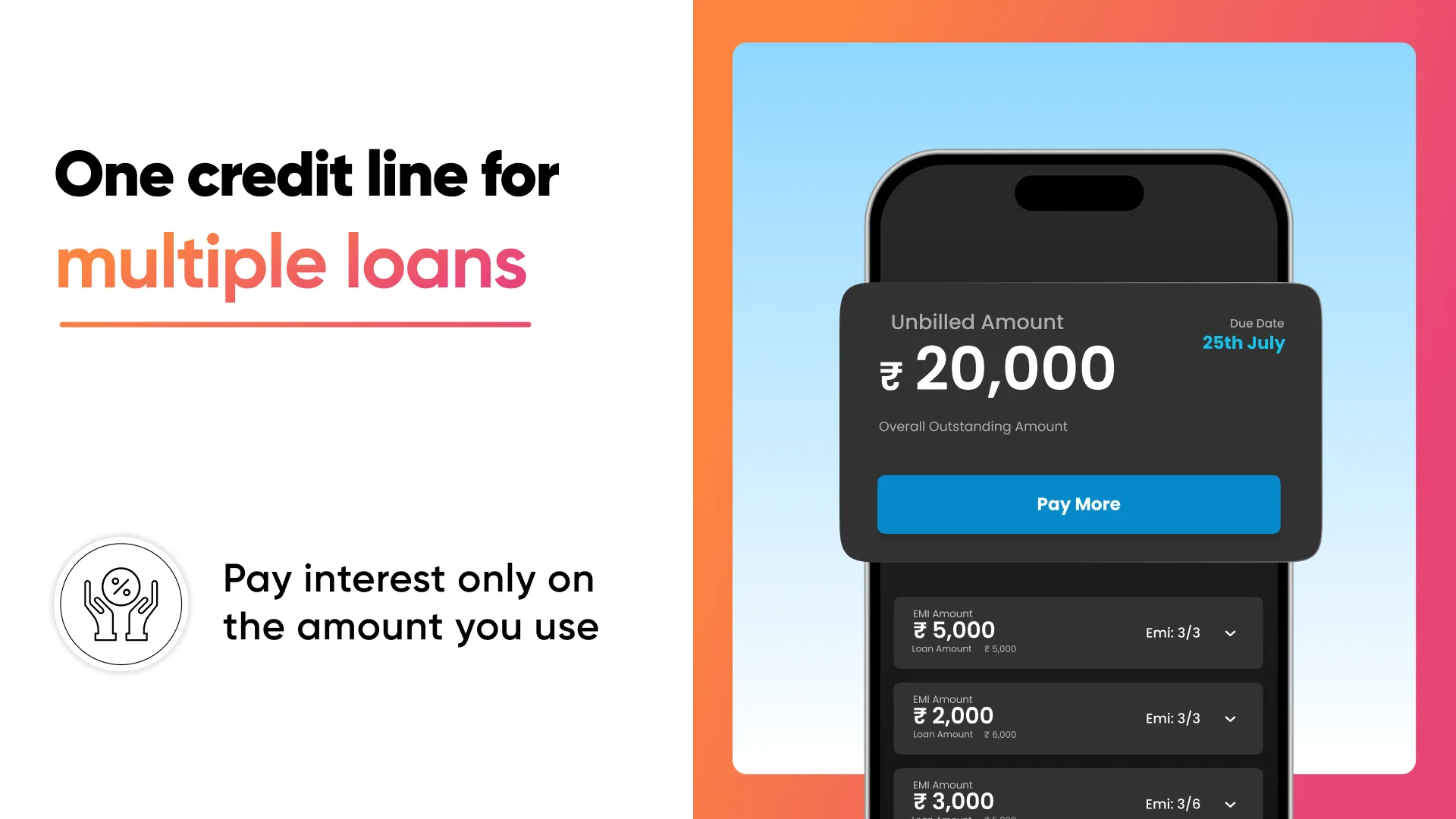

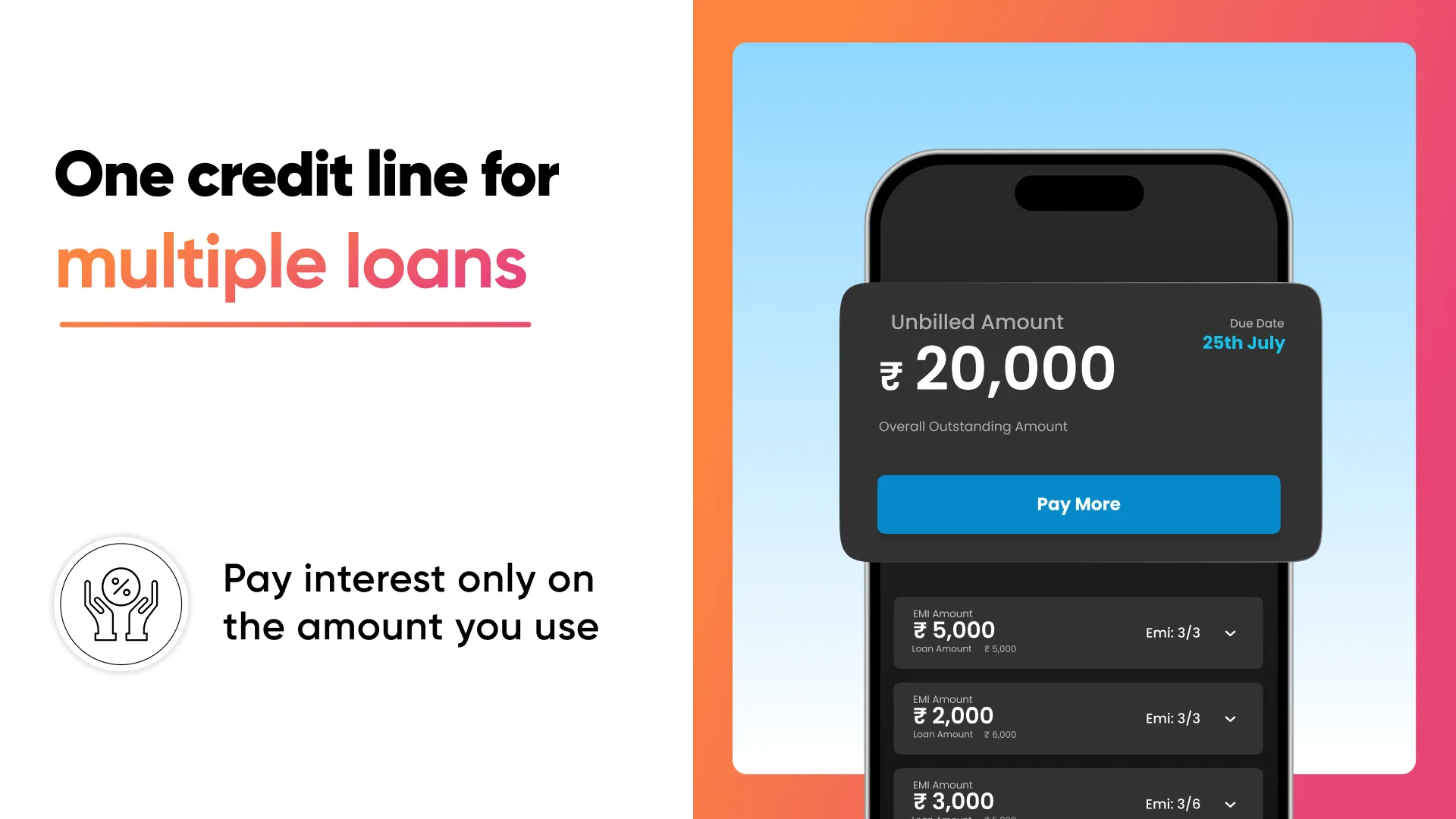

✅Take instant loans directly from your credit line

✅Check your credit score for free

✅Make utility bill payments

✅Avail superior customer support services from our personal loan assistance team

Here are some reasons why you’ll love our instant loan app:

👉Eligibility Criteria

This is what you need to get a salary loan from Zype:

✅Be a salaried professional

✅Have a minimum monthly salary of ₹15,000

✅Have a valid PAN Card

✅Have a valid Aadhaar card

👉 Other Features of Instant Personal Loans

💥Getting an instant personal loan online from the Zype personal loan app assists in getting quick funds during financial emergencies

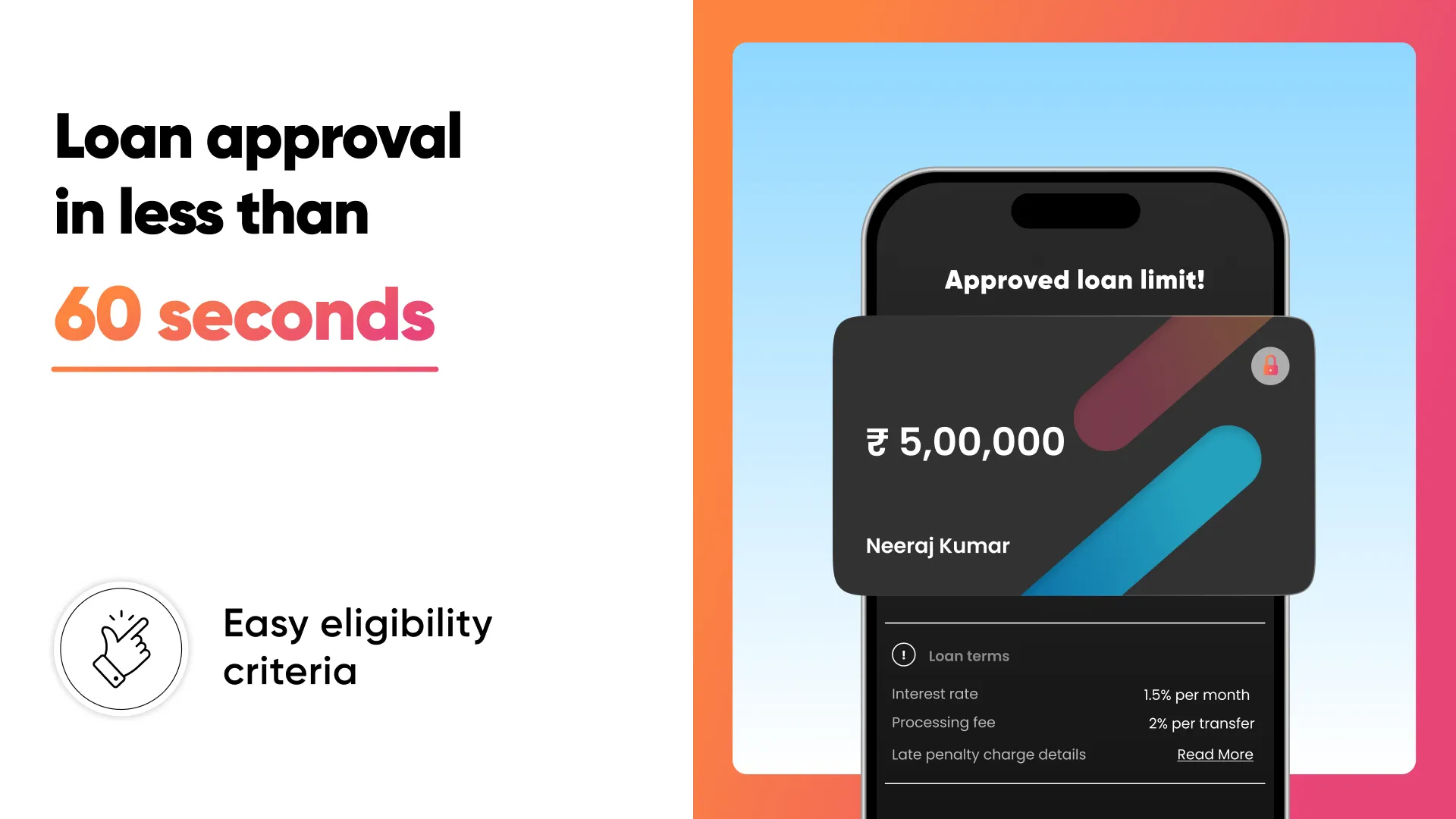

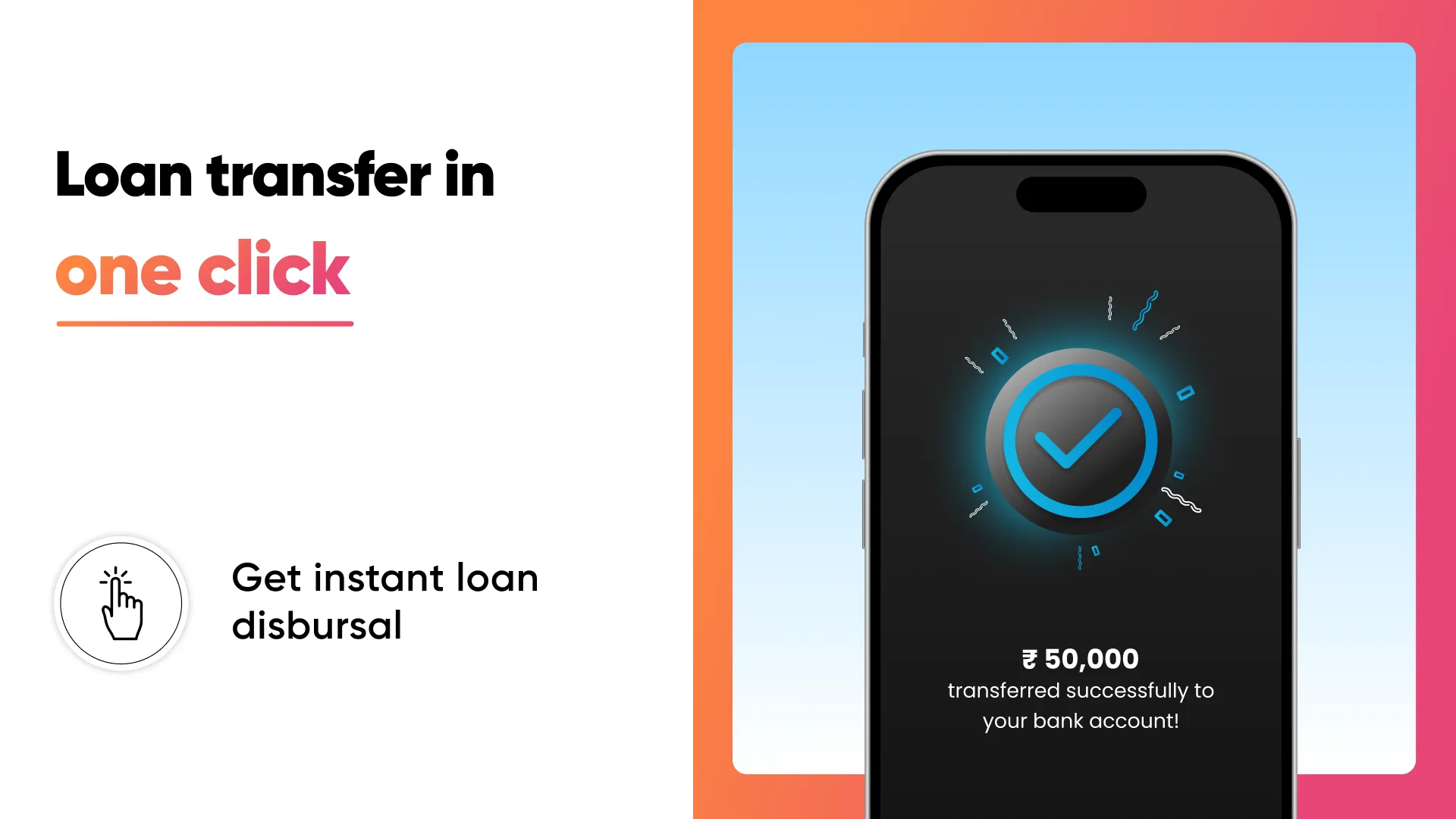

💵Get an instant money loan up to ₹5,00,000 with quick loan approval in 3 easy steps

✅Transfer the required quick loan amount from your credit line instantly, & pay Interest only on that salary loan amount

👌Interest rates start at only 1.5% per month

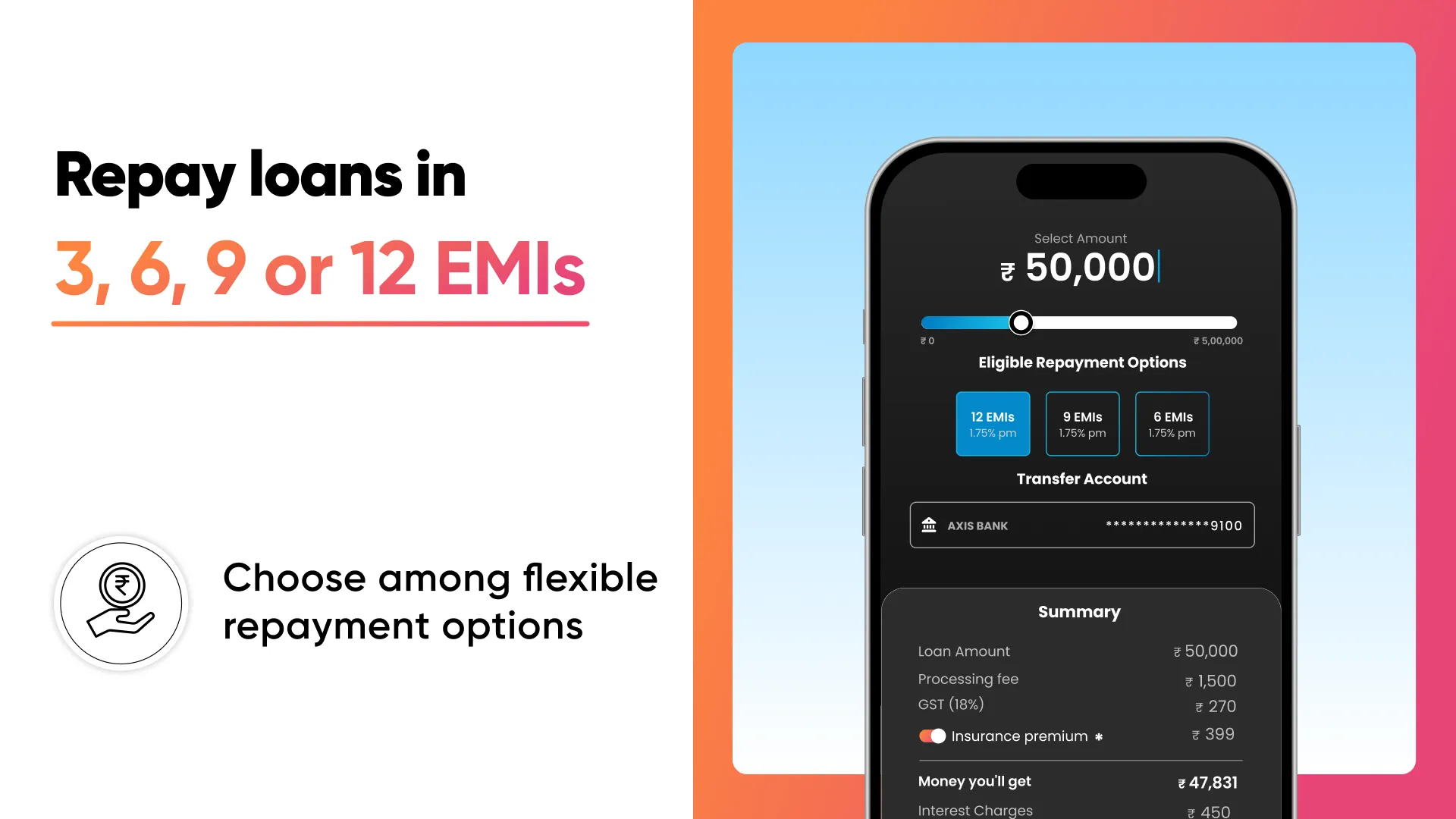

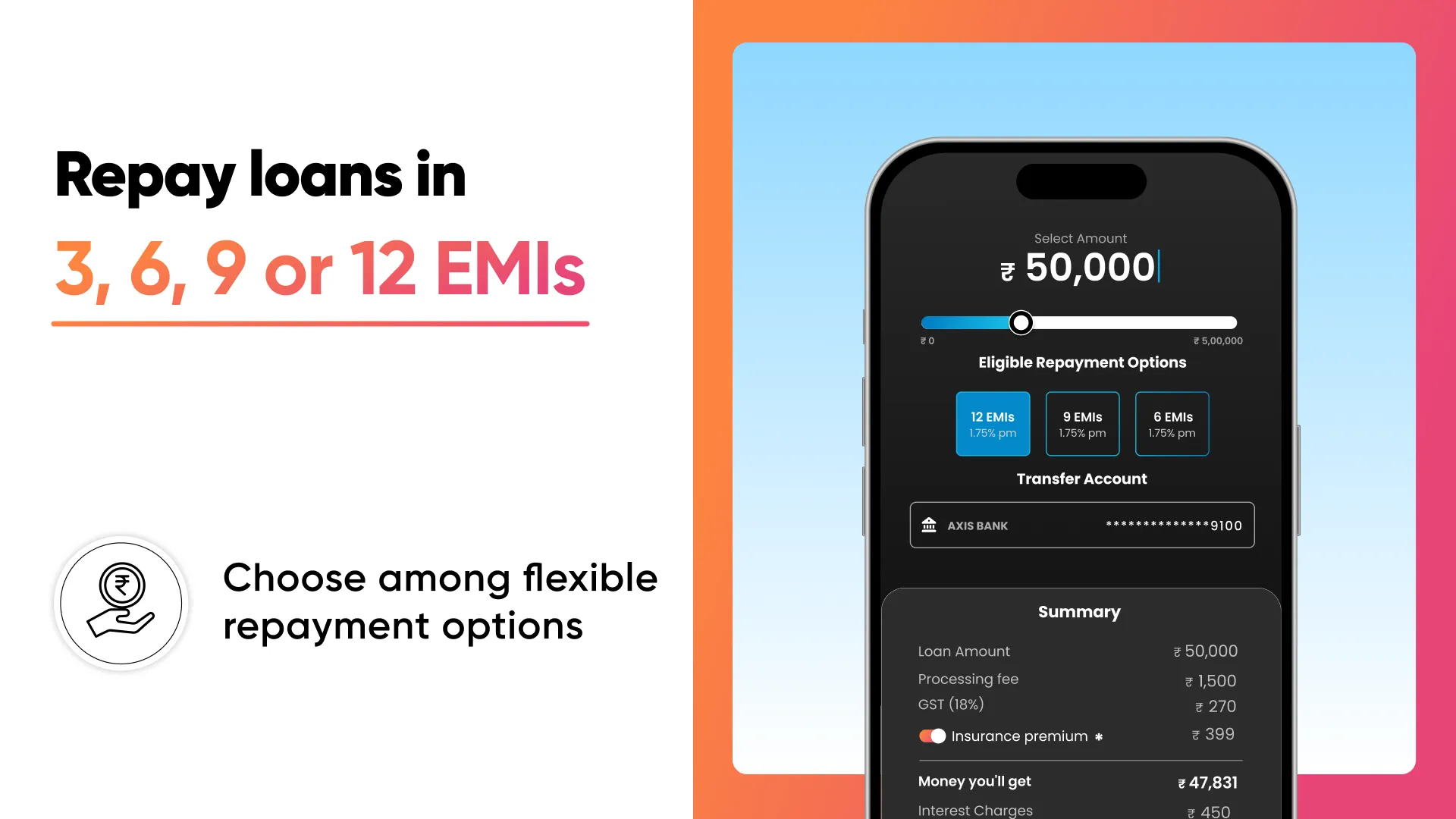

📝Select a repayment plan that works for you & pay later in flexible EMIs

👉Smart Money Insights

- With smart money insights offered by the Zype instant loan app, online money management has never been this easy.

- Analyze your money through Zype Spend Analyser. Set a budget goal & track every expense to save more money.

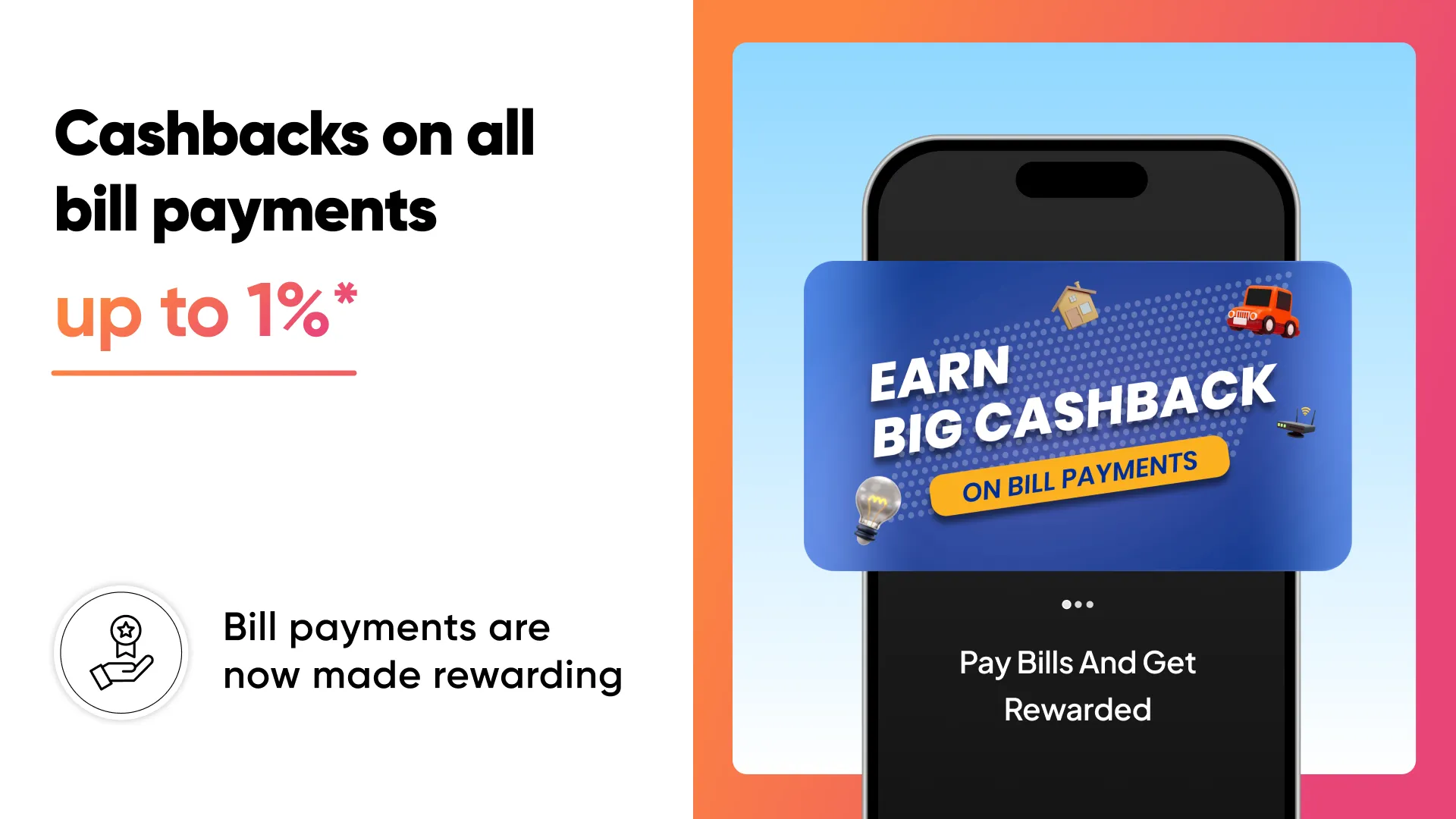

👉Utility Bill Payments

- Make online bill payments for electricity bills, gas bills, water bills, insurance premiums, post-paid mobile bills, etc.

- Enjoy guaranteed cashback every time you pay bills online via the Zype loan app

👉Terms, interest rates & other charges on the Zype instant loan app

- Get Instant Credit Line Facility from ₹5,000 to ₹5,00,000

- Interest rates – 18% to 39% per annum*

- Tenures – 3 months to 12 months

- Processing fees from 2% to 6%

- Quick loans & easy EMI

(*) Interest Rate varies based on your risk profile

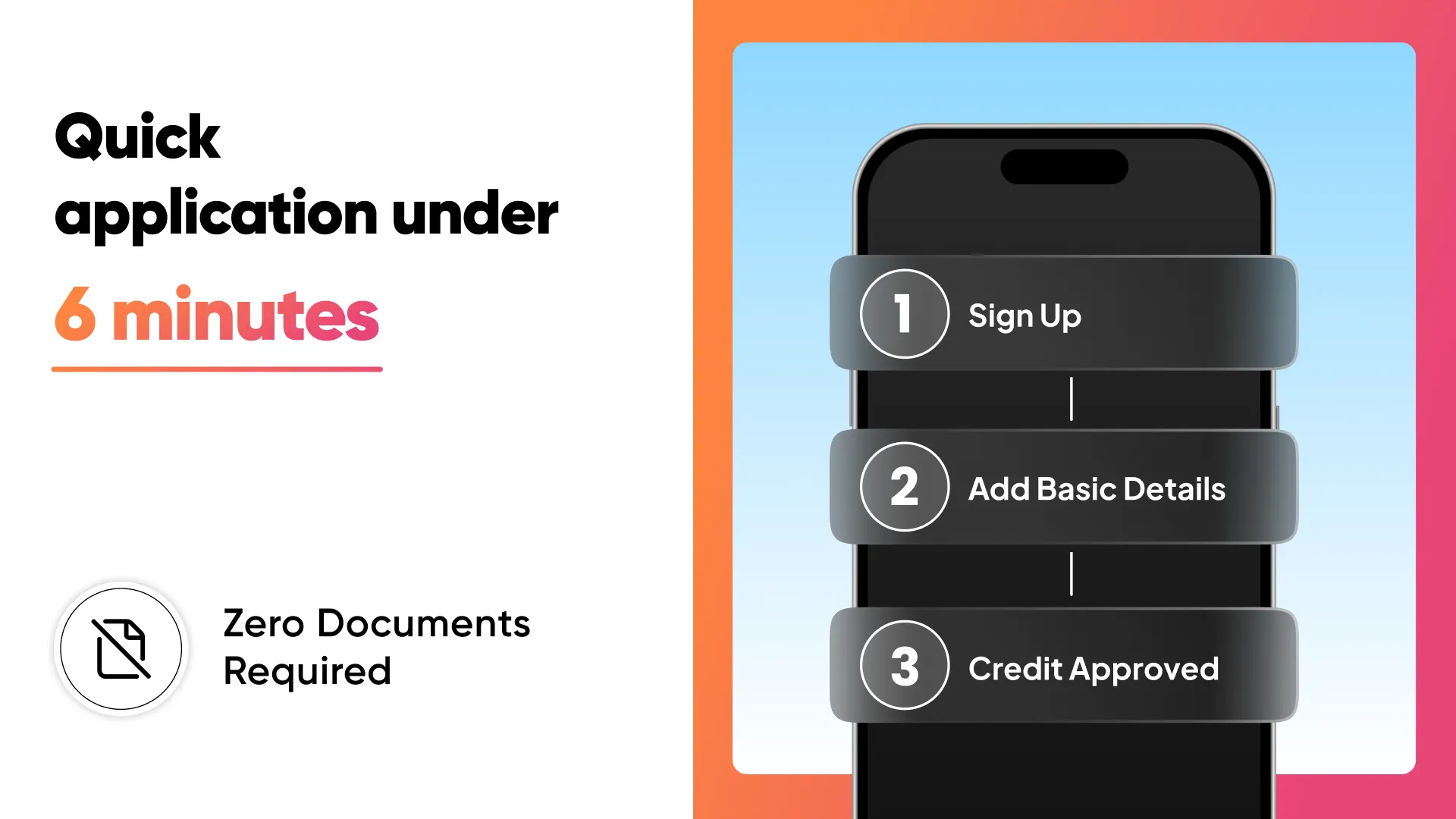

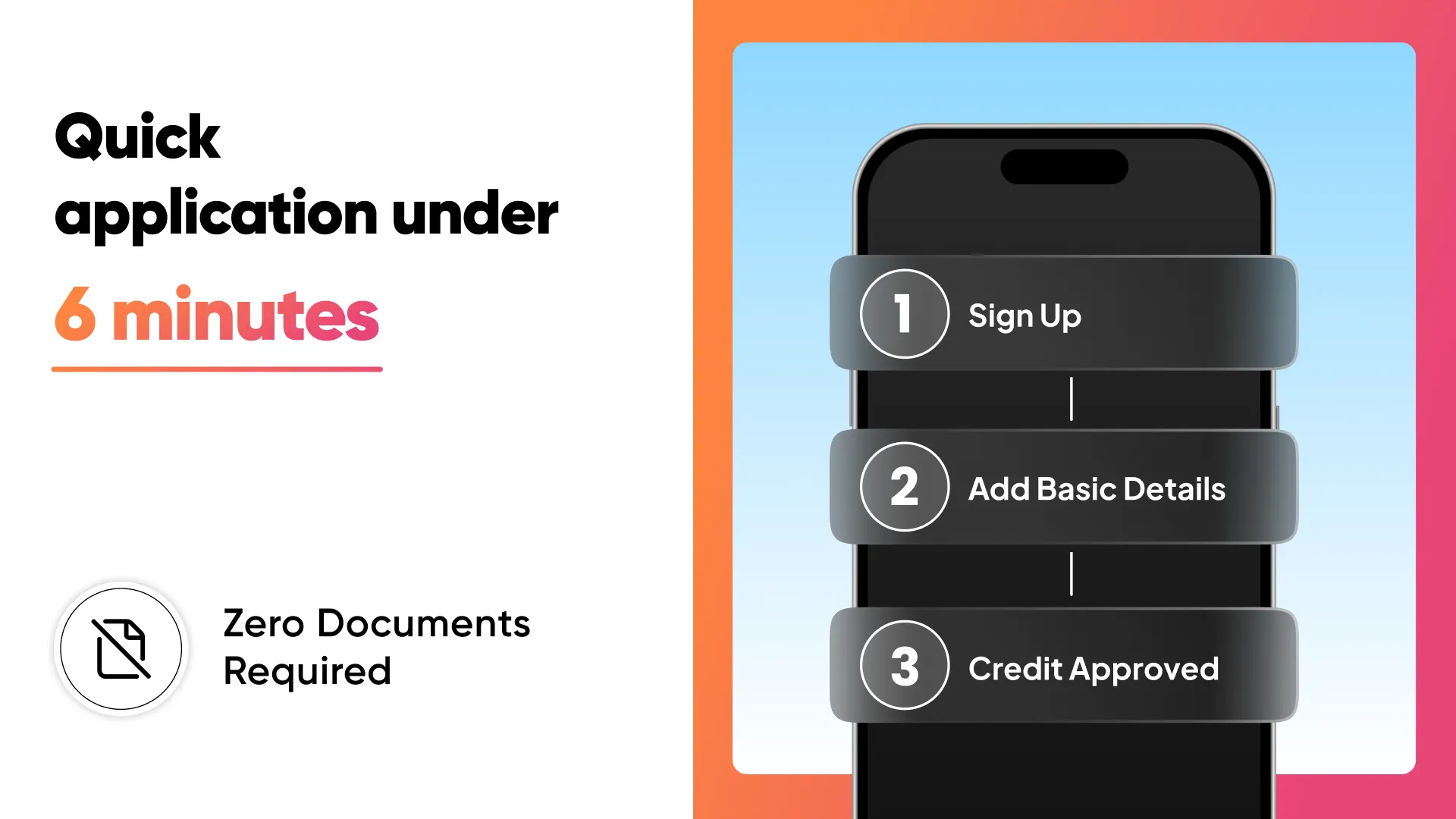

How do you activate your Zype credit line?

1. Install the Zype loan app & create your account

2. Add basic information such as name, mobile number, PAN number, and employment details

3. Get quick approval for a credit line based on your profile & credit score

4. Unlock the credit line by completing your KYC with Aadhaar no. & selfie

5. Choose the amount & EMI plan for the personal loan amount that you want to avail

6. Transfer the money instantly to your bank account from your credit line

Our Lending Partners:

✨Respo Financial Capital Private Limited

https://respo.co.in/our-partners/

✨RPN Fintralease & Securities Pvt. Ltd.

https://rpnfin.com/index.php/our-partners/

Sample calculation of a personal loan from Zype:

✔️Loan Amount: ₹50,000

✔️Tenure: 12 months

✔️Rate of Interest: 24% p.a.

✔️Processing Fee: ₹1,250 (2.5%)

✔️GST on Processing Fee: ₹225

✔️Total Interest: ₹6,736

✔️EMI: ₹4,728

✔️Amount Disbursed: ₹48,525 (PF + GST are deducted upfront during the loan disbursal)

✔️Total Repayment Amount (Loan amount + Interest): ₹56,736

*Note – All the above numbers are for representation only. The final interest rate or processing fee may vary depending on the profile assessment.

Reach Out To Us

Email:

[email protected]

Phone: 080-35018179

Address: Ground floor, Dyna Business Park, Street no. 1, MIDC, Andheri (East), Mumbai, 400093

Data Security & Privacy: All the data that you submit to the Zype instant loan app is safe & secure. All data transactions are protected through secure 256-bit SSL encryption