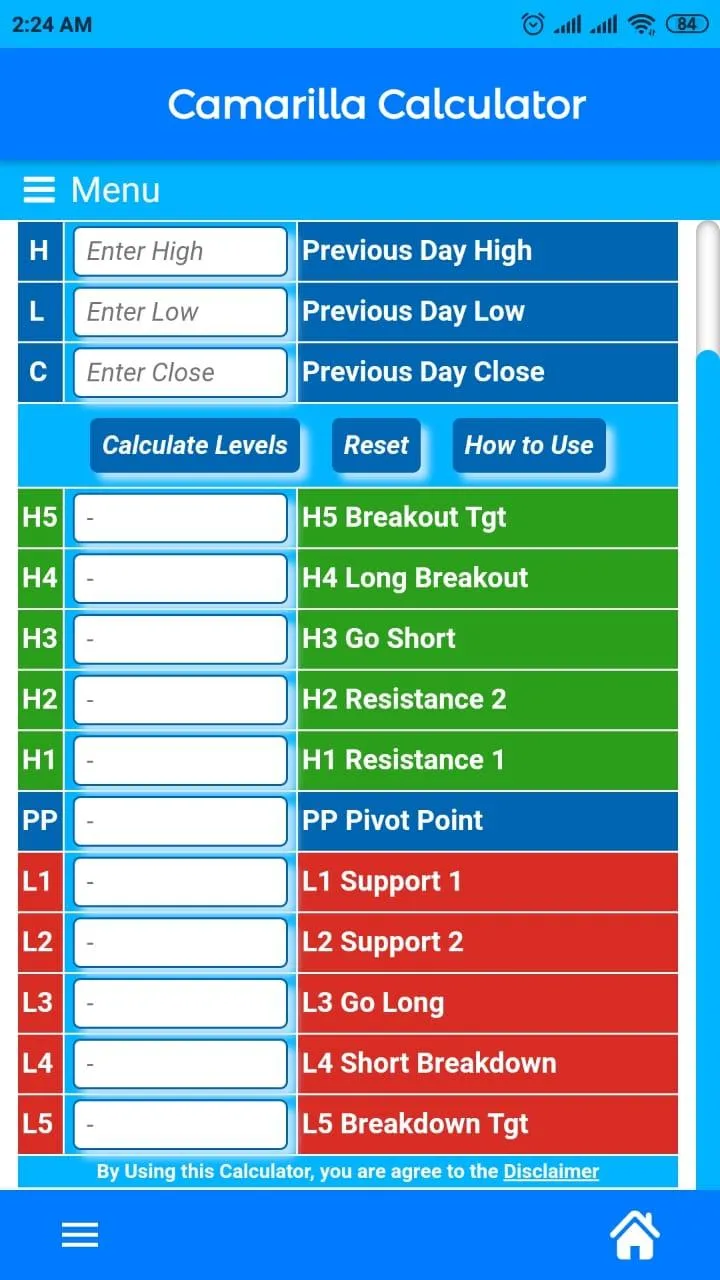

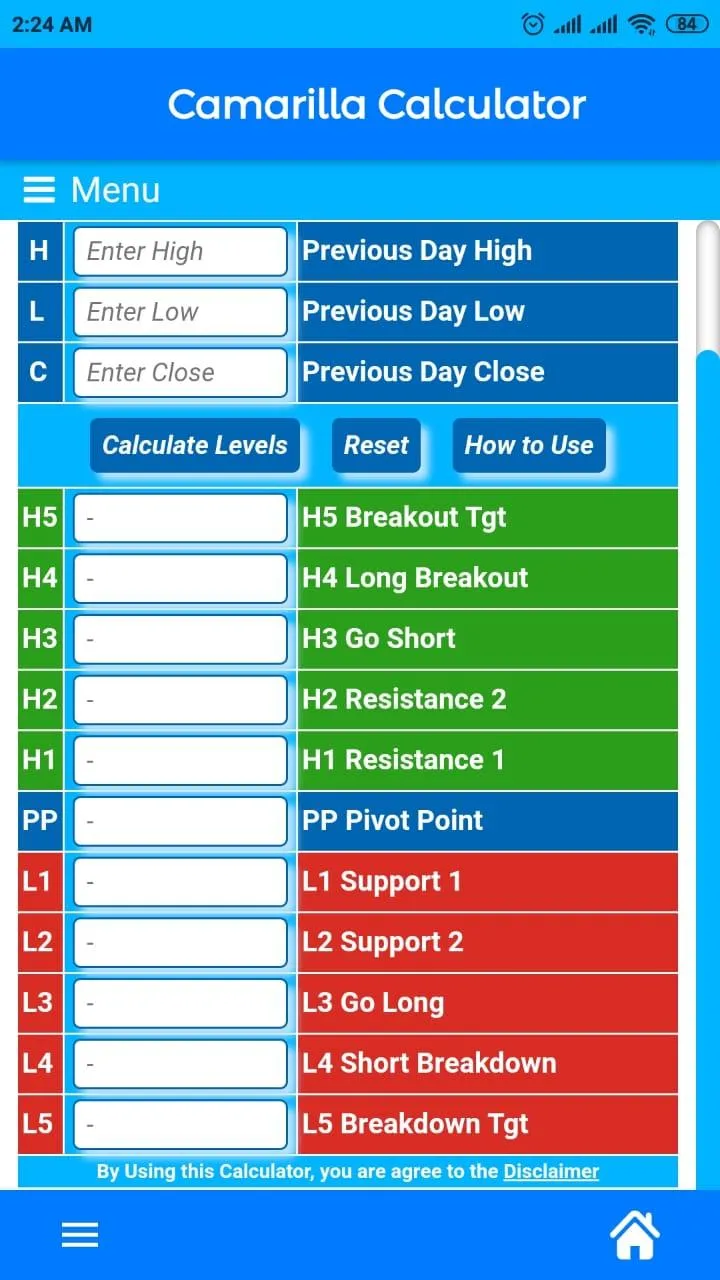

Camarilla Calculator

camarilla-calculator

About App

The Camarilla Equation in calculates ten levels of intra-day support and resistance according to yesterday’s High, Low, Open and Close. There are 5 of these “S” levels below yesterday’s close, and 5 “R” levels above. They are numbered S1, S2, S3, S4 and S5 etc. The most important levels are S3, R3 levels and S4, R4 levels.

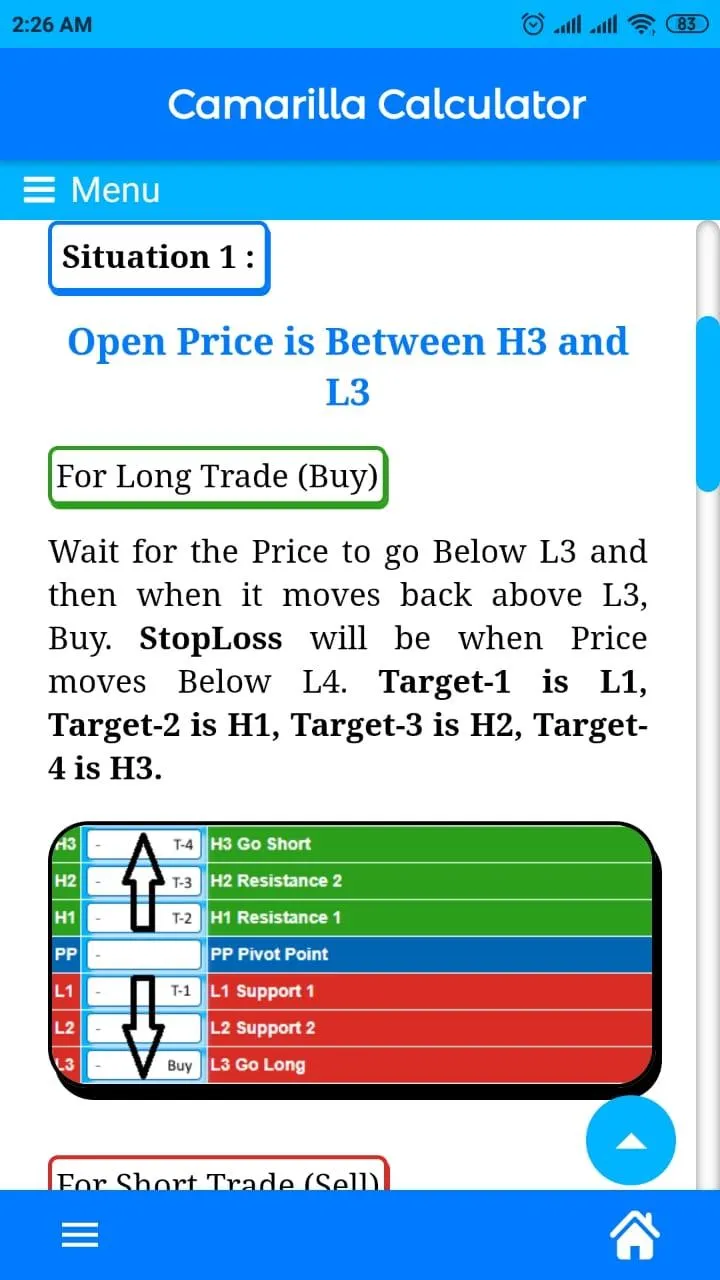

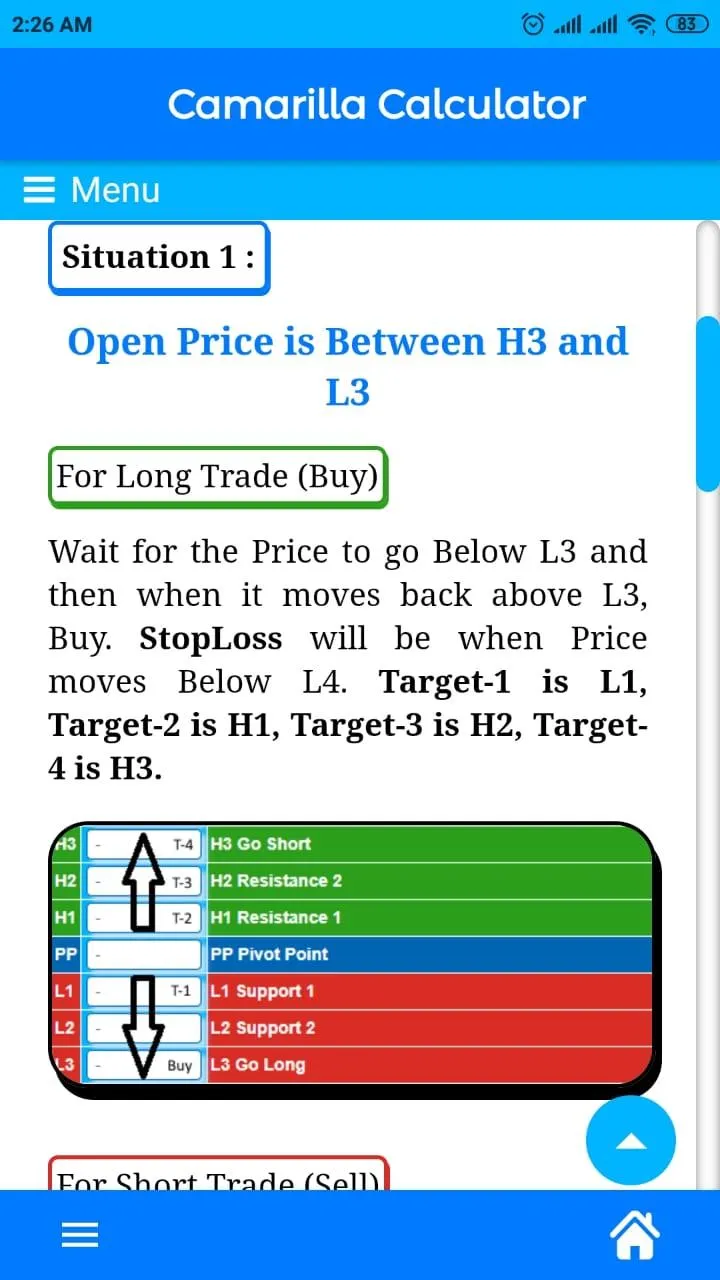

The main way to use Camarilla equation in stock or indices is to wait for price to approach S3 or R3. When price does so, traders expect market to reverse at S3 and R3 level and so they open positions against a trend and place protective stop loss outside closest S4 or R4 level.

Stop level at S4/R4 is only a suggested stop, you’ll learn why below, traders are encouraged to find their own stops according to the money management rules and risk appetite.

Developer info