Easy CCI (20)

cci

About App

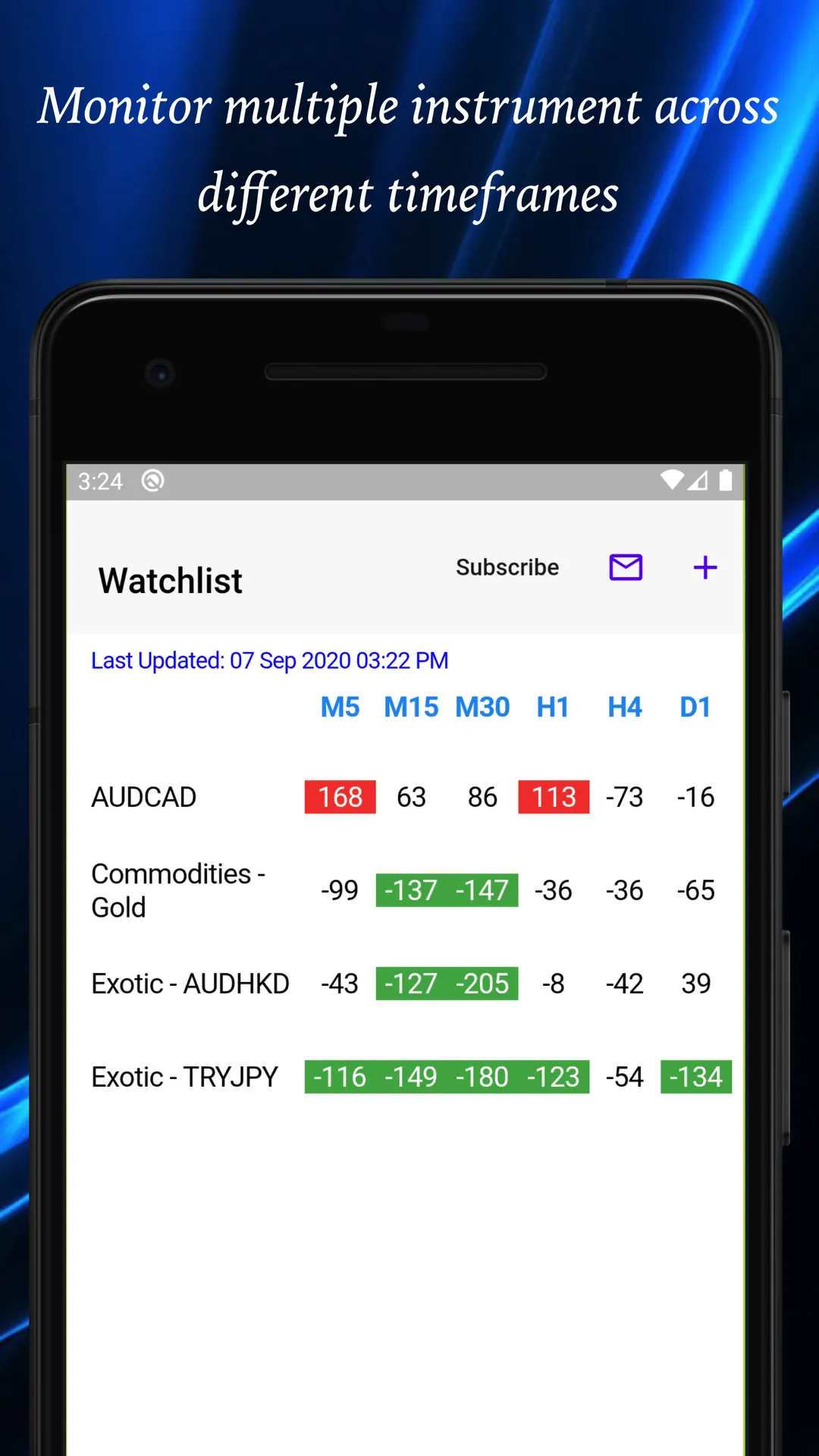

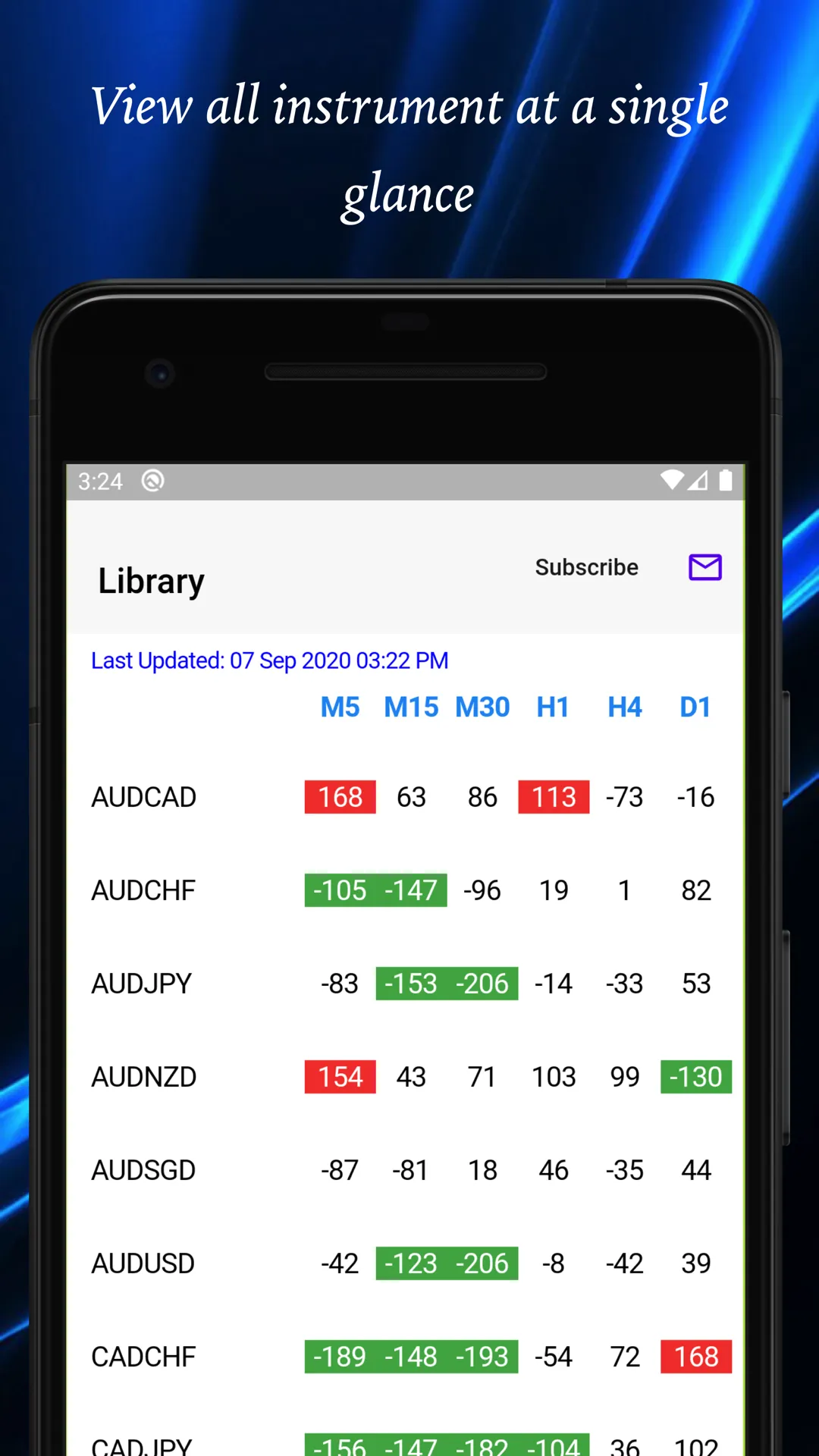

The commodity channel index (CCI) is an oscillator originally introduced by Donald Lambert in 1980. Since its introduction, the indicator has grown in popularity and is now a very common tool for traders in identifying cyclical trends not only in commodities, but also equities and currencies.

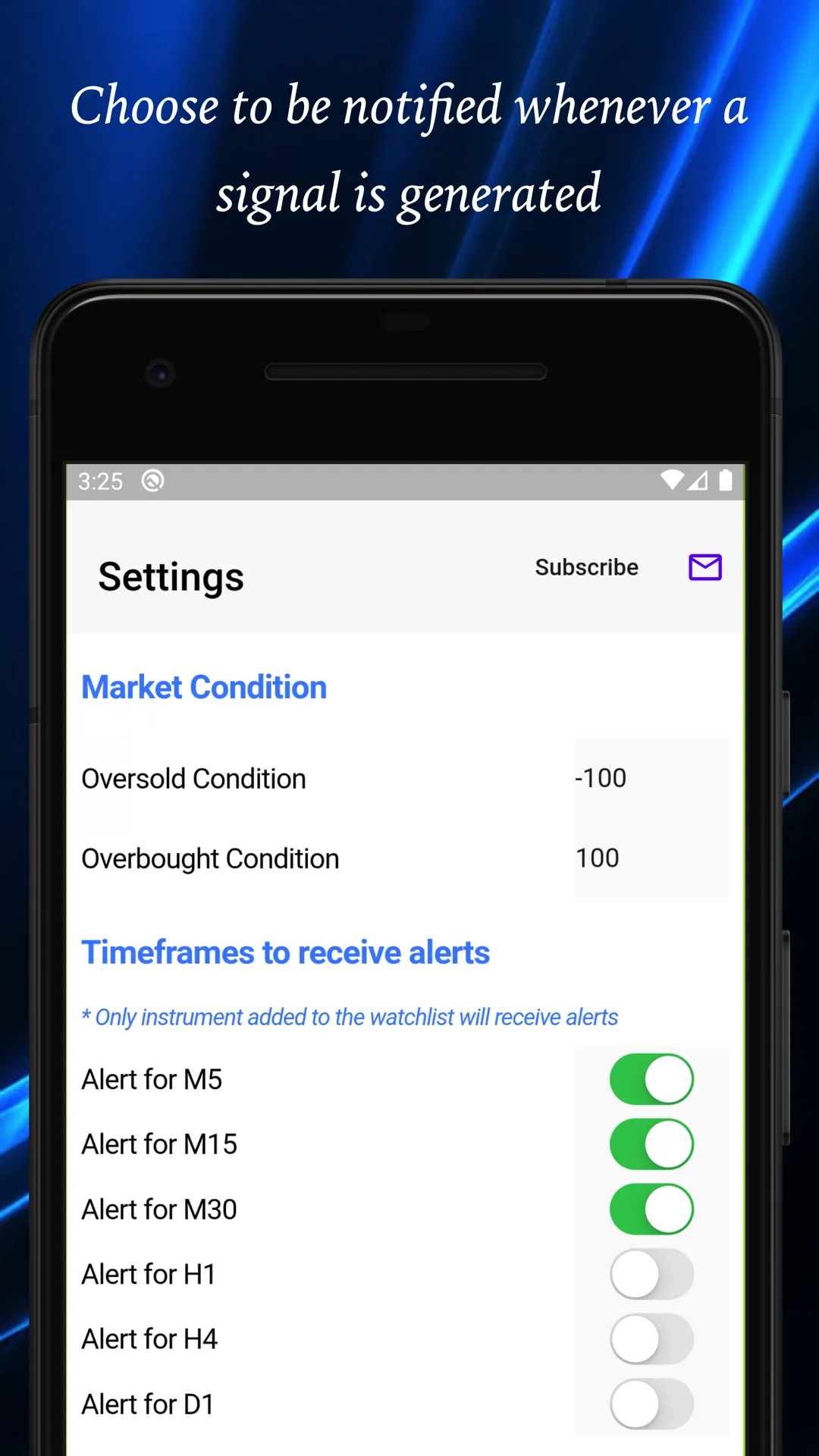

CCI fits into the momentum category of oscillators. Like most oscillators, the CCI was developed to determine overbought and oversold levels. The CCI does this by measuring the relation between price and a moving average (MA), or, more specifically, normal deviations from that average. The CCI typically oscillates above and below a zero line. Normal oscillations will occur within the range of +100 and −100. Readings above +100 usually imply an overbought condition, while readings below −100 imply an oversold condition. As with other overbought/oversold indicators, this means that there is a large probability that the price will correct to more representative levels.

Developer info