Verified

4

Rating

15 MB

Download Size

36 MB

Install Size

About App

CreditKlick’s credit score is powered by Experian - 1 of the 4 credit bureaus authorized by RBI.

🏁 Services we provide you:

Credit Score and Analysis

- Check your FREE Credit Score Report & get detailed analysis of your credit profile.

- Subscribe to premium credit health report for personalized recommendations.

- Assistance in resolving errors and disputing negative accounts, if have any errors.

- Improve your credit score with inputs from our professional and dedicated experts.

- CIBIL clean-up following settlement.

Track Spends & Bills

- Plan your budget & track your spends across categories

- Quickly add any cash spent to accurately track your expenses

- Get EMI reminders & credit card bill reminders to pay on-time

- Check bank balance & ATM withdrawal count

Loans & Card offers

- Apply for exclusive loans & credit cards from lenders, get Instant approval

- Build your credit score with your first credit product

Credit score FAQs❔

What is a credit score & how is a credit score calculated?

Credit score is an indicator of a borrower's ability to make credit payments on time. Credit score is calculated based on the data provided by the banks and NBFCs to the bureau. Major factors that influence a credit score calculation are timely credit payments, current outstanding balance and new credit enquiries etc.

If I check my credit score, will it hurt my credit report?

No, requesting your credit score through CreditKlick is considered a soft inquiry on your credit report (as opposed to a hard inquiry, when a lender requests your credit score during a loan decision).

Loans FAQs

What are the kind of loans available?

CreditKlick’s Marketplace offers a wide range of products matched to the customer’s credit profile which include personal loan, home loan, and business loan.

What is the loan amount, tenure and interest rate I can get on different types of loans?

Loan amount, tenure and interest rate are determined by your credit profile and requirements.

1. Personal loan: From ₹1,000 to ₹5,00,000 & tenure from 90 days to 36 months & interest rate varies from 11.99% to 35% per annum

2. Home loan: From ₹3 Lakhs to ₹1 Crore & tenure from 3 to 30 years & interest rate varies from 8.35% to 15% per annum

3. Business loan: From ₹50,000 to ₹15,00,000 & tenure from 12 to 36 months & interest rate varies from 13.99% to 22% per annum

*Who are the lenders that partnered with CreditKlick to provide Personal Loans?

CreditKlick has partnered with Leading NBFCs to provide Personal Loans. Below is the list of Lenders:

Tata Capital Financial Services Limited

Aditya Birla Finance Limited

CASHe Finance Loan App

Representative example of the total cost of the loan:

Loan amount - ₹1,00,000

Interest rate(APR) - 13% p.a

Loan tenure - 12 months

Total Interest to be paid - ₹13,000

Processing fee + GST - ₹588 (₹499+GST)

Monthly EMI repayment - ₹9,466

Total amount to be repaid - ₹1,13,588

• However, in case of change of payment mode or any delay or non-payment of EMIs, additional charges / penal charges may also be applicable, depending on the lender's policy

• Also depending upon the lender, prepayment options may or may not be available and applicable charges for the same may vary.

****************************************************

Download the CreditKlick App to become Credit healthy with CreditKlick Credit refine program and avail loan and credit card offers from India’s leading banks and NBFCs via seamless digital processes.

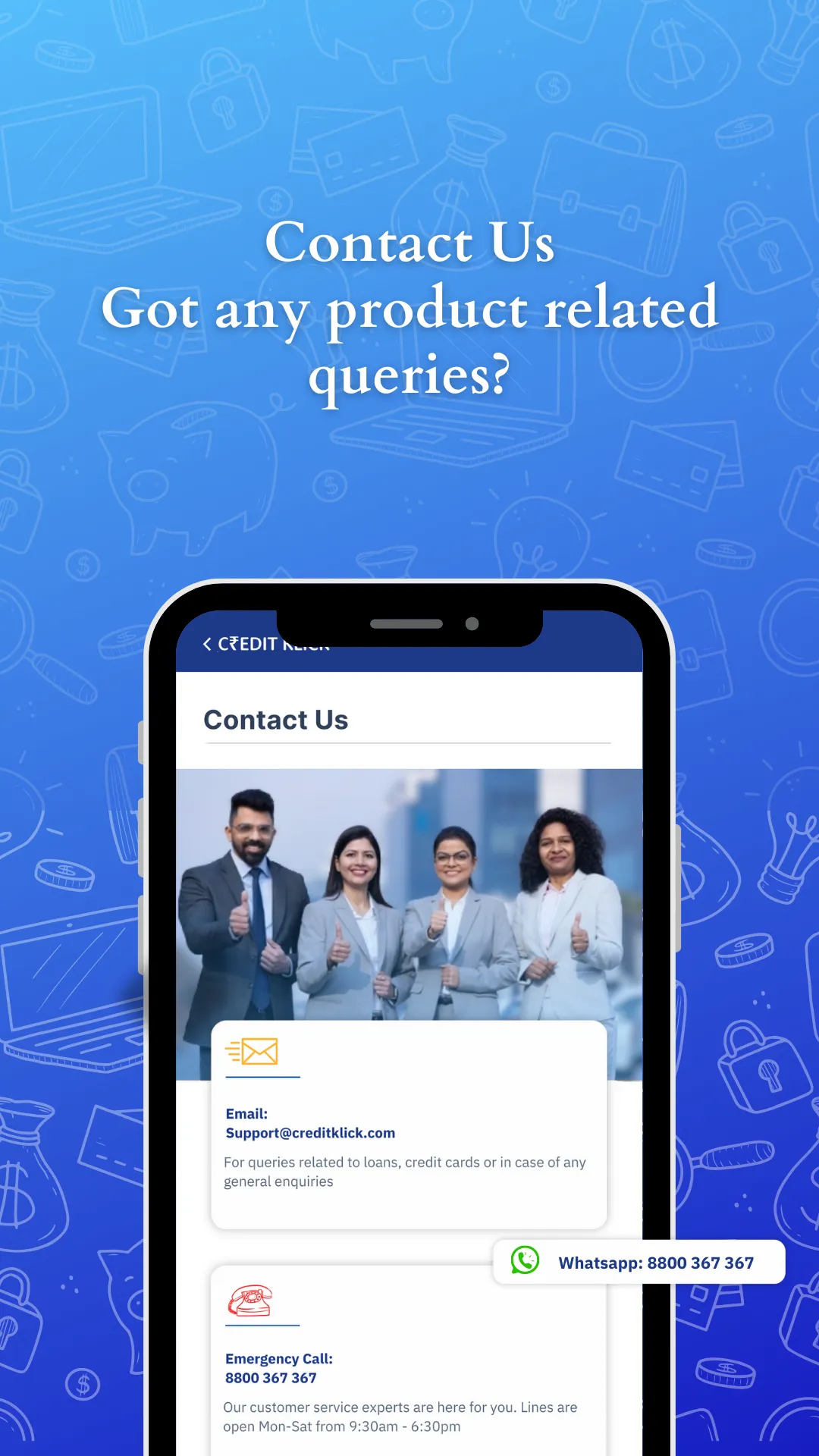

Contact us:

Emergency Call: 8800 367367

WhatsApp: 8800 367 367

Email: [email protected]

Developer Infomation

Safety starts with understanding how developers collect and share your data. The developer provided this information and may update it over time.

Email :